Professor Blanaid Clarke Trinity College Dublin

advertisement

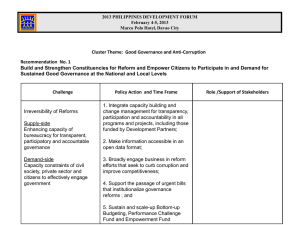

Corporate Governance Reform Professor Blanaid Clarke Trinity College Dublin Law Reform Commission Annual Conference 11th December 2012 Presentation I. What went wrong? Corporate Governance Failings II. Recent Regulatory Initiatives Irish EU III. Next Steps 2 I. Global Corporate Governance Failings in Financial Institutions (Hopt, 2012) • Risk Management and Internal Control Failures • Deficiencies in the Profile and Practice of directors and Senior Management • Complex and Opaque Corporate and Bank Structures • Perverse Incentives • Failures in Disclosure and Transparency • Weak Market for Corporate Control 3 Domestic Corporate Governance Failings (Regling and Watson, 2010) • Management failed to appreciate the risk entailed by the significant concentration of bank assets in property related activities. • Lending guidelines and processes were widely circumvented. • Poor remuneration policies were tolerated which encouraged and rewarded risk‐taking. • There were “very specific and serious breaches of basic governance principles” in specific institutions 4 II. Regulatory Initiatives Ireland • PRISM Supervisory Engagement Model and new Enforcement Model • Fitness and Probity regime • Corporate Governance Code for Credit Institutions • Central Bank Supervision and Enforcement Bill • Irish Corporate Governance Annex 2010 • Companies Consolidation and Reform Bill • Department of Justice, White Collar Crime Consultation 5 Enforcement powers “assertive risk-based approach underpinned by a credible threat of enforcement” Supervisory measures and stronger enforcement tools (including combination of both) to address concerns about regulated entities and their senior management/individuals Principles: “proportionate, consistent, targeted and transparent” 6 Settlement Agreements and Monetary Penalties €20,671,000 Monetary Penalties Settlement Agreements Monetary Penalties 14 12 €7,000,000 10 €6,000,000 8 6 €5,000,000 4 €4,000,000 2 €3,000,000 0 2006 2007 2008 2009 2010 2011 2012 €2,000,000 €1,000,000 56 Administrative Sanctions Settlement Agreements (other work includes refusals, revocations, F&P and supervisory warnings) €0 2006 2007 2008 2009 ASP Fines 7 2010 2011 2012 Fitness and Probity • Central Bank Reform Act 2010, Part III • Financial service Providers (not credit unions) • Pre-Approval Controlled Functions (Chief Executive Officer, Heads of Compliance, Risk, and Internal Audit). • Controlled Functions • Fitness and Probity Standards (Competent and Capable; Honest, Ethical, Financially Sound) 8 Corporate Governance Code for Credit Institutions and Insurance Undertakings - Composition of the Board Chairman CEO Independent Non-Executive Directors Directors Role of the Board Appointments Risk Appetite Meetings Committees Compliance Statement to the Central Bank 9 Central Bank (Supervision & Enforcement) Bill • Penalty up to €10,000,000 for body corporate or 10% of turnover (whichever highest) and €1,000,000 for natural person • Suspension of authorisation • Revocation of authorisation • Directions - single, wide ranging directions regime • Skilled persons reports power to require reports at the cost of the firm • Authorised Officers - single appointment regime and wide ranging powers • Regulations - detailed and expansive powers to make regulations • Facilitates assistance overseas supervisors to • Gives protection whistleblowers to • Court power to restitution orders 10 make Other Irish Initiatives • Irish Annex • Companies Consolidation and Reform Bill 11 White Collar Crime • Discussion Document (October 2010), Submissions published (April 2011) – Definition – Investigating and Prosecuting White collar Crime – Protection for Whistleblowers – Legislation – Sanctions – Structures • Section 57 of the Criminal Justice (Theft and Fraud Offences) Act 2001 • Criminal Justice Act 2011 12 EU Regulatory Initiatives Corporate Governance • Green Paper on Corporate Governance in Financial Institutions (2010) Feedback (July 2012) – – – – – – – – Boards of Directors Risk Related Functions External Auditors Supervisory Authorities Shareholders Implementation of Corporate Governance Principles Remuneration Conflicts of Interest • Proposed Amendments to the Capital Requirements Directive (2011) • Commission Recommendation on Remuneration Policies in the Financial Services Sector (2009) • Green Paper on General Corporate Governance (2011) • Proposed Directive on Women on Boards (2012) 13 EU Regulatory Initiatives Company Law • Green Paper on Auditing (2010) and Proposals (2011) • Reflection Group on the Future of Company Law (2011) • Consultation on the Future of European Company Law (February 2012)Feedback (July 2012) 14 • The European Banking Authority • Single Supervisory Banking Mechanism 15 III. Next Steps 1. Review of Existing regulatory regimes to assess effectiveness in respect of agreed objectives and consistency 2. Consider EU regulation/guidance and best Practice in other jurisdictions 3. Develop, where appropriate, a co-ordinated approach in terms of information gathering, case building and enforcement 16