David Mayer AP Macroeconomics Winston Churchill High School

Multiple Deposit Expansion and the Federal Reserve

The Federal Reserve System

The Federal Reserve was established in 1913 to regulate the banking system

• There is a Board of Governors of 7 members, appointed by the president for

14 year, staggered terms

• The Federal Open Market Committee includes the 7 governors, and 5 of the regional Federal Reserve Bank presidents (New York region always included) and they set policy of the buying and selling of government bonds

• Federal Advisory Council includes 12 important commerical bankers from each FED district who advise the Board

Federal Reserve System

• There are 12 district Federal Reserve Banks and 25 regional banks with 3 functions

• Work with the central bank or FED

• Each is quasi-public: owned by member banks, but controlled by

Federal Reserve Board and profits go to Treasury

• They accept reserve deposits and make loans to banks and other financial institutions

Functions of the FED

• It issues paper currency

• Sets reserve requirements and holds reserves of banks

• It lends money to banks and charges them interest

• They are a check clearing service for banks

• It acts as personal bank for the government

• Supervises member banks

• Controls the money supply in the economy

How Banks Create Money

• How do banks create money?

• By lening out deposits that are used multiple times

• Where do the loans come from?

• From depositors who take cash and place it in their banks

• How are the amounts of potential loans calculated?

• Using their bank balance sheet, or T-accounts that consist of assets and liabilities for banks

Bank Liabilities

• Right side of the T-Account Sheet

• #1=Demand Deposits (DD) or checkable deposits

• Cash deposits from the public

• They are liabilities because they belong to depositors

• #2=Owners Equity (stock shares)

• There are values of stocks held by the public ownership of bank shares

• Key concept for AP concerning Liabilities:

• If demand deposit come from someone’s cash holdings, then the DD is

already part of money supply

• If the demand deposit comes in from the purchase of bonds (by the

FED) then this creates new cash and therefore creates new Money

Supply (M-1)

Bank Assets

• Left side of the T-Account Sheet

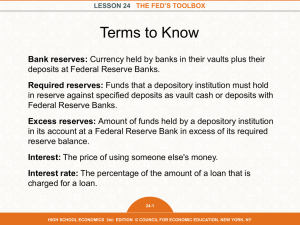

• #1=Required Reserves (RR)

• These are the percentages of demand deposits that must be held in the vault so that some depositors have access to their money. This amount can vary, but AP usually uses 5%, 10%, or 20% for easy calculations

• #2=Excess Reserves (ER)

• These are the source of new loans. These amount are applied to the Monetary

Multiplier/Reserve Multiplier (DD=RR plus ER)

• #3=Bank Property Holdings (buildings and fixtures)

• #4=Securities (Federal Bonds)

• These are bonds purchased by the bank, or new bonds sold to the bank by the

Federal Reserve. These bonds can be purchased from the bank, turned into cash that immediately becomes available as “excess reserves”

• #5=Customer Loans

• This can be amounts held by banks from previous transactions, owed to the bank by prior customers

Creating Money (using excess reserves)

• Banks want to create profit. They generate profit by lending the excess reserves and collecting interest. Since each loan will go out into customer’s and business’ accounts, more loans are created in decreasing amounts (because of reserve requirement). A rough estimate of the number of loan amounts created by any first loan is the “money multiplier”.

• The Money Multiplier, a.k.a.: Checkable Deposits Multiplier, Reserve

Multiplier, Loan Multiplier

• The formula: 1 divided by the reserve requirement (ratio)

• RR=10%=1/.1=Monetary Multiplier of 10

• Excess Reserves are multiplied by the Multiplier to create new loans for the entire banking system and this creates new Money Supply

Summary

• Bank Balance Sheet

• Asses and Liabilities in a T Account

• Liabilities

• DD and Owner’s Equity (Stock Shares)

• Assets

• RR, ER, Bank Property, Securities, Loans

• Assets must equal Liabilities

• DD=RR+ER

• Money is Created through Monetary Multiplier

• ER x 1/RR (Multiplier)=New Loans throughout the banking system

• The Money Suplply is affected

• Cash from citizens becomes a DD, but does NOT change the Money Supply; the

ER from this cash becomes an “immediate” loan amount

• ER x Multiplier become New Loans and DO change the Money Supply

• The Fed Buying bonds creates new loans and changes the Money Supply

• If the Fed buys bonds on the open market, this also beocmes a new DD amount; if the Fed buys bonds from accounts already held by a particular bank, then the amount only becomes new Excess Reserves

• Finally, bond “prices” move opposite to the changes in interest rates

• Higher interest rates will push bond prices downward (less money supply)

• Lower interest rates will push bond prices upward more money supply)

The Three Types of Multiple Deposit Expansion

Question

•

Type 1: Calculate the initial change in excess reserves

a.k.a. the amount a single bank can loan from the initial deposit

•

Type 2: Calculate the change in loans in the banking system

•

Type 3: Calculate the change in the money supply

• Sometimes type 2 and type 3 will have the same result (i.e. no Fed involvement)

The Three Types of Multiple Deposit

Expansion Question

•

Oops!!!! Type 4: Calculate the change in demand deposits

Example 1

•

Given a required reserve ratio of 20%, assume the Federal Reserve purchases $100 million worth of US Treasury Securities on the open market from a primary security dealer.

Determine the amount that a single bank can lend from this Federal Reserve purchase of bonds .

The amount of new demand deposits – required reserve = The initial change in excess reserves

$100 million – (20% * $100 million)

$100 million – $20 million = $80 million in ER

Example 2

•

Given a required reserve ratio of 20%, assume the Federal Reserve purchases $100 million worth of US Treasury Securities on the open market from a primary security dealer. Determine the maximum change in loans in the banking system from this Federal Reserve purchase of bonds .

The initial change in excess reserves * The money multiplier = max change in loans

$80 million * (1/20%)

$80 million * (5) = $400 million max in new loans

Example 3

•

Given a required reserve ratio of 20%, assume the Federal Reserve purchases $100 million worth of US Treasury Securities on the open market from a primary security dealer.

Determine the maximum change in the money supply from this Federal Reserve purchase of bonds .

The maximum change in loans + $ amount of Federal

Reserve action

$400 million + $100 million = $500 million max change in the money supply

Example 4

•

Given a required reserve ratio of 20%, assume the Federal Reserve purchases

$100 million worth of US Treasury Securities on the open market from a primary security dealer. Determine the maximum change in demand deposits from this Federal Reserve purchase of bonds .

The maximum change in loans + $ amount of initial deposit

$400 million + $100 million = $500 million max change in demand deposits

Review

•

Required Reserve = Amount of deposit X required reserve ratio

•

Excess Reserves = Total Reserves – Required Reserves

•

Maximum amount a single bank can loan = the change in excess reserves caused by a deposit

•

The money multiplier = 1/required reserve ratio

•

Total Change in Loans = amount single bank can lend X money multiplier

•

Total Change in the money supply = Total Change in Loans + $ amount of

Fed action

•

Total Change in demand deposits = Total Change in Loans + any cash deposited