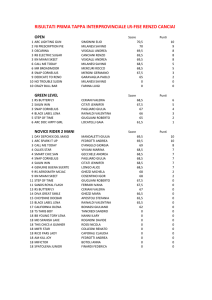

Money market

advertisement

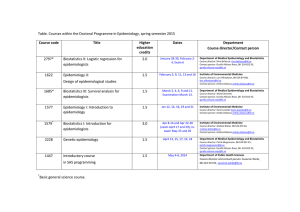

How to read financial papers Basic financial terms, instruments and markets to know in order to understand news Vallyon Andrea 2010 1 How to read financial papers How to get information for the best investments? Vallyon Andrea 2010 2 Would you have invested? Vallyon Andrea 2010 3 December 1977: Arrested for bad driving Vallyon Andrea 2010 4 The entire Microsoft staff. Albuquerque, 1978 Vallyon Andrea 2010 5 Learning goals Define Finance and the Financial System Understand the relationship between financial institutions and markets Describe the role of money and capital flow in the financial system Define the money and its functions Vallyon Andrea 2010 6 Materials to learn from Stephen Valdez: An Introduction to Global Financial Markets,Macmillan Press Ltd.1997 – chapter 1 György Székely: The Essence of Money and Banking A Handbook for Financial Managers. KJK-Kerszöv Kft. 2002. CH 1 Lawrence J. Gitman: Principles of Managerial Finance, Addison - Wesley 10th Edition – see sharepoint: CH1:21-28old. Sharepoint: Keown CH2 Financial Markets and Interest rates Lecture ppt. Vallyon Andrea 2010 7 Indicative aim Link theory with the ‘real’ world. Vallyon Andrea 2010 8 "In my whole life, I have known no wise people (over a broad subject matter area) who didn't read all the time - none, zero."-- Charlie Munger Vallyon Andrea 2010 9 Money = Happiness? Vallyon Andrea 2010 10 Power of Money and Finance "We witnessed the collapse of the financial system,' said Mr. Soros. "There's no sign we are anywhere near the bottom." Vallyon Andrea 2010 11 Vallyon Andrea 2010 12 Securities FINANCIAL MARKETS -Money and Capital markets -OTC, Stock- exchanges ? Funds LENDERS Funds -HOUSEHOLDS priv.placement -Government ? Deposits Funds Funds BORROWERS -COMPANIES -Government -Municipalities Loans FINANCIAL INSTITUTIONS -Commercial banks,Investment banks, Funds Mutual funds,Leasing comp.,etc. Vallyon Andrea 2010 13 Investment decision „All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies„ Warren Buffett Vallyon Andrea 2010 14 Money evolution I. Direct interchange of commodities (barter trade) II. The general equivalents (salt, slaves etc.) – Served as a basis of comparison Vallyon Andrea 2010 15 Criteria of money Physical essentials: – – – – – – Cheap to produce Homogeneously equal Highly divisible Convenient to carry Universally acceptable Stability in value Vallyon Andrea 2010 16 III. Functions of money – Measure of value (értékmérő) – Means of turnover (forgalmi eszköz) – Medium of payment, medium of exchange (fizetési eszköz) –standard of deferred payment (halasztott fizetési eszköz) – Store of wealth (kincsképző) – World money – if accepted internationally Vallyon Andrea 2010 17 When did money first appear? All equivalents are money Karl Marx – only gold Today? –credit money system Vallyon Andrea 2010 18 Think About That!: Vallyon Andrea 2010 19 Era of metals Monometallism Bimetallism Greshams axiom. The good money was crowded out by the worse Vallyon Andrea 2010 20 Money substitutes Growing turnover Need to increase rotation Vallyon Andrea 2010 Appearance of substitutes 21 Money substitutes 2 Acceptability Discounting papers Commercial papers, trade bills (kereskedelmi váltó) Today –e-money Vallyon Andrea 2010 22 Pyramid shape analysis company For long term Fundemental analysis Economic variables and the exchange rate country world economy Q? Vallyon Andrea 2010 23 Participants bearish and bullish traders and speculators Vallyon Andrea 2010 24 A VERY Bad Bear! Vallyon Andrea 2010 25 Market terminologies – Secondary and primary – Money and bond market, domestic and international markets – Wholesale and retail market – Open and closed ( open offer for sale and private placing – Claim for the interest (Bearer and registered securities) Vallyon Andrea 2010 26 Money market Short term instruments Pure discount securities Contracts up to 1 year Huge volume and vigorous competition No physical place Essentially for professionals ( banks, fin. institutional investors, brokerage firms, companies) Liquidity ( fine spreads based on interest rate of lending and borrowing) Creditworthiness (risk and return) Vallyon Andrea 2010 27 Financial instruments Money market instruments – – – – – – – Treasury bills (T-bill) Local authority/ public utility bills Certificate of deposit (CD) Commercial paper (CP) Bill of exchange Bankers` acceptance (BA) Federal agency securities (Fannie Mae) Vallyon Andrea 2010 28 Financial instruments Other possibilities – – – – Call money Interbank market Repurchase agreement /repo/ - Time deposit Vallyon Andrea 2010 29 Call money – Call money – Term: very short period of time • Overnight(12p.m-12p.m. next day) • 3 or 7 days notice – Negotiable: no – Money is lent by one bank to another and may be called back anytime Vallyon Andrea 2010 30 Money market securities T-bills – Domestic instruments issued by governments to raise short term finance balancing cashflow – Non-interest bearing and interest-bearing, sold at discount in auction – Negotiable – Generally 13,26,52 weeks Certificate of deposit - CD – Usually issued by banks, is simple the evidence of time deposit – Negotiable not as time deposit – Sold at discount or pay coupon – Interest payed at maturity – 30 days to 3 month or could be longer Vallyon Andrea 2010 31 Money market securities 2 Commercial paper- CP – Issued by large, safe and well-known companies bypassing banks to achieve lower borrowing rates (sometimes below the bank’s prime rate) – Very short term (max 270 days, most 60days or less) – Issued at discount – Unsecured security Vallyon Andrea 2010 32 Money market securities Trade bill, bills of exchange, bankers’acceptance – Used by companies for trade purposes – The seller draws up a bill to the buyer to pay and asks to sign it – Could be sold at a discount to the bank – Bank’s signature is a guaranty ( eligible bills in UK the Bank of England is the guarantor) Vallyon Andrea 2010 33 Capital market Instruments – Bonds – Government bonds – Local authority papers – Mortgage or other assets backed bonds – Corporate – Foreign – Junk – Shares – Preferred – Normal Innovations – Convertibles – Variables Investment notes Vallyon Andrea 2010 34 Thanks for your attention! Vallyon Andrea 2010 35