Automation of Provisional Payments – Varsha – 21Aug2014

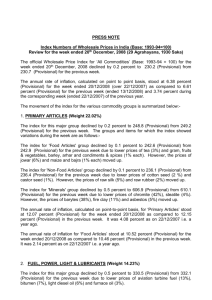

advertisement

Automation of ‘Provisional Payment’ requirements 21 August 2014 Stakeholder Modernisation Meeting (Megawatt) Varsha Singh What we need to achieve Automation to the transactional ‘Security’ (provisional payment) requirements that will also be included within the CUSDEC message format. This eliminates the separate paper transaction (DA70) for electronic declarations and allows for full automation and end-to-end management of Customs’ security requirements. The scope includes pre and post declaration “security”, as well as “penalty” and “forfeiture” amounts. Automate Provisional Payments as part of an Integrated Process • Develop Provisional Payments as part of iCBS • Manage the conditions pertaining to the type of provisional payment lodged. • Finalise the liquidation of provisional payments. 2 Platform Phase 1: Link to Declaration EDI Channel Processing on iCBS Develop as part of declaration and VOC Section 91 – submitted as a supporting document with signature Development will be required by the trader systems as well as internally ito interfaces 3 Provisional Payment Categories - Type 1 Type 1 – Provisional payments lodged at time of clearance a) Pending implementation of Anti-Dumping/Countervailing duty b) Pending re-exportation of temporary imported goods c) To cover duties/VAT pending VOC - hire/lease agreement based on flight hour d) To cover duties/VAT pending VOC – consignment goods Part of Declaration / VOC 4 Provisional Payment Categories – Type 2 Type 2 - Provisional payments lodged for conditional release of goods a) Pending production of import documents (excl. permits/certificates) b) Pending production of any document for of any other Act (excl. permits/certificates) c) To obtain release under embargo (Sec. 107) d) Pending production of literature to establish/confirm tariff heading e) Pending tariff determination by HQ (no testing or product analysis involved) f) To cover analysis fees g) Pending value determination (VDN) h) Pending implementation of Anti-Dumping/Countervailing duty Part of VOC 5 Provisional Payment Categories – Type 3/4 Type 3 – Provisional payments lodged for penalty or forfeiture • Pending a decision on the imposition/amount of a suitable penalty (Sec.91) • Forfeiture Part of VOC Type 4 - Provisional payments unrelated to customs clearance (Not included in this Phase to remain part of CEB01) • Pending allocation of proceeds of State Warehouse auction/sale • Payment of instalment amounts (Audit schedule) • Issued for customs border control contraventions • Other 6