Breakfast Meeting

advertisement

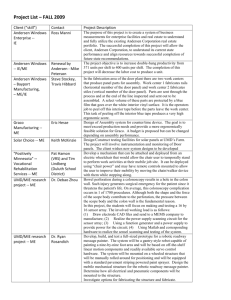

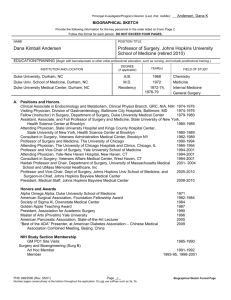

Christine K. Galloway Okabena Company Jill M. Koosmann HRK Group Don Wally Doug Bruce Ken 2 1918 1946 1962 1967 1975 - 2000 - The Dayton Foundation is created with an endowment of $1 million The Dayton Company’s bylaws establish the practice of giving 5% of pretax profits back to the community The Dayton Company enters discount merchandising with the opening of its first Target Store The Dayton Corporation has its first public offering of common stock. Okabena Company is incorporated. K.N. Dayton instrumental in starting “Five Percent Club” today called “Keystone Club” – member corporations agree to give away 5 percent of pre-tax profits for philanthropy. Some corporations give 2 percent. Dayton Hudson Corp. changes its name to Target Corporation 3 Hans Andersen 1854 - 1914 Andersen Lumber Company 1903 4 Fred Andersen 1886 - 1979 By 1929 builds Andersen into the largest specialized window company in the country 5 a title it still holds today. 1903 - Hans Andersen founded Andersen Lumbering Company; now Andersen Corporation 1914 - Hans introduced his underlying business theory: 1. Make a product that is different and better 2. Hire the best people and pay top wages 3. Provide steady employment insofar as humanly possible 4. Reward ideas and share with your community 1914 - Hans signed the first profit-sharing checks for employees 1941 - Bayport Foundation is established, which is a corporate foundation and funded annually from Andersen Corporation’s profits 1959 - Andersen Foundation is established by Fred Andersen (Hans’ son – G2) 1962 - Hugh J. Andersen Foundation established by Hugh Andersen (G3) 1962 - MAHADH Foundation (now HRK Foundation) established by Bill and Betty Hulings (G3) 1975 - Fred Andersen sold partial ownership in Andersen Corporation to its employees through a stock ownership trust 1987 - Katherine B. Andersen Fund of the St. Paul Foundation is established 2003 - Andersen celebrates 100 years in business with a partnership with Habitat for Humanity to build 100 homes Andersen Corporation is still privately held and all five foundations/funds are still running strong 6 Foundations Foundation #1 Chadwick Wood-Rill Foundation #2 Foundation #3 WM Oakleaf Meadowood 7 Mission Statement: To deliver superior and creative, integrated financial services, founded on our core principles of integrity, dedication, and respect. Okabena Company (parent) • • • • Integrated financial, tax and estate planning Family continuity and client education Foundation administration and compliance Accounting, reporting and compliance Okabena Investment Services, Inc. (subsidiary) • Strategic and tactical asset allocation • Manager selection and monitoring Boulder Bridge Trust Company (subsidiary) • Trusteeship • Trust Administration • Executorship 8 Andersen Foundation (FKA Bayport Foundation) 1941 Fred C. & Katherine B. Andersen Foundation (FKA Andersen Foundation) 1959 Hugh J. Andersen Foundation 1962 HRK Foundation (FKA MAHADH Foundation) 1962 Katherine B. Andersen Fund of the St. Paul Foundation 1987 Habitat for Humanity St. Croix Valley The Andersen Related Foundations meet often, collaborate regularly, but never speak for each other. 9 HRK Foundation MAHADH Fund Family Fund #1 Family Fund #2 Family Fund #3 Family Fund #4 Family Fund #5 Family Fund #6 10 • Integration of long-term investment, financial, tax, and philanthropic estate plans • Leadership team consists of CEO, CFO, CIO & CPO • Family motto = “Good Stewards with a Generous Spirit” • HRK Foundation structure allows for “life-cycle” giving due to having seven funds under one foundation umbrella (older generations give more from their funds and younger generations build their funds as they grow into their philanthropy) • Family members contribute annually to their funds so the Foundation’s giving is a combination of 5% of the endowments and pass-through from annual giving 11 • Family has a strong tradition of general operating support and “quiet giving” – and they believe “showing up” consistently for grantees is important • Family believes that giving consists of more than just grants – PRIs, Impact Investing, volunteering, advocacy, networking funders 12 Pros Cons • Diffuses potential for conflict • Creates flexibility to focus on individual philanthropic objectives • Increased number of individuals involved in philanthropic decisions • Reduced complexity – family dynamics • Increased complexity – administration • Allows for anonymous giving • Lack of asset aggregation reduces potential impact of charitable dollars • No family “glue” • Does not promote a unified family legacy 13 Pros Cons • Family has the support of the family office • Flexibility in giving by each family unit • Individual passions can be funded • Collaboration can increase grant impact • Provides family “glue” • Formal structure that meets regularly • Conflicts can arise from consensus giving on common fund 14 • Langwater Foundation • 5th Generation (pooled) 15