Front slide * 32pt Arial

advertisement

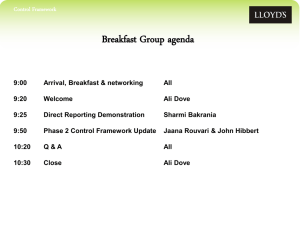

< Picture to go here > Solvency II workshop ORSA, Model Change & Catastrophe Risk 24 & 25 June 2014 © Lloyd’s 1 Agenda ► Introduction ► ORSA – Feedback from recent reviews – Themes from market submissions ► Model Change ► Table discussions ► Catastrophe Risk ► Questions © Lloyd’s 2 Approaching the end of a long and winding road… ► Solvency II now confirmed to start 1 January 2016 ► European Parliament has now approved Omnibus II ► Level 2 measures (Delegated Acts) will follow Omnibus II 11 March 2014 EP vote on Omnibus II Draft delegated Acts (DAs) (Level 2) Trialogue agreed 1 January 2016 Date of application Beginning 2015: Adoption of DAs Adoption of Regulatory Technical Standards (RTS) Text examined by lawyers and linguists Nov 2013 Dec Jan July/ Sept Mar 2014 End MarchJune EP Elections/ Results OctDec March June 2014 Dec 2015 2016 Finalising draft DAs Pre/Re-consultations/public consultation on over 52 Guidelines (some will contain RTS/ITS) © Lloyd’s 3 Solvency II ratings SAG Agreed Rating April 2014 8% 49% 43% Red and Amber ratings driven by….. Model weaknesses Model Validation ESG validation Validation following re-platforming A large number of feedback points to address GRMU issues ORSA Large number of gaps across the workstream Risk and Governance issues Model development Re-platforming Methodological weaknesses Dependencies Market Risk Volume of work across all workstreams © Lloyd’s 4 Solvency II ratings SAG Agreed Rating June 2014 SAG Agreed Rating April 2014 8% 6% 49% 51% 43% 43% Red and Amber ratings driven by….. Model weaknesses Model Validation ESG validation Validation following re-platforming A large number of feedback points to address GRMU issues ORSA Large number of gaps across the workstream Risk and Governance issues Model development Re-platforming Methodological weaknesses Dependencies Market Risk Volume of work across all workstreams © Lloyd’s 5 Still a lot to do to close all gaps by year end… ► For most agents, including Green agents, there is still work to do within the GRMU workstream to close all gaps: – ORSA – Model Change – Use Test – Risk and governance issues ► Evidence Template submissions will help us assess any additional gaps, or any additional review work to be done before Dec 2014. © Lloyd’s 6 SAG and CPG interaction Q1 SAG assessment of agent Solvency II compliance July Solvency II ratings incorporated into CPG papers with any recommendation for prudential measures CPG input into SAG process SAG input into CPG process Q4 Annual Agent Solvency II attestation September/ October SAG reconsiders agent Solvency II ratings in light of CPG findings September / October CPG review of final SCR and SBF and reconsideration of application of prudential measures July/August CPG review of draft SCR and SBF including consideration of application of prudential measures July/ August CPG feedback to agents © Lloyd’s 7 Lloyd’s interaction with the PRA ► 2014… increased interaction with the PRA ► With managing agents in the sample: – PRA meetings to follow up on 2013 feedback ► With Lloyd’s: – PRA supervisory teams are meeting with Lloyd’s review teams The Syndicate Workstream is material to Lloyd’s Internal Model approval PRA need to be comfortable that Lloyd’s process is robust We are expected to be able to justify agent SII ratings Understand any differences of opinion – Regular fortnightly Syndicate Workstream meetings with the PRA’s LIM review team © Lloyd’s 8 Agenda ► Introduction ► ORSA – Feedback from recent reviews – Themes from market submissions ► Model Change ► Table discussions ► Catastrophe Risk ► Questions © Lloyd’s 9 ORSA Reviews - Recap 2012 ► All ORSA reports reviewed as part of FAP reviews in Q1 and individual feedback provided ► Individual resubmissions/reviews during 2012 as needed 2013 ► Formal submission of all ORSAs in March 2013 ► Reviews completed and formal feedback provided by end Q2 ► Some resubmissions required Q3/Q4 to address specific feedback 2014 ► Formal submission of all ORSAs in March 2014 ► Reviews completed and formal feedback to be provided by end Q2 ► Reviews focused on meeting the Tests & Standards and not ‘gold-plating’ ► Section resubmissions required Q3 to address specific feedback © Lloyd’s 10 Previous areas of development 2012 2013 Basic information not always Forward looking assessment included Syndicate level information Reverse stress testing Solvency assessment Conclusions from process Stress & Scenario testing Forward looking perspective Assessment of capital Links to risk appetite/monitoring Reliance on underlying documentation © Lloyd’s 11 High level findings from 2014 Well developed executive summaries Enhancements to layouts and presentations Inclusion of requirements to a reasonable standard Conclusions from the process Links to risk appetite/monitoring A range of scenarios for the forward looking assessment Development of reverse stress tests, conclusions and actions Quality of own funds © Lloyd’s 12 Forward looking assessment Observations ► Majority of ORSA reports included forward looking assessment ► Assessments generally included projected capital requirements ► Commentary provided high level detail on analysis of own funds ► Development required on stressing the forward looking assessment Expectations ► Range of scenarios in relation to the future plans ► Should consider plans under stressed conditions and current market conditions ► Details of any material changes in own funds or solvency position ► Contingency plans and management actions, where necessary © Lloyd’s 13 Reverse stress testing Observations ► Majority of agents provided good level of detail on potential scenarios that could lead to business failure ► Focus remains on loss of capital, but agents should consider qualitative aspects such as the loss of market confidence ► Scenarios assessed did not always lead to unviability ► Conclusions from the analysis not always clear Expectations ► Scenarios and circumstances that would render the business model unviable ► Start point is the point of unviability, e.g. capital exhaustion, loss of business, reputational impacts of events ► Analysis and planned actions clearly identified © Lloyd’s 14 Own Funds Observations ► Some good examples on how capital requirements are/will be met with breakdown of sources of funding ► Information included on group support where relevant e.g. parent’s security rating ► Some focused on the SCR, with little detail on solvency ► Development needed around the quality of the funds and loss absorbing capacity Expectations ► Analysis of funds available to meet capital requirements i.e. basic own funds, third party capital etc. ► Recognise that non-aligned syndicates will have limited transparency over available capital © Lloyd’s 15 How much refinement has the ORSA process been through in 2013/14? A. No change B. A little through BAU C. Certain areas developed significantly D. Fundamental changes 55% 31% 12% 2% A B C D © Lloyd’s 16 Which area of the ORSA causes the most concern? A. Risk Profile and Appetite B. Stress & Scenario Testing (including Reverse Stress Testing) C. Forward looking assessment D. Capital analysis E. Something else 50% 26% 7% A B C 10% 7% D E © Lloyd’s 17 Market submissions - Key risks ► Underwriting cycle Challenging market conditions, overcapacity, softening rates and depressed investment returns. ► Increased regulatory burden Increased regulatory focus and intensity from both the PRA and FCA particularly around conduct risk and consumer protection. The development of EWIs is also highlighted. ► CAT risk Remains a significant proportion of most portfolios. ► Broker facilities/distribution Concern raised following deals such as Aon/Berkshire Hathaway and Willis. ► Non-traditional/alternative capital entering the market Abundance of non-traditional capital is leading to price pressure. © Lloyd’s 18 Market submissions – Other risks ► Terrorism Risk Insurance Programme Reauthorisation Act (TRIA/TRIPRA) US federal law creating a ‘backstop’ for insurance claims related to terrorism but renewal of legislation remains uncertain. ► Political risk Exposure following heightened levels of conflict and unrest around the world. ► Foreign Account Tax Compliance Act (FATCA) Provisions could result in significant additional compliance burden which could impact volumes of US business. And of course: ► Eurozone and economic climate © Lloyd’s 19 Market Submissions – Own economic capital ► Over two thirds (72%) of syndicates have set the Lloyd’s ECA as their own economic capital ► Only 9% of syndicates are setting capital below the Lloyd’s ECA ► 17% of syndicates have set their own capital level above the Lloyd’s ECA ► 2% have not made clear the level of economic capital and/or Lloyd’s ECA in their ORSA report © Lloyd’s 20 Agenda ► Introduction ► ORSA – Feedback from recent reviews – Themes from market submissions ► Model Change ► Table discussions ► Catastrophe Risk ► Questions © Lloyd’s 21 Timeline of activity on model change ► July 2012: – First review of the market’s model change policies & initial views on guidance developed ► July 2013 – first review of the market’s model change reports ► September 2013 – Lloyd’s meeting with the PRA, followed by publication of Interim Measures ► Q4 2013 – Model change workshops and market working group discussions ► Q1 2014 – Model change meetings with the market – Lloyd’s model change guidance & 2014 submission requirements issued July 2012 July 2013 September 2013 Q4 2013 Q1 2014 © Lloyd’s 22 Parameters and batching ► Explanatory text under Guideline 5 covers parameter updates: “Update of parameters can have a significant impact on the model outputs and the SCR in particular and hence it is generally within the scope of the model change policy” “Some internal models include a great number of parameters which interact together in impacting the outputs of the internal model. Hence it may be more appropriate for the undertaking to consider the impact of changes to some parameters in batch instead of individually.” “EIOPA recognises that it is not always appropriate to report changes in value of individual parameters.” “The process for updating the parameters … is also to be captured in the model change policy.” © Lloyd’s 23 Parameter – 2014 requirements ► Lloyd’s have provided guidance to agents which includes potential definitions of types of changes. These are categorised as: – Data updates – Risk Profile – Model Parameterisation – Model Methodology – Model Design – Governance/Controls ► Agents’ model change policies should clarify their definition of each category and also provide specific examples. ► If agents choose to use their own definitions, the policies need to explain how they reconcile with the Lloyd’s definitions. © Lloyd’s 24 Batching – 2014 requirements ► Changes that are related to updating/ refreshing existing parameters can be batched. ► Unrelated changes to the parameterisation methodology should always be reported individually and therefore should not be batched. ► Agents will be allowed to decide how they will batch parameter changes and make this clear in their change policy. ► When reporting batched changes to Lloyd’s, agents will need to explain which changes have been batched and reported as one. © Lloyd’s 25 Combination of changes Guideline 7 covers combination of changes: ► Lloyd’s will not prescribe how minor changes should be combined Undertakings should be able to: ► Agents to decide their approach to – “evaluate the effect of combination and explain this to Lloyd’s. each change in isolation and the effect of all changes combined on the Solvency Capital Requirement or its individual components” and – “evaluate such effects in order to prevent individual impacts that offset one another and the combined impact of multiple changes from being overlooked.” ► The approach should consider both quantitative and qualitative changes ► Change policies will need to be clear on how they meet the guidelines. ► Increased focus on an agent’s validation process and the SCR analysis of change. ► Lloyd’s will approve agents’ approaches as part of authorising the overall model change policies © Lloyd’s 26 2014 submission requirements 3 July ► Model change report – all changes from date of final 2014 SCR approval in 2013 – submission template and guidance notes issued ► Model change policy – Key focus on change types, approaches to batching and combination of changes ► Documentation to show how change types map to Lloyd’s guideline definitions (either in the policy, or a separate supporting document/appendix) 16 September ► Model change report – all changes since 3 July © Lloyd’s 27 Proposed major model change reporting process ► Risk Assurance manager will be contact point and central liaison for model changes ► Approval of major model changes will be through the Standards Assurance Group (SAG), which meets weekly ► Lloyd’s will use existing processes for notification of major changes where relevant e.g. SBF, SCR submissions, governance notifications ► In practice Lloyd’s would expect to be aware of major changes in advance of any formal submission ► Likely timings – Six months maximum time lapse from initial conversations to approval – Formal submission expected mid way through this process – Three months maximum elapsed time from formal submission to approval, but Lloyd’s would expect to approve many within a month ► Further definition on large market wide changes required over coming months ► Formal process to go live in 2015 Further guidance to be provided as part of the 2015 plan © Lloyd’s 28 Agenda ► Introduction ► ORSA – Feedback from recent reviews – Themes from market submissions ► Model Change ► Table discussions ► Catastrophe Risk ► Questions © Lloyd’s 29 Suggested discussion topics ► Have you used Lloyd’s guideline definitions for model change types? ► Have you excluded data updates from model changes? ► What approach have you adopted to: – Combination of changes – Batching parameter changes © Lloyd’s 30 How many major changes have you made in 2014? A. 0 changes B. 1-2 changes C. 3-4 changes D. 5+ changes 67% 17% A 11% B C 6% D © Lloyd’s 31 Which is the key category which you expect the changes to occur? A. Risk Profile B. Methodology C. External model D. Model design E. Governance 29% 29% 24% 10% A B C 7% D E © Lloyd’s 32 Have you used Lloyd’s guideline definitions for model change types A. Yes B. Partially C. No 65% 26% 9% A B C © Lloyd’s 33 Have you excluded data updates from the model change policy? A. Yes B. No 49% 51% A B © Lloyd’s 34 Agenda ► Introduction ► ORSA – Feedback from recent reviews – Themes from market submissions ► Model Change ► Table discussions ► Catastrophe Risk ► Questions © Lloyd’s 35 Catastrophe risk What we’re thinking about… • • • • Validation of cat risk Use of broker models PRA feedback ‘Non-Modelled’ ► Validation of catastrophe risk Managing agents should be able to demonstrate that: – there is evidence of full ‘ownership’ of validation – this cannot be outsourced, no matter how the actual documentation may have been compiled – risk rankings for catastrophe are up to date – validation of cat risk within the internal model includes any changes since Dec 2012, including process documentation and evidence of sign-off – validation report clearly & explicitly covers cat, including re-validation as necessary ► Broker models Defined as ‘the use of broker-generated cat model outputs in the Internal Model’ – PRA has clarified requirements:– adjustments should be made (or data re-run) consistent with materiality; – no requirement to re-run original exposure data; – quality control – Lloyd’s publishing market guidance, plus webinar in early July © Lloyd’s 36 Catastrophe risk What we’re thinking about… • • • • Validation of cat risk Use of broker models PRA feedback ‘Non-Modelled’ ► PRA feedback on cat risk – PRA will re-visit all agents who had PRA/ FSA feedback about catastrophe risk dating from 2012/13 – Lloyd’s Exposure Management team ► ‘Non Modelled’ catastrophe risk – ABI has published “Non Modelled risks: a guide to more complete catastrophe risk assessment for (re)insurers” – two-year Lloyd’s market project starting 1st July 2014 – Trevor Maynard to launch via webinar in early July © Lloyd’s 37 Questions? © Lloyd’s 38 What happens next ? ► Slides will be made available on lloyds.com after both sessions ► Next scheduled workshop/briefings: – Launch of new Minimum Standards: 1 & 2 July ► Model change submissions due on 3 July and 16 July ► Draft SCR submissions and interim validation reports due on 3 July 39 © Lloyd’s 39 © Lloyd’s 40