*Bored of your Board* How is it for you? - Co

advertisement

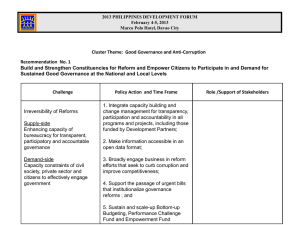

Risk Management and the role of the Board Risk Oversight and Good Governance Dugald Ross Jeito Board Reviews November 2013 Who are we? Dugald Ross; B.Econ Jeito Pty Ltd Australian & UK Expertise in financial market operational risks and board oversight Jeito Pty Ltd Consulting firm with a global focus on the Web delivery of reviews of third sector Boards ‘Jeito’ (pronounced ‘J2′ ) is Brasilian/Portuguese slang meaning “the knack,” which sums up our vision to find the right solution to our client’s needs. 2 Points to Understand – focus that RM begins with good governance • Good risk management is a key component of good governance • Risk failures are usually a result of poor governance • The boards role in risk management is of oversight • Risk oversight is a continual process of questions, decisions, feedback and review. Risk Failures at the Heart of the Financial Crisis “It is clear that governance failures contributed materially to excessive risk taking in the lead up to the financial crisis. Weaknesses in risk management, board quality and practice, control of remuneration, and in the exercise of ownership rights need to be addressed in the UK and internationally to minimise the risk of a recurrence Walker Review of corporate governance of UK banks and other financial entities: July 2009 Why the Failures? Why did some financial institutions fail or need public rescue, some came close to the brink but many others weather the storm and continue to operate profitably? Part of the answer is differences in business models….. But a significant part, was the differences in the quality of their corporate governance. THE IMPORTANCE OF GOOD GOVERNANCE speech by JOHN F LAKER Chair of Australian Prudential Regulation Authority to the Australian British Chamber of Commerce, Melbourne 27 February 2013 Risk Oversight Failures – a Governance Issue The inability of many Boards to accurately identify and understand the risks inherent in their businesses is seen as the main governance failure leading to the crisis. ……………………. Their risk appetite was vague. THE IMPORTANCE OF GOOD GOVERNANCE speech by JOHN F LAKER Chair of Australian Prudential Regulation Authority to the Australian British Chamber of Commerce, Melbourne 27 February 2013 Egregious Cultural failures Corporate culture is widely seen as a difficult and complex issue, but the egregious cultural failures that lie behind the lamentable story that is now emerging in relation to the conduct of some banks make action essential. Values and ethical standards, and the overall culture in which they are embedded, are keystones of governance in any corporate entity. ‘Banks must solve the problems of ethics’ by Roger Ferguson, John Heimann, William Rhodes, Sir David Walker .Times newspaper August 22 2012 What is happening in the world today? Focus world wide is increasing on risk management and good governance • What is new? • Comply or Explain • Insurance wont save you from poor performance Board‘s Role in Risk Oversight Risk Oversight v Risk Management The board should provide oversight and guidance for ‘the systems and processes concerned with ensuring the overall direction, supervision and accountability of an organisation.’ Chris Cornforth Governance Overview, Governance and Participation project, Co-operatives UK, 2004 Management should provide the risk management implementation Risk Complacency “Just 15 per cent of directors reported a very good understanding of the risks their company faces, 54 per cent a good understanding, while almost one third (29 per cent) said they either have a limited or no understanding. The remaining two per cent said they did not know.” There is little variation from a previous study in 2011 Improving board governance Mckinsey global survey results 2013 Co-operatives UK Findings • The Boards role in risk oversight is misunderstood • They see it as managements role to report and provide instruction. • They forget the board has the ultimate responsibility and is responsible for oversight Risk Governance and Risk Management Cycle BOARD oversight and adequacy BOARD understand and relate to strategy Identify and Accept Risk Board Reviews Test Review Report Procedures Control and Manage Risks Monitor risks Management to Implement Risk Oversight Foundations Risk oversight IS NOT a process with a beginning and an end. It is continual process from which to make sound decisions in two areas of oversight. 1. oversight of critical risks and risk decisions (risk governance) 2. oversight of enterprise risk programs (risk management). Appropriate Risk Oversight – ‘No one size fits all’ • Strategy and risk management are linked. • An Intelligent risk management culture is never an impediment and should more than just a supplement. • It should fit the organisation, and the role of the board is to ensure the risk management framework is appropriately designed, adapted, implemented and becomes an integral part of an organisations decision making culture. The Upside to Oversight and Good Governance Healthy risk oversight is not just about risk avoidance Setting Culture Improved education, communication and innovation Preparation for crisis Better understanding of processes across an organisation Building Morale Better decision making Governance Codes & Risk Good Governance Good governance should be thought of as a floor – not as a ceiling Good Governance is all about • • • • • • Recognising and accepting risk – don’t be afraid Setting the appropriate risk oversight. Setting the culture from the top Question, question, question Ensuring the board is a high performance board Review and assessment What the code wants from Societies Provide statements of recommendations Comply with requests for Information Support the code in your rules Provide reasons for non compliance High Performance Board meeting minimum standards Provide Reasons for appropriateness Four Themes to Improve Risk Oversight Board Capabilities Board Values and Culture Board Information Risk Governance Financial Stability Board (FSB) Thematic Review on Risk Governance Peer Review Report 12 February 2013 Board Capabilities ‘Many boards simply lacked the financial industry experience and understanding of market complexities needed to ensure they could perform their fundamental role of independent and objective oversight. They had inadequate skills, technical expertise or confidence — to challenge a dominant or ‘imperial’ chief executive officer (CEO) pursuing aggressive growth strategies. JOHN F LAKER Chair of Australian Prudential Regulation Authority speech to the Australian British Chamber of Commerce, Melbourne February 2013 Not Just Skills - but Behaviour Too often directors were unable to dedicate sufficient time to understand the firm’s business model and too deferential to senior management. Financial Stability Board (FSB) Thematic Review on Risk Governance Peer Review Report 12 February 2013 Understanding Your Board Capabilities Attitudes & Values Knowledge Performance Assessments of Board & Members Skills Skills Self Assessments by Members Board Values - Culture and Ethics ‘The crisis exposed significant shortcomings in the governance and risk management of firms and the culture and ethics which underpin them. This is not principally a structural issue. It is a failure in behaviour, attitude and in some cases, competence.’ Sants, H, Delivering effective corporate governance: the financial regulators role, Speech at Merchant Taylors’ Hall, April 2012. Board Values - Culture and Ethics Values and ethical standards, and the overall culture in which they are embedded, are keystones of governance in any corporate entity. ‘Banks must solve the problems of ethics’ by Roger Ferguson, John Heimann, William Rhodes, Sir David Walker .Times newspaper August 22 2012 Risk Culture – an example of poor standards A poor risk culture was not consistent with the risk appetite and can manifest itself in a number of ways. • Lack of understanding • Lack of candour in the relationship between board and management • Headstrong front-office leaders always looking to push the risk control boundaries, that passes the ownership of risk to the risk management function or internal audit. Business areas must be the owners of risk. JOHN F LAKER Chair of Australian Prudential Regulation Authority speech to the Australian British Chamber of Commerce, Melbourne February 2013 Setting corporate culture as ‘Risk Intelligent’ • The board should encourage and set the tone for an organisations risk culture. • The board should understand how their strategies and incentives reward and encourage people to take risks intelligently. • This is why risk oversight is a continual process of defining, measuring, reviewing and questioning. Board Information - What is Needed • Timely, relevant & comprehensive information • Reports that can be easily digested by the board • A holistic view of the risk exposures of their institution Reports • Information not heavily filtered by management hierarchy nor reaching the board late and/or distorted. JOHN F LAKER Chair of Australian Prudential Regulation Authority speech to the Australian British Chamber of Commerce, Melbourne February 2013 Board Information - Integrity in Financial Reporting • Can I trust the data? • Does it cover the critical issues? • Is it sufficiently up to date? • Can I digest it quickly ? • Does it cover future as well as historical? • Does it include a holistic perspective? • Is it in relevant time context? CIMA Performance Reporting to Boards. A Guide to Good Practice Risk Governance Issues • Inability to accurately identify and understand risks • Inability to ensure robust structures for managing and reporting on these risks o Unclear definitions as to the degree and nature of risks. o Vague risk appetite. o Lacking the stature, authority and independence to challenge the business areas; o Unclear accountability and lines of reporting to the board o Inadequate experience or independence from management or the board JOHN F LAKER Chair of Australian Prudential Regulation Authority speech to the Australian British Chamber of Commerce, Melbourne February 2013 Independent Assessment of Risk Framework • Independent assurance that the risk governance framework works and works as intended. • However, such internal or external audits and assessments tend to be compliance-focussed. • Internal audit don’t reveal external trends and/or align with best practices. JOHN F LAKER Chair of Australian Prudential Regulation Authority speech to the Australian British Chamber of Commerce, Melbourne February 2013 Questions About Your Risk Processes • Does your risk management method work? • Would anyone on the Board know if it didn’t work? • If it didn’t work what would be the consequences? Blank thoughts? Assessing Board Performance – is your board adding value in terms of its risk management and performance? The most valuable outcome of a board evaluation is that it helps to bring “issues to the surface”; and allows directors to “stand back” from day to day matters and improve the performance of the board as a whole. Evaluating the Performance UK Boards: Lessons from the FTSE350 – The All Parliamentary Corporate Governance Group 2007. Thank You Dugald Ross dugald ross@jeito.org.uk +44 (0) 779 582 4162