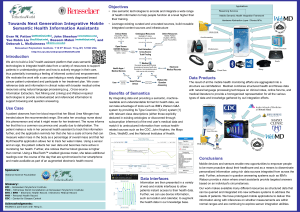

RPI based on 1993 value

advertisement

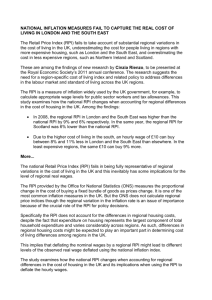

Rising costs It’s quite clear that the cost of food is rising. Soon we won’t be able to afford to eat, let alone drive a car! Everything costs more, but some things seem to cost a lot more. How can we tell how much prices have risen by? Rising costs The Retail Price Index looks at the changes in the cost of a combination of: food, heating, housing, household goods, bus fares and petrol costs. The figures on the next slide show the ratios of how these costs have increased since 1993. For each £100 in 1993, the equivalent cost in 2013 is £178. Rising costs 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 1.00 1.02 1.06 1.09 1.12 1.16 1.18 1.21 1.24 1.26 1.29 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 1.33 1.37 1.40 1.46 1.52 1.52 1.58 1.66 1.73 1.78 • When did costs rise quickest? • In what year would you expect costs to be double those of 1993? Rising costs Which items have increased most in price since 1993? 1993 price Average house price £68,032 1 litre of unleaded petrol 50p Loaf of bread 39p First class stamp 25p A pint of milk 34p Predicted 2013 cost, using RPI Real 2013 Percentage price increase from 1993 to 2013 Rising costs 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 1.00 1.02 1.06 1.09 1.12 1.16 1.18 1.21 1.24 1.26 1.29 From 1995 to 1997 the increase was 3% each year, so each year people paid 3% more for things than they paid the year before. …is that true? Better off or not? I think we’re better off now than a few years ago… What does it mean to be ‘better off’? What data would we need to be able to tell if we are better off? Better off or not? • People attach different meanings to the phrase ‘better off’. The list of possible measures is very diverse. • Measures might include: economic well being, employment rates, home ownership, crime rates, educational achievements, amount of free time people have, how happy people are… • What would you include? Better off or not? • One way to decide whether we are generally financially better off is to look at ‘discretionary income’. • This is an estimate of how much money each household has left after paying all taxes and essential living costs including rent or mortgage, fuels and electricity, food, insurances etc. Better off or not? • Data about discretionary income are difficult to calculate and locate, but one supermarket chain provides the following information: Average discretionary income per household per week £ 2008 148.00 £ 2009 161.00 £ 2010 158.00 £ 2011 145.00 £ 2012 147.00 • Can we simply compare the average amount of money a household has available each year to what they had the previous year? • If not, how could we compare them? Can we afford it? We’d like to buy a new car, but will need to take out a loan. There are lots of loans around that don’t make you pay much back each month. Should it matter how much we pay back in total? Can we afford it? • Assuming that the couple wish to borrow £10,000 over 2, 3 or 5 years. Several options are available to them. • They might consider borrowing money from the following sources: – Bank (personal loan) – Online ‘payday’ loan – Credit card • APR is the Annual Percentage Rate, can you find an APR for each type of loan? Can we afford it? • How much would they pay each month using each type of borrowing? • How much would they pay back in total using each type of loan? • What would you advise the couple to do? • This will help to check your findings! Teacher notes: • • • These activities target the following content and skills: – Using percentages – Understanding ratios and percentages – Plotting graphs and predicting values – Using real life contexts – Understanding and reasoning with data – Problem solving Most activities encourage students to think and discuss both their thoughts on the mathematics and the real world aspects of the problem Some activities are more challenging than others Teacher notes: Rising costs • • • • • • The aims of this activity are to help students consider how year on year comparisons are made to determine the rate at which prices increase. You might ask students to think about changes in diet and how a ‘typical’ basket of shopping might alter over time, within different cultures and also in response to food standards issues arising such as ‘egg and salmonella’, ‘mad cow disease’ and ‘horsemeat’. Slide 4: these are the January values from each year taken from data from the Office of National Statistics Plotting and extrapolating the data will enable students to predict when the RPI has doubled the 1993 values. However, extrapolating from more recent years gives a prediction of 2016, whereas predicting using a ‘line of best fit’ leads to a prediction of 2018. (see next slide) Slide 5: Ideally, students should look up the current costs. March 2013, guideline prices are: – Average UK house price: £238,000 – 1 litre of unleaded petrol: £1.38 – Loaf of bread: £1.35 – First class stamp: 60p – A pint of milk: 49p See slide 18 for answers based on these prices. The connection between ‘percentage increase’ and RPI ratio will need to be made i.e.276% is equivalent to an RPI ratio of 2.76 Slide 6: A common misconception. Although each year increases by 3%, this is 3% of the 1993 value, which means that the year to year percentage increases are actually as follows: 1993 1994 2.47 1995 3.33 1996 2.88 1997 2.80 1998 3.30 1999 2.45 2000 1.96 2001 2.70 2002 1.29 2003 2.94 RPI data plotted RPI based on 1993 value 2.10 2.00 1.90 1.80 1.70 RPI 1.60 1.50 1.40 1.30 1.20 1.10 1.00 0.90 1990 1992 1994 1996 1998 2000 2002 2004 2006 Year 2008 2010 2012 2014 2016 2018 2020 Price comparison answers 1993 price Average house price £68,032 Predicted 2013 cost, using RPI Real 2013 Percentage price increase from 1993 to 2013 £121,096.96 £238,000.00 349.84 1 litre of unleaded petrol 50p £0.89 £1.38 276.00 Loaf of bread 39p £0.69 £1.35 346.15 First class stamp 25p £0.45 £0.60 240.00 A pint of milk 34p £0.61 £0.49 144.12 Teacher notes: Better off or not? • • Slides 7 & 8: These slides encourage students to consider what is meant by ‘better off. Slide 10: Can we simply look at the amount of discretionary income? No, we also have to consider that the cost of living has increased. One way to do this is to use the given values of the RPI based on the 1993 value and simply divide to find out how much the equivalent discretionary income would have been in 1993. Year Discretionary income £ RPI Comparative 1993 values £ • 2008 2009 2010 2011 2012 148.00 £ 1.52 161.00 £ 1.52 158.00 £ 1.58 145.00 £ 1.66 147.00 1.73 97.37 £ 105.92 £ 100.00 £ 87.35 £ 84.97 These data suggest that household are worse off now than they were in 2008, which supports the idea that we are in recession. Teacher notes: Can we afford it? • • • • • • • • Slide 11: Students may not be familiar with the fact that it is possible to borrow money from different sources, and that the repayment amounts vary considerably. Although paying off a loan over a longer term results in lower monthly payments, the total amount paid back increases. Students should also be made aware that ‘payday’ loans tend to have extremely high APRs and the amount to repay often increases dramatically for longer repayment terms. Slide 12: If possible, search for the values online in front of the students, or ask them to find them. The ‘payday’ loan APR will otherwise seem unbelievable compared to the others. Typical values are: – Bank: APR 7.9% – Online ‘payday’ loan: APR 2689% to 4214% – Credit card: APR 18.9% Slide 13: At the bottom of the slide is a link to an online repayment calculator. This will allow all students to access the problem, even if they struggle with working out the values. Ask students to draw up a table of values to compare 2 years, 3 years and 5 years as typical lengths of time that people borrow money for. The values obtained will beg the question: “Why would people choose a ‘payday’ loan?” The reasons are varied but include: not having a good credit rating, not having access to banking facilities, not wishing to fill in forms. It is important to emphasise that they are really designed to be very short term loans – days rather than years, but, because of the high interest rate, people can get into more financial difficulties very quickly with this type of loan. Teacher notes: data sources used RPI data: http://www.ons.gov.uk/ons/taxonomy/index.html?nscl=Retail+Prices+Index Supermarket prices: http://www.mysupermarket.co.uk/#/shopping/findproducts.aspx?query=milk House prices: http://news.bbc.co.uk/1/shared/spl/hi/in_depth/uk_house_prices/html/houses.stm Petrol prices: http://www.theaa.com/public_affairs/reports/Petrol_Prices_1896_todate_gallons.pdf Discretionary income data: http://your.asda.com/system/dragonfly/production/2012/11/15/10_21_32_928_ASDA_Income_Tracker _Nov_2012.pdf APR data: • https://www.wonga.com/ • http://www.rbs.co.uk/private/loans-cards/g1/loans.ashx • http://www.barclaycard.co.uk/personal/credit-cards