variable costs

advertisement

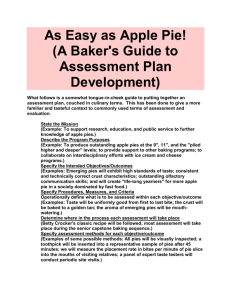

BUSINESS ECONOMICS TOPICS GOAL OF BUSINESSES COSTS OF BUSINESSES PRICES AND REVENUES MARKET STRUCTURE MARKET CHANGE INTERNATIONAL MARKETS TYPES OF BUSINESSES SOLE PROPRIETORSHIP PARTNERSHIP CORPORATION GOAL OF A BUSINESS MAXIMIZE PROFIT PROFIT = REVENUES – COSTS PROFIT = PAYMENT TO OWNERSHIP PURSUIT OF PROFIT ALLOCATES RESOURCES COMPETITION KEEPS PROFIT IN LINE (AVERAGE: 3%) BUSINESS PLAN WHAT TO PRODUCE WHO BUYS AND WHY WHO ARE COMPETITORS STAFFING AND SUPPLIES SALES AND REVENUES COSTS PROFITS ALL OVER MULTIPLE YEARS FIXED COSTS COSTS WHICH DON’T VARY WITH HOW MUCH IS PRODUCED AND SOLD ALSO CALLED “OVERHEAD” SPACE AND EQUIPMENT MUST PAY VARIABLE COSTS COSTS THAT DIRECTLY INCREASE WITH PRODUCTION AND SALES WORKERS, ENERGY, RAW MATERIALS MIX OF FIXED AND VARIABLE COSTS CAN BE DIFFERENT FOR DIFFERENT BUSINESSES GYM: ALMOST ALL FIXED COSTS FOR SPACE AND EQUIPMENT PERSONAL TRAINER: ALMOST ALL VARIABLE COSTS (TIME) TOTAL COSTS TOTAL COSTS = FIXED COSTS + VARIABLE COSTS RAY’S PIZZERIA (MONTHLY SALES) FIXED COSTS VARIABLE COSTS 2000 PIES $10,000 $8,000 4000 PIES $10,000 $15,000 TOTAL COSTS $18,000 $25,000 ONE IMPLICATION OF THE DIFFERENCE BETWEEN FIXED AND VARIABLE COSTS – THE SHUTDOWN RULE IF ALL VARIABLE COSTS, SHUTDOWN WHENEVER REVENUES ARE LESS THAN COSTS BUT IF HAVE FIXED COSTS, EVEN IF SHUTDOWN, STILL ARE RESPONSIBLE FOR FIXED COSTS IN THIS CASE, STAY OPEN AS LONG AS REVENUES EXCEED VARIABLE COSTS – HAVE $ LEFTOVER TO APPLY TO FIXED COSTS EXAMPLE OF THE SHUTDOWN RULE RAY’S PIZZERIA (4000 PIES) FIXED COSTS $10,000 VARIABLE COSTS $15,000 TOTAL COSTS $25,000 IF REVENUES ARE $22,000, PAYS VARIABLE COSTS, AND HAS $7000 REMAINING TO APPLY TO FIXED COSTS; IN “RED” BY $3000 IF SHUTDOWN, STILL MUST PAY FIXED COSTS OF $10,000 IF REVENUES ARE UNDER $15,000 THEN DOES SHUTDOWN MARGINAL COST SIMPLY THE COST OF MAKING ONE MORE UNIT OR, IF MAKING SEVERAL MORE UNITS, THE COST PER UNIT EXAMPLE: RAY WANTS TO ADVERTISE TO TRY TO SELL 500 MORE PIES PER MONTH. MARGINAL COST IS THE ADDITIONAL COST PER PIE RAY’S PIZZERIA (4000 PIES) FIXED COSTS VARIABLE COSTS TOTAL COSTS $10,000 $15,000 $25,000 IF RAY IS ALREADY SELLING 4000 PIES AT A TOTAL COST OF $25,000, WON’T THE MARGINAL COST OF EACH OF THE NEXT 500 PIES BE $25,000/4000 = $6.25? NO, IF RAY USES HIS EXISTING SPACE, THEN FIXED COSTS DON’T CHANGE. ADDITIONAL COSTS ARE ONLY VARIABLE COSTS AT $15,000/4000, OR $3.75 PER PIE DEFINITIONS AVERAGE COST: TOTAL COSTS/#UNITS, where total costs include fixed plus variable MARGINAL COST: WHAT IT COSTS TO PRODUCE ONE MORE UNIT usually is variable cost per unit. LABOR ISSUES A BUSINESS WANTS IN A WORKFORCE: * APPROPRIATE SKILLS FOR THE JOB * MOTIVATION * DEDICATION * ADAPABILITY * PRODUCTIVITY * LOW TURNOVER QUESTION: PAY A HIGHER-THAN-NEEDED WAGE TO GET THESE – SAVE $ IN LONG-RUN? OWNING VERSUS LEASING ADVANTAGES OF OWNING * TOTAL CONTROL * LOCK-IN COSTS * FOR REAL ESTATE, POSSIBILITY OF VALUE-APPRECIATION ADVANTAGES OF LEASING * FLEXIBILITY * NOT “LOCKED-IN” TO SPACE * AVOID POSSIBLE DEPRECIATION HANDLING OF OWNERSHIP COSTS IF LEASE, LEASE PAYMENTS ARE PART OF FIXED COSTS IF BUYING AND BORROW FUNDS, LOAN PAYMENTS ARE PART OF FIXED COSTS HOWEVER, EVEN IF OWN PROPERTY FREE OF ANY PAYMENTS, PAYMENTS COULD HAVE EARNED BY LEASING SHOULD BE PART OF FIXED COSTS WHEN TO GO TO THE NEXT LEVEL? TWO REASONS TO EXPAND A BUSINESS: 1) BECOME MORE COST-EFFICIENT PRODUCING MORE AT A LOWER COST PER UNIT 2) SELLING MORE UNITS (MORE VOLUME) AND THEREFORE MAKING MORE PROFIT RAY DOUBLES THE SIZE OF HIS PIZZERIA PIES PER MONTH 4000 8000 FIXED COSTS $10,000 $20,000 VARIABLE COSTS $15,000 $25,000 TOTAL COSTS $25,000 $45,000 AVERAGE TOTAL COST $6.25 $5.63 REVENUE @$10/PIE $40,000 $80,000 PROFIT $15,000 $35,000 IS BIGGER ALWAYS BETTER? YES, IF HAVE ECONOMIES OF SCALE – COSTS PER UNIT FALL AS INCREASE PRODUCTION NO IF HAVE DISECONOMICES OF SCALE – COSTS PER UNIT RISE AS INCREASE PRODUCTION MANAGEMENT AND COORDINATING COSTS SEEM TO BE THE INHIBITING FACTORS FOR CONTINOUS ECONOMIES OF SCALE