PERTEMUAN 10 1. A strategic control process in a MNE

advertisement

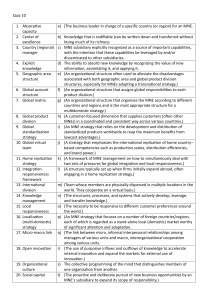

PERTEMUAN 10 1. A strategic control process in a MNE a. Involves a one-directional flow of products, capital and knowledge. b. Should be formal but not necessarily rigid. c. Will not work if the firm cannot get good data on global competitors. d. All of the above. 2. The right objectives should be based on I. Analysis of the competition II. Strengths of the firm a. Only I b. Only II c. Either I or II d. I and II 3. A strategic control process in a MNE should include a. Personal rewards b. Central intervention c. Periodic reviews d. All of the above. 4. The benefits of a strategic control process in a MNE include a. More stretching of performance standards b. Greater realism in planning c. More motivation for business unit managers d. All of the above. 5. A challenge for the strategic control process is a. Clarity in planning b. The process gets big and bureacratized c. Non-financial measures d. Annual operating plans 6. Which of the following is not true concerning the performance evaluation of global innovators. a. They need relatively flexible performance evaluation systems. b. They rely more on behavioral controls. c. They rely on outcome controls. d. They need more autonomy than do implementors. 7. Which of the following is true concerning the performance evaluation of implementors. a. They need relatively flexible performance evaluation systems. b. They rely more on behavioral controls. c. The rely on outcome controls. d. They need more autonomy than do global innovators. 8. The international environment and global strategy of the MNE are very influential in the budgeting process in that a. The value of budgets is equally accepted worldwide due to the increased flow of information about evaluation techniques. b. Transfer prices can affect profitability and, therefore, performance evaluation. c. Managers in countries with wide variations in inflation rates usually can predict those rate variations for budgeting purposes. d. All of the above. 9. Which of the following does not accurately describe economic value added. a. It is after-tax operating profit minus the total annual cost of capital. b. It includes the cost of debt and the cost of equity. c. It is a measure of the value added or depleted from shareholder value in one period. d. It requires that different costs of capital be used in different country settings. 10. Foreign subsidiaries have a better understanding of financial performance with I. Financial statements in the home headquarter’s currency II. Financial statement in the local currency a. I b. II c. Either I or II d. I and II