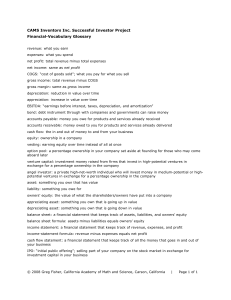

KEY FUNCTIONS OF BUSINESS Finance slides – brief overview

FINANCE

cash flow statement income statement balance sheet

Finance

The financial statements (balance sheets, profit and loss account and cash flow statement) can be used to check the performance of a business entity. These statements can be used to compare businesses and to analyse trends.

Finance (and accounting)

Accounting and finance support the operations of a business.

Accounting allows business performance to be monitored. It is concerned with information management.

Money comes into the business (revenue) as a result of sales

Money goes out of the business (expenses)

And the flows are recorded. This is accounting.

Finance relates to the external sources of funding that allow the business to perform its prime function and to make a profit using borrowed funds

Larger businesses have separate departments however in a small business the owner is often responsible for keeping the basic records for accounting purposes and will outsource the final accounting, auditing and financial advice to an accountant.

Source of funds (not in syllabus)

There are two ways a business can source funds, can you think of what these are?

Source of funds:

INTERNAL AND EXTERNAL

Equity and debt

INTERNAL FUNDS

Business owners hold profit back to reinvest in the business as ‘retained profits’

Owners equity

EXTERNAL FUNDS

When a company ‘goes public’ or is

‘listed’/’floated’ it means a business is seeking shareholders to contribute funds to the operation of the business

Many organisations have floated companies on the ASX

Can all companies access money easily this way? Why/why not?

What is a blue chip company?

External Funds

Other funds are available these can be from:

Private funds: family, friends, personal loans

Banking:

Overdrafts, bank loans

Merchant Banks:

Investment, corporate financial advice, money market

Finance companies: medium-term financing to smaller businesses and companies. Active in lease financing and lending for equipment purchases.

Building Societies: deposits/housing loans. Many now banks and can loan money

Insurance companies and superannuation funds

Financial markets

Debt vs Equity

Which is better?

Debt vs Equity

Debt financing comes from loans (borrowed funds).

The business goes to an outside source for the money that it needs. The interest due from large loans needs much consideration.

Equity financing comes from the owners of the business

– either retained profits or personal savings.

Small businesses will often re-invest their profits in capital assets in an attempt to minimise taxation, such as purchases that are tax deductable.

Discuss the purpose of financial statements

Employment contracts

Looking at examples provided to you of employment contracts in different industries and for different employment types (casual, permanent, part-time); identify similarities and differences between the contracts

cash flow statement see pg. 127

Cash flow: businesses exist to make a profit..to keep up with payments and financial commitments and stay active, the business needs a steady flow of funds.

Liquidity: describes a business’s ability to meet its debts from its cash inflows.

All aspects of a business depend on its ability to pay bills as they become due. If it can’t pay its bills it will be declared insolvent and cease to exist.

Cash-flow budgets will help a business predict if and when cash shortages are likely to occur. Such shortages may need to be covered by short-term loans such as bank overdrafts.

Regular (monthly) cash-flow budgets and statements allow such needs for finance to be recognised and acted upon.

income statement

REVENUE STATEMENT or PROFIT AND LOSS ACCOUNT

Summarises the structure of the revenue that has come into the business and the expenses that have been incurred in running and operating the business.

See income statement on pg. 122

Through bookkeeping and accounting each business is able to look at the GROSS PROFIT and NET PROFIT which will show how the business is performing.

Gross profit vs Net profit

GROSS PROFIT subtracting the costs associated with sales from the value of sales (revenue)

NET PROFIT deducting from the gross profit the other expenses that were part of operating the business.

balance sheet – see fig on pg. 124

The final document that is produced at the end of the full accounting process.

It is built on the accounting equation:

Assets = Liabilities + Owner’s equity

The balance sheet shows the owners all the things that have been done with its earnings.

Balance sheet

Assets: items of value/there are 3 types

Current assets: cash or items that can very easily be converted to cash (stock, debtors, accounts receivable and pre-payments)

Non-current assets: more durable and more expensive. Difficult to sell quickly (buildings, furniture, land, machinery and office equipment)

Intangibles: difficult to measure/value. Goodwill, trademarks and patent rights and can be of great value when selling

Balance Sheet

Liabilities: items that the business owes to other people or organisations.

Current Liabilities: include short-term debts that need to be paid within 12 months or the financial year, bank overdrafts, creditors, accounts payable and accruals.

Non-current liabilities: include mortgages (land, buildings), and loans for large machinery and equipment (usually large, long-term loans)

Balance Sheet

Owners’ equity: starts off with what the business owner invests in the business..in larger companies owners’ equity is replaces with shareholders’ funds

Paid-up capital: amount of money originally put into the business – basis for determining the success of the original investment

Reserves/retained profits: the amount added to the original money put into the business. Often owners have re-invested in the business or are preparing to do so.

Net profit: figure calculated in the revenue statement for a certain trading period, presented as net profit before tax or a net profit after tax

Financial statements recap- in worksheets

After looking at various businesses annual reports online explain the construction of financial statements, their role and importance

Using simple financial data construct examples of all three financial statements

Assess the importance of effective cash flow management for business