Ichimoku Swing Trading

Robert C. Joiner

L. A. Conference

2012

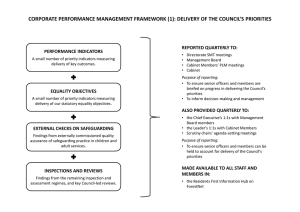

Eastern Indicators:

•

Ichimoku

•

Heiken-Ashi

•

Renko

The Present:

Tenkan-Sen = 9 moving average

Kijun-Sen = 26 moving average

Key points on TenkanSen & Kijun-Sen:

•

Both lines act as Support & Resistance

•

Price crossing the Tenkan-Sen is the first sign of possible

reversal

•

Tenkan-Sen crossing up and through Kijun-Sen is more

Bullish above the Kumo

•

Tenkan-Sen crossing down and through Kijun-Sen is more

Bearish below the Kumo

The Future:

Kumo

Senkou Span A = (9 + 26 moving averages)/2

Senkou Span B = (hi & lows P52)/2

…then drop those answers 26 periods into the future.

Key Points on Kumo:

•

Kumo acts as both Support and Resistance

•

Thick Kumo is stronger than thin Kumo

•

Price above Kumo is Bullish

•

Price below Kumo is Bearish

•

Rising far right edge of Kumo is Bullish

•

Falling far right edge of Kumo is Bearish

The Past:

Chiku = Closing price of current candle

…and drop that 26 periods into the past.

Key Points on Chiku:

•

Chiku above the historical price curve is Bullish

•

Chiku below the historical price curve is Bearish

•

Chiku crossing the historical price curve is predictive of

a new trend, but should not be anticipated

S&P-500 August 2011

Between

9-19-11 and 10-10-11

I posted 16 trades

…..

All shorts.

S&P-500 February 2012

Between

12-29-11 and 2-24-12

I posted 39 trades

…..

38 longs. 1 short.

Western Indicators:

•

Parabolic SAR

•

Money Stream

•

TSV

•

ADX w/DI+ and DI-

Parabolic SAR

Money Stream

TSV – Time Segmented Volume

ADX w/DI+ DI-

Key Points on

Western Indicators:

•

Create intentional chaos. Use different indicators that

measure different variables on different moving

averages.

•

Parabolic SAR is the weakest indicator, but it makes me

think twice about entries and exits.

•

Money Stream + TSV = “Money Indicators”…I want

them to be in harmony relative to their moving

averages.

Western Indicators,

cont.

•

ADX supports the current dominant trend, DI+ or DI-.

•

I like to see ADX rising from below 10 and moving above

20+.

•

The further ADX climbs above 40, the higher the probability of

profit taking by investors.

•

I prefer steady upper movement of the dominant DI, creating

divergence with the weaker DI, rather than quick spikes.

PXP – long on 2-7 @ 40.92

RVBD – 2-7-12…did not trade

Entries & Exits:

•

Ideally, you enter a long trade at a moment of weakness

within the context of strength.

•

We set 3% and 6% Targets, liquidating 40% of shares on

each Target.

•

We move our stop to break-even on the remaining shares

after the first target is hit, and use a moveable stop

on the remaining shares.

Bought long on 1-6-12 @ $9.78…hit 3% on 1-9-12…hit 6%

on 1-10-12…moved stop 8 times…hit stop of $12.53 on 2-712…total profit on 20% position was 28% ROI.

How do you find

stocks?

•

Scans create candidates; they do not create trades.

•

Scan for Eastern crossovers: Tenkan-Sen crossing

Kijun-Sen, Chiku crossing the historical price

curve, price moving above Kumo, etc.

•

Scan for Western crossovers: DI+ crossing DI-, rising ADX

values, Money indicators crossing their moving

averages, etc.

PVT scan from 2-25-12

“Is this a High Probability trade?”

What would you do

on the following

stocks?

Let’s see how you did.

Questions

&

Answers