here - Administration, Monash University

advertisement

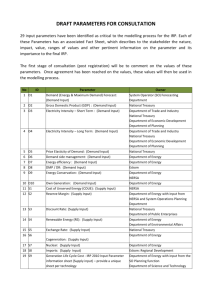

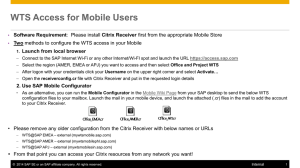

4 June 2010 Financial Services Enhancement Treasury Review Workshop Welcome Back ground and the need for improvement as part of the Financial Systems Enhancements (FSE) review Current functions of Monash University Treasury • Manage the University’s foreign exchange needs (Library, South Africa, Prato, major equipment purchases, etc.) • Manage the University’s transactional banking arrangements (Westpac) • Cash Forecasting • Manage University’s investments and Fund Managers • Manage the University’s Commercial borrowings (currently $320M. approx) • Manage internal investment funds (approx 230) Research funds, Commonwealth Grants, Foundations, Donations, Bequests etc -combined value greater than $220M. ..and growing The Commercial borrowings and Internal investments are currently managed via spreadsheets which is a time consuming process to manage and needed system improvements. How will improvement be done? New SAP Treasury functionality will provide improvements through: Better visibility from an audit view, Automated processes, Data consistency, More secure data storage facility (central), and Improved reporting. New SAP Treasury functionality will be introduced in stages. Stage one: (3rd quarter 2010) • External Commercial loans (central users only) • Internal Investment portfolios (excluding Common Fund investments) Including Cash, Capital Protected, Treasury managed funds ONLY. Reports for quarter ended 30 September will be SAP generated and sent via email to nominated person(s). How will improvement be done? Stage two: (mid 2011) Common Fund internal investments (longer term focus b/w 3-5 years) externally managed portfolio comprising a mixture of domestic and foreign equities, fixed interest, listed property trusts and some cash –where we need to maintain both market and cost values. SAP programmers and Business Systems have been consulted about Treasury requirements and system design. Expect work to start by 3rd quarter 2010 and SAP functionality available for testing early 2011 Stage three: (TBA) Improved cash forecasting What will these new SAP features mean to owners of internal investment accounts? • Additional entries in ledger for interest earnings & fund movements -For each update period, an interest journal will post to ledger • Text on journal will begin "Treasury Allocation" followed by the investment name • SAP document type for journal transfers will be identified as “TR” • New SAP generated reporting. (refer pdf example) . What happens next? Action Timeframe SAP Treasury (stage 1) moves to production June 2010 Data cutover for internal investment data 3rd quarter Reporting on internal investments from new system (3rd quarter results) ~ Oct 2010 Any questions? Treasury Contacts: Phillip Tanner (ext. 56325) Phillip.Tanner@adm.monash.edu.au Amanda Fernando (ext. 56938) Amanda.Fernando@adm.monash.edu.au Geoff Murray (ext. 56317) Geoff.Murray@adm.monash.edu.au Corporate Business Systems Contact: Liz West (ext. 56049) Liz.West@adm.monash.edu.au