Tariffs

advertisement

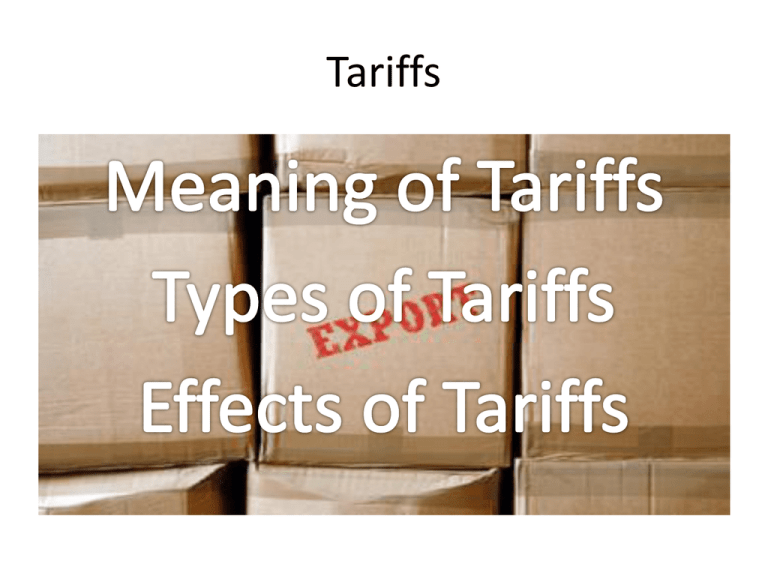

Tariffs Meaning of Tariffs Tariffs refers to import duties and export duties. In other words we can say tariffs is a tax or duty levied on goods when they enter or leave the national boundary. Cont’ed • Why impose tariff? • • • • To discourage consumption To raise revenue To discourage imports To protect domestic industries Types of Trade Tariffs are classified in a number of ways. 1. On the basis of purpose 2. On the basis of origin and Destination 3. On the basis of country- wise discrimination 1. On the basis of Purpose Tariffs are used for two different purpose 1. Revenue Tariffs: Revenue tariffs are meant to provide revenue to the state. Revenue duties levied on luxury consumer goods. 2. Protective Tariffs: protective tariffs are meant “ to maintain and encourage those of home industry protected by duties”. Now a days government levy import duties with the principal objective of discouraging imports in order to encourage domestic production of protected industry. 2. On the basis of origin and Destination 1. Ad Valorem duty: It is levied as a percentage of the total value of the imported common duty. The import duty is a fixed percentage of the c.i.f ( cost, insurance and freight) value of the commodity. It may be 10%, 20% etc. 2. Specific duty: specific duty are levied per physical unit of the imported commodity, as Afs X per TV, as cloth per meter, as oil per liter etc. 3. Compound duty: Often government levy compound duties which are a combination of the ad valorem and the specific duties. For instance a country may impose an import duty on a car at the fixed rate of 1 lake afs + 10% on the price of car. On the basis of country-wise discrimination Single column tariffs: When a uniform rate of duty is imposed on all similar commodities irrespective of the country from which they are imported is called single column tariffs. It is non discriminatory tariffs which is very simple and easy to design and administer. But it is not elastic and adequate. Much revenue may not be collected by this system. 2. Double column tariffs: Under this system, two different rates of duty exist for all or some of the commodities. It can be classified as under, I: General or conventional Tariffs: The general tariffs is the list of tariffs which is announced by the government as its annual tariffs policy at the beginning of the year. Conventional tariffs based on agreements with other countries. II: maximum and minimum Tariffs: Govt. usually fix rate two rates for importing the same commodity from different countries. Countries have good relation minimum rates are imposed like Pakistan and maximum tariffs rate is imposed on imports from the rest of the countries. Effects of tariffs 1.Trade Effect: The impact of the tariff on the quantity of goods imported and sold in the domestic market. As demand would decline due to the tariff imports of the commodity would also decline 2.Consumtion effect Refers to the reduction in domestic consumption as a result of a Tariff imposed on an imported commodity. As the price of the commodity would increase as a result of the tariff its demand in the market of the importing country would decline 3.Revenue Effect The revenue collected by the government as a result of the imposition of the tariff on the imported commodity. 4. Production Effect • The increase in domestic production of the commodity as a result of the tariff imposed on the imported commodity. The Government Imposes a Tax/Tariff We could describe this as a shift in the demand function. Or We could think of this as an increase in the price of imports Before Tariff Domestic Supply Price World Supply Domestic Demand Quantity After Tariff Domestic Supply Price World Supply with Tariff World Supply Domestic Demand Quantity Who gains who loses? Domestic Supply Price Tariff World Supply Domestic Demand Quantity Consumers lose this Domestic Supply Price Tariff World Supply Domestic Demand Quantity Producers gain this Domestic Supply Price Tariff World Supply Domestic Demand Quantity Government gains this much tax Domestic Supply Price Tariff World Supply Domestic Demand Quantity Net the country loses Domestic Supply Price Tariff World Supply Domestic Demand Quantity Key Words • Taxes levied on imports (also sometimes on exports) – Specific tariff: fixed charge for each good imported – Ad valorem tariff: a % of imported goods value • Who gains: – Government – Domestic producers (at least in the short run) – Employees of protected industries keep their jobs • Who loses: – Consumers who pay higher prices – The economy which remains inefficient – Employees of protected industries who don’t develop new skills