Discussion of household leveraging and deleveraging

advertisement

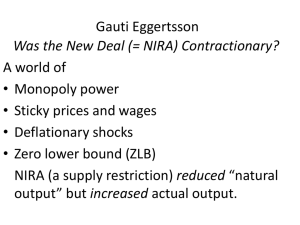

Discussion of household leveraging and deleveraging Discussion by Gauti B. Eggertsson Brown University This paper (from my perspective) • Can a deleveraging cycle generate the great recession in a standard DSGE mode? (paper addresses other issues too!) • Ask this questions in a quantitative model. • Early models (e.g. Eggertsson and Woodford (2003)) model trigger of the crisis as preference shock. • Free variable, little discipline • Recent work aimed at modeling the origin (debtdeleveraging). Why? – Puts more discipline on the shocks (can model it to match features of the data rather than a residual). – Important? Yes may have important interaction with policy • Mortgage write-downs, Fisher Debt deflation, fiscal multipliers, etc etc. • This paper is one of the first to deliver on this promise. • First order importance, exciting stuff. This paper • Can a household debt-deleveraging cycle generate the great recession in a standard DSGE model? • Answer: No • But not the last word … • Focus here on plausible change so that the answer is “yes”. • Build on Eggertsson and Krugman (2012) (web Appendix) Story in Eggertsson-Krugman • Part of the economy “need” to cut down spending • For output to be at potential somebody need to make up for it • Who? • Those unconstrained. • How? By a drop in the real interest rate Thought experiment • Imagine an endowment economy. • One agent more patient than the other. • Impatient (borrowers) subject to a debt limit. At steady state at the limit. • Now D high ®D low D high ®D low C C b t s t rt n Basic mechanism EK • Some part of the population stops spending (“deleveraging shock”) • Somebody else needs to make up for it. • How do we make those other guys “make up for it”. • By a drop in the interest rate. Can trigger a zero bound. • With nominal frictions: Big problem! • Liquidity trap. • Show this also in a “standard looking” NK model This paper • Augmented by housing sector. Deleveraging happens via deleveraging of the households. • Model drop in D more seriously. • Can it generate a meaningful response? • Answer: No • Why? Because even if households are cutting down their spending on housing …. Somebody else is making up for it even without a reduction in the real interest rate. This paper • Very little drop in real interest rate • Unconstraint agents (savers) don’t need to see much of a drop in interest rate to start spending. • Why? • Because they will start investing in productive capital. • Investment is tied to the real interest rate via marginal productivity of capital. • Question: What happens to investment in the model? Main comment • A key feature of the recession is the drop in investment and real interest rate. • You want to make sure that your model delivers this. • How to do this? • One approach: Eggertsson and Krugman - web appendix Eggertsson and Krugman – web appendix • Does incorporating productive capital change the result? • Yes, if savers can invest, drop in the real interest rate small. • Similar to Christiano (2004) result in discussing Eggertsson and Woodford (2003) – same preference shock will mean the zero bound no longer binding. • My response at the time – Introduce shock to the “capital adjustment function”. – Not really a convincing thing to do here. Eggertsson and Krugman Web Appendix • We should think of “investors” as constrained? • How to do it? • Most obvious way: Eggertsson and Krugman make the constrained agents the ones that have access to capital investment. • Deleveraging now applies not only to “household” but also the “investors” – they are the same person. Result form EK • Now deleveraging shock has an even bigger effect. • Investment responds by even more than “regular” consumption” • Fraction of savers is 0.7 with fixed capital stock • It is 0.9 with flexible • Bigger effect with flexible investment Suggestions for next paper • Introduce entrepreneurs (use e.g. Iacoviello (AER, 2005)). • The entrepreneurs are also constrained. • Conjecture: Deleveraging will make zero bound binding and effect can be quite big. • Details will of course matter (does land show up in collateral constraint – housing prices etc) • Bottomline: – Can deleveraging explain crisis,? – Might make sense to have an alternative, e.g. households vs. entrepreneurs? Conclusion • Exciting research agenda. • Discipline models with data on deleveraging to search for the origin of the crisis. – Can we use the Mian-Sufi evidence to impose some discipline? • Result so far: Difficult to put the usual leveraging-deleveraging stories into a quantitative model and get much action. • For story to fly need to add more features.