Document

advertisement

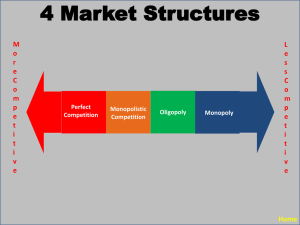

100 80 Where? How? When? What? Why? 2014 60 East West North 40 20 0 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Who? Managerial Economics Stefan Markowski Market structures: Monopoly, monopolistic competition and oligopoly The economics of competitive advantage Detailed course schedule Day no Topic Textbook ch. 1 (24 Nov; 3 hrs) 1. Introduction. Decision making process and its elements. The scope of economic decision making. Application of marginal analysis Chs. 1-2 2 3 3 3 2. Demand analysis and demand elasticities Ch. 3 3. Buyer product valuation and choices. Consumer surplus. Buyer pricing decisions Ch. 4 4 (27 Nov; 2 hrs) 4. Production/transformation process. Production technologies and input-output structure Ch. 5 5 (28 Nov; 2 hrs) 5. Cost structure and cost drivers of producer pricing strategies. Production scale and scope. Chs. 5 and 7 6 (1 Dec; 3 hrs) 6. Structure-conduct-performance. Market structures: competition and contestability. Pricing strategies of buyers and sellers Ch. 8 7 (2 Dec; 3 hrs) 7. Market structures: monopoly/monopsony, monopolistic competition and oligopoly. Pricing strategies and strategic behaviour Chs. 9-10 8 (3 Dec; 3 hrs) 8. Input sourcing and investment. Pricing and market power Chs. 6 and 11 9 (4 Dec; 2 hrs) 9. Decision making under conditions of uncertainty. Informational asymmetries and risk management Ch. 12 10 (5 Dec; 2 hrs) 10. Market research and market analysis. Auction and rings. Strategic behaviour Ch. 13 11 (8 Dec; 2 hrs ) 12 (9 Dec; 2 hrs) 11. Public sector perspective Ch. 14 13 (11 Dec; 2 hrs) Examination (25 Nov; hrs) (26 Nov; hrs) 12. Revision 13. Examination Topic 7: Market structures: Monopoly, monopolistic competition and oligopoly Pricing strategies and strategic behaviour Topic contents 7.1 Managerial perspective 7.2 Monopoly 7.3 Collusive pricing 7.4 Market differentiation 7.5 Monopsony 7.6 Bilateral monopoly 7.7 Oligopoly 7.8 Monopolistic competition 7.9 The dominant firm 7.10 Questions for self-assessment and review 7.11 Further reading 7.1 Managerial Perspective • This topic focuses on non- or less-competitive market arrangements • You can envisage these configurations of buyers and sellers as idealised market structures located along the continuum between perfect competition at the one extreme and monopoly at the other • In practice, most market structures tend to be less than highly competitive as much of business competition is about establishing secure market niches and carving out market territories 7.2 Monopoly • A market is a monopoly if there is only one active seller in it, although there may or may not be other inactive sellers • If there are no threats from potential competitors or buyers, a monopolist is free to act as a price maker • Decision rule to maximise monopoly profit: MR = MC s.t. AC < AR • In Figure below, the monopoly profit-maximising price is PM and quantity QM whilst the competitive (price taker) would sell QC quantity at price PC 7.2 Monopoly Price/Costs PM PC AC=MC Demand = AR QM MR QC Quantity Economics for Managers 7.2 Monopoly • There is a net welfare loss from the use of monopoly power as well as a transfer of welfare from the buyer to the monopolist • The monopolist has no supply schedule (price maker) • The strength of a monopoly depends on the availability of substitute products and, thus, contestability of the monopolist’s market dominance • The most enduring monopolies tend to be ones protected by law • A monopolist may also use its market power to segment the market to differentiate groups of buyers to charge them different prices 7.3 Collusive Pricing • A group of sellers may collude to act as a monopolist • This may take the form of a cartel or an implicit collusion • To succeed, a cartel or collusive agreement must establish barriers to entry • Cartels and collusive agreements are unstable as: – high profits attract newcomers – existing members have an incentive to cheat and engage in non-price competition 7.4 Market Differentiation Price Discrimination in Two Markets Market One Market Two P P P1 P2 MC Q1 Q2 MR MR 7.4 Market Differentiation Perfect Price Discrimination Price LRMC MR Quantity Demand = MR* 7.4 Market Differentiation • Peak-load pricing is similar to price discrimination in that involves a firm charging different prices for the same product at different times (peak and off-peak) as demand fluctuates over time • Both price discrimination and peak- load pricing may be used by industries where the long term AC curve declines as output expands 7.5 Monopsony • A monopsony is market characterised by the presence of only one active buyer and many sellers • A monopsonist is a monopolistic buyer who may use its market power to maximise profits • The monopsonist is a price maker who faces an upward sloping supply curve • The monopsonist has no demand curve (price maker) 7.5 Monopsony Monopsony Price/Costs Buyer’s Marginal Cost Average Cost = Supply PC Average Benefit = Marginal Benefit PM QM QC Quantity 7.6 Bilateral Monopoly • A bilateral monopoly is a market where a monopolistic seller is trading with a monopsonistic buyer • Bargaining between the two parties is confined to price-quantity combinations acceptable to both of them • The outcome depends on their relative market power 7.7 Oligopoly • Oligopolistic markets are characterised by the presence of few sellers facing large numbers of atomistic buyers • Each sellers recognises that its profits depend on how its competitors respond to its own market strategy • The perception of interdependence and strategic behaviour are the two key aspects of oligopolistic market 7.8 Oligopoly • A duopoly is a market with only two active sellers and many atomistic buyers • In some oligopolistic markets there may be firms that exercise price leadership (set the market price as price makers, which other firms accept as price takers) • Barometric pricing by a particular firm means its price leadership is seen as an indicator of the market price 7.8 Monopolistic Competition • A monopolistic competition refers to a market where a number of price making sellers face many atomistic buyers • Each seller operates as a price maker in a particular market niche selling somewhat differentiated product to achieve competitive advantage • But there is enough competition between these market niches to stop sellers from making monopoly profits 7.9 The Dominant Firm • This is a case where a single firm dominates the market (controls 60-80% of it) and other firms are confined to the competitive fringe • The dominant firm acts as a price maker and the competitive fringe sellers are price takers • The dominant firm may engage in predatory pricing to deter challengers, especially if it enjoys scale and/or scope related cost advantages 7.10 Questions for self-assessment and review Basic concepts and applications 1. a. What is a market? b. Give an example and explain how market boundaries are determined in this case 2. Describe market equilibrium and outline the forces that move a market toward its equilibrium 3. What is the 'invisible hand' of the market place and what does it do? 4. Define price 'ceiling' and price 'floor' and give an example of each 5. When the price of petrol increases, what happens to the demand for and supply of second hand cars? 7.10 Questions for self-assessment and review 6. a. What is the short run effect of a price ceiling applied in a particular market? Give an example b. The long run effect of this policy? Give an example 7. Are price controls: a. likely to be effective? b. desirable? 8. Using a suitable diagram show why a market monopoly is likely to reduce the buyer’s welfare 9. Using a suitable diagram show why a market monopsony is likely to reduce the seller’s welfare 10. What does it mean that the monopolist has no supply curve and the monopsonist has no demand schedule? 7.10 Questions for self-assessment and review 11. Explain the nature and mechanics of monopolistic competition and the practical relevance of this model 12. Describe the mechanics of oligopoly. What does it mean that oligopolists are likely to behave strategically? 13. What is a cartel? Why this form of market collusion tends to be unstable in the long term? If so, why is it often illegal? 7.11 Further reading Baye (2010): chs. 9-10