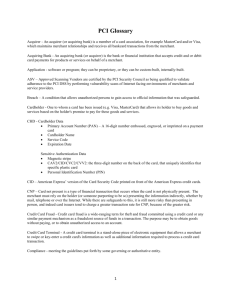

Leading Causes of a Data Breach

advertisement

Payment Card Industry Data Security Standards Annual Refresher Training This refresher course will: • Review of the PCI Data Security Standards – – – – PCIDSS in a nutshell Payment Card Protection Team Compliance basics Data breach review • 2013 Change to How the University’s Compliance is Measured • 2013 New Technology: Online SAQ Portal • Update of PCIDSS compliance roles at the University • Contact information The Purpose for PCI DSS “The PCI DSS was developed to encourage and enhance cardholder data security and facilitate the broad adoption of consistent data security measures globally.” PCI DSS Requirements and Security Assessment Procedures, October 2010, pg. 5 PCI DSS Quick Reference Guide, slide 8 Payment Card Protection ‘Team’ 1. Employees, contractors or students involved in accepting credit or debit cards (or who touch the cardholder data environment) Merchant Managers & staff (including student workers) Support units: ARS, IT, Purchasing, OGC, third party vendors 2. Credit card brands Visa MasterCard American Express Discover 3. Acquiring bank (Wells Fargo) Complying with PCI Standards at the University • Standards are established & updated by the PCI Council and card issuers • Standards are enforced primarily through the University’s contract with Wells Fargo which is managed by Accounts Receivable Services (ARS) • ARS oversees PCI compliance through Policy & procedures Merchant Manager training & support Coordination with related units such as University Information Security Facilitation of the annual merchant account compliance review process PCI Council Visa MasterCard AmEx Discover Wells Fargo UMN Accounts Receivable Services OIT UIS Dept IT Merchant Manager Employees & student workers What is a data breach? Broadly speaking…a breach is: An unauthorized acquisition of protected data that compromises the security, confidentiality, or integrity of the protected information. Leading Causes of a Data Breach 1. Malicious attack – Targeted attack with the intent to commit data theft or otherwise inflict harm 2. Negligent employee or contractor – Failure to follow established standards – Lack of training 3. System glitch – IT or business process failures Cost of a Breach • $5.5 million: the average total organizational cost of a data breach* – 39% of incidents involved a negligent employee or contractor – 37% concerned a malicious or criminal attack – 24% involved system glitches including IT and business process failures • $222: The average cost per compromised record for detection, escalation, notification, and remediation (doesn’t include costs associated with damaged reputation)* • 1,506,900 records: the number of private records exposed in data breaches at 59 US higher education institutions in 2012** 1.5M X $222 = $333,000,000)/59 = $5,644,068 estimated cost per HE breach *2011 Cost of Data Breach Study, Ponemon Institute **http://www.privacyrights.org/data-breach The University at Risk http://bits.blogs.nytimes.com/2012/10/03/hackers-breach-53-universities-dumpthousands-of-personal-records-online/?smid=tw-share The University as Data “Gold Mine” But, it isn’t always about the money. Hacktivism Change in 2013 • Wells Fargo and Visa raised the University’s compliance demonstration requirements. This change was based on the annual number of Visa transactions. This means: – Compliance is now measured by a security assessor • – – For 2013 we will use a Qualified Security Assessor (QSA) from CampusGuard, a firm specializing in higher education security Individual merchants must continue to complete the annual Self-Assessment Questionnaires (SAQ), and… The University will only be considered PCI compliant if all accounts are deemed compliant by the assessor New Technology • Rolled out an online portal for SAQ completion & document collection – The portal provides merchant managers with 24/7 access to complete their SAQs – Managers can ask the assessor questions directly through the portal – A secure ‘document locker’ provides each merchant with a dedicated area to store PCI-related documents Updated Contacts for 2013 • Accounts Receivable Services pmtcard@umn.edu – General inquiries Darla Schroeder, Cash Application Manager (612-626-7215), schro077@umn.edu Terminal issues Account set-up, close, modify Reconciliation, chartstring or other accounting issues • University Information Security abuse@umn.edu • Your IT professionals _______ Laura Gilbert, PCI-DSS Compliance Analyst (612-624-7892) gilbert7@umn.edu Manager training CampusGuard portal Annual assessment : SAQ &UMN form completion ROC assessment Remediation plan oversight Policy questions Vendor relationship support (e.g., pen testing, 3rd party outsourcing) Resources • Be familiar with University policy & procedures – Accepting Revenue Via Payment Cards – Obtaining Approval to Accept Credit Cards – Managing Payment Card Acceptance • Your IT professionals • Applicable University Forms – – – UM 1624 Payment Card Manager Form UM 1623 Employee Non-Disclosure Form UM 1705 Desktop Usage Agreement (only required for SAQ-A e-commerce solutions) • Controller’s Office Website: General and SAQ-specific training materials & guidance documents • PCI Security Standards Website: SAQ forms, guidance docs • PCI Glossary • Look for emails throughout the year from the Controller’s Office and partner departments about program changes, new issues, annual deadlines and training. Allow time in your schedule to fully manage your account.