regulatory change in bermuda

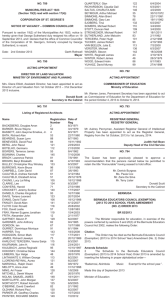

advertisement

REGULATORY CHANGE IN BERMUDA: AN INDUSTRY PERSPECTIVE NEIL GLASS – GROUP LEADER, ASSET MANAGEMENT Why Bermuda Created A New Fund Class In Fall 2013, Bermuda took a bold step to modernize its fund legislation. Create a new ‘user friendly’ investment fund class that can be registered and launched via a streamlined process. Executed through the collaboration of the Bermuda Monetary Authority (BMA), Government of Bermuda, Bermuda Business Development Agency (BDA) and key contacts with Bermuda’s fund industry. Funds could be launched on a fast-track basis using the BMA’s online system ERICA. Demonstrated Bermuda’s responsiveness to market by enabling a fund to register and launch faster, more efficiently and cost effective. Investment Funds Amendment Act 2013 Self Declared Exempt Funds – Same Day Registration 1. Class A Exempt Funds - targeted to qualified participants. 2. Self Certification- No regulatory approvals. Electronic filing of Certificate and Offering Document only with the Bermuda Monetary Authority (“BMA”). 3. Immediate launch. Class A Exempt Fund: Qualified Participants 1. High income private investors. 2. High net worth private investors. 3. Sophisticated private investors. 4. Institutional investors. Class A Exempt Fund: Investment Manager 1. Authorized by the BMA, the SEC or by other foreign regulator recognized by the BMA. OR 2. Gross assets under management individually or as part of a group of at least $100 Million Dollars and carrying on business in a jurisdiction recognized by the BMA. Class A Exempt Fund: Fees ( in US$) 1. BMA Initial/Annual filing fee 2. Registrar of Companies Incorporation fee $1,500 1,995 3. Tax Assurance certificate 170 4. Certificate of Incorporation 277 5. Registrar of Companies Filing fee 6. Non-Licensed Person fee (AML) Total Fees to Launch: 82 930 $4,954 Investment Funds Act 2006: Class B Exempted Fund 1. New Class B Exempted Fund. 2. Existing Exempted Funds Grandfathered. 3. Subject to Approval Process. Investment Funds Act 2006: Standard, Authorised and Institutional Funds 1. Standard Fund. Retail. Overview. 2. Administered Fund. Local fund admin requirement. Overview. 3. Institutional Fund. Minimum investment of US$100,000 or a qualified participant. Private Equity Funds: Not Subject To IFA 1. Private Fund Exclusion: private offer to less than 20 investors. 2. Closed Ended Funds. No investor redemption rights. 3. Limited Partnership. No Bermuda GP required. Updates and Future Initiatives 1. US-Bermuda FATCA IGA Model 2 signed. 2. UK-Bermuda FATCA IGA Model 2 signed. 3. AIFMD: Co-Operation Agreements signed.