Strategic Opportunities & Planning for the Future

advertisement

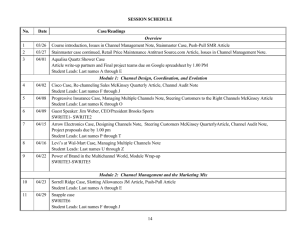

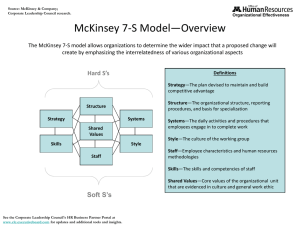

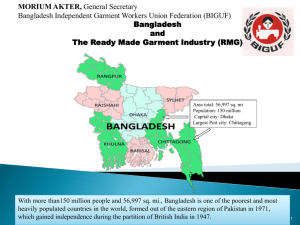

Bangladesh Strategic Opportunities & Planning for the Future Date: 24th Nov’ 12 Venue: Lake Shore Hotel ICTA 2012 John T. Smith Comp TI, CText, FTI, CMC, MIMC. International Coordinator / Long Term Adviser Textiles and RMG UNIDO – BEST & Chairman, International Events The Textile Institute Where Are We Now? • Textiles and Clothing accounted for 87.9% for export in 2011/12 • EU demand for Bangladeshi textiles and clothing surged by 28.6% in 2011 • The EU was also Bangladesh’s largest market for woven clothing Source: McKinsey Report Where Are We Now? Source: McKinsey Report Where Are We Now? Source: McKinsey Report Implication of McKinsey Competitive International Factors • SWOT Analysis STRENGTH -EPZ’s -Back to Back L/C -Plentiful Population -Modern Equipment -Dynamic Entrepreneurs - Financial Model WEAKNESS -Infrastructure : Electricity, Gas, Roads, Rail, Ports -Slow Reaction -Product Development -Technical Management -Literacy - Lack of integrated thought OPPORTUNITY -Broaden Categories of Products -Move Up market -Introduce more linkages -Cooperation Partners -Introduce non-woven -Introduce fibre production - Change Philosophies THREATS -Worker Unrest -Uncompetitive Practices - outdated administration THE WAY FORWARD New Opportunities for Textiles & Garment Entrepreneurs New Opportunities… • Primary Textiles - Backward/ Forward linkages - New processes - Value raw material for its positive properties - Use international research results - New Fibre use e.g. Bamboo - New Fabric finishing New Opportunities… • - Garments More effective production More CAD/ CAM More Design Groups More Fast Response /ERP More Integrated Product Design More Mix & Match New Opportunities… - Comprehensive Integrated Manufacture! - Use Critical Path Analysis - Product friendliness (change easy parameters) - Many products from few inputs (raw materials) New Opportunities… • Literate Educated Workforce • Design & Build Eco-Friendly Economic Factories New Buying Markets Source: McKinsey Report Challenges for Growth • • • • • Major Issues Infrastructure Compliance Supplier Performance Raw Materials Economy & Political Stability Source: McKinsey Report The Next Sourcing Hot Spot Source: McKinsey Report The Next Sourcing Hot Spot • Goldman Sachs includes Bangladesh in the Next 11 (N-11) • J P Morgan – ‘Frontier Five’ stating that major advantages of Bangladesh is ‘ Price & Capacity’ • Labour cost expected to rise by 30% Efficiency Increase to Match Wage Increase RMG Factories in Different Countries Bangladesh 5000 + Indonesia 2450 Vietnam 2000 Cambodia 260 Expected Trends • Shift from ‘Knitwear’ to ‘Woven’ expected • Upgrade Service Level e.g. Design, Package, Ticketing, Warehousing, Delivery Expected Trends • Government • Supplies ( Garment Makers) • Buyers ‘The story of Bangladesh has just begun’ – Head of Sourcing Office ‘ Battle for Capacity is on the Horizon’ Expected Trends • China dominated in 2010 Source: McKinsey Report CPO Forecasts • 32% will decrease sourcing from China • 54% plan to decrease their sourcing from China i.e. 86% are reducing • Wages in Coastal China increasing rapidly • Shortage of Garment Workers in the area • China will eventually be a net importer – not exporter!! Sources With thanks to : - The McKinsey Report - Textiles Intelligence Reports 145 & 157 - UNIDO BEST BWTG Reports Thank You For Your Attention