Economic Development Tools - Iron Range Economic Alliance

advertisement

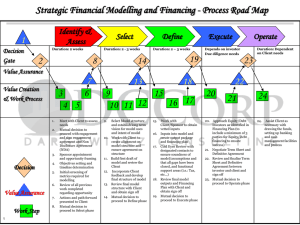

Presentation to Iron Range Economic Alliance May 28, 2014 Paul Steinman Tony Schertler Public Resources for Private Use/Benefit • Housing and Economic Development efforts can be summed up as direct efforts undertaken by a local government to encourage private investment. • Three flavors – Community Development (capacity building) – Housing Development (needs based vs. demands) – Economic Development (increase market value) 1 Framing the Issue • How much of the vision is going to be implemented by the public and how much by the private – Important because the return on investment for public is typically different than the return on investment for private • Prioritize public benefit outcomes then start to apply a cost to them • Start looking for the fiscal values generated with the vision area A Good Economic Development Strategy • Requires conducting a three part evaluation for every project – Public purpose benefits – Strength of opportunity – Public costs 3 Public Purpose Benefits (Policy) • Increased private investment (consequently market value) through: – – – – – Increased employment (Type of Jobs) Added housing units (Affordable or Market Rate) Attraction of visitors who contribute to the local economy Increased sales volume Addition of infrastructure such as parking or public improvements which results in increasing market value through the above – Elimination of negative or blighting influences effecting surrounding property (Blight Curve) 4 Blight mitigation example 5 Strength of Opportunity (Professional) • Market demand for the use developed (Market Study) • Control or prospects for control of a suitable site (Legal & Engineering) • Motivated and qualified developer (Developer Review) 6 Strength of Opportunity (Professional) cont. • Healthy growing employer (Industry Evaluation) • Extent to which the expected positive consequences of a project outweigh the negative consequences of doing it (e.g. increased public liability) • Probability that the project will leverage additional private investment or spin-off investment adjacent to the development (domino effect) 7 Public Cost (Professional & Policy) • Existence of a financial gap (the amount of the difference between total development cost and private market/investment value) • In absolute terms, the availability of public or philanthropic resources to fill the gap for a specific project (This is a good time to for managers to connect with the finance director) • In relative terms, the amount of subsidy required for a given project in contrast to amounts provided for similar projects in the past or current alternative projects (If everything is a “catalyst” what is catalyzed?) 8 What role does your community want to play to encourage development? • Simply grant the permit and zoning allowance – Lowest risk • Conduit issuer of tax exempt financing – Low risk (reputation) • Reimburse the prospect as benefits are completed – Low risk • Be the lender – Medium risk • Be the borrower or guarantor – Higher risk • Be the developer – Highest risk 13 What about other returns for accepting more risk? • There are no published benchmarks for what an appropriate financial return should be for projects that blend public purpose outcomes and financial risk 10 If your community chooses to accept more risk then: • Determine up front that a complete development plan with detailed sources and uses is necessary. Every piece of information needs a responsible party providing it and those that are estimates should be noted. • Before making a resource commitment, the best available information should be provided in a manner that is consistent and comparable. • The level of detail required will be a function of the level of risk that you are willing to undertake. 11 Financing Tools • Traditional – – – – – – Tax Increment Financing Tax Abatement Revolving Loan Funds Fee waiver IRRRB programs DEED programs 12 Financing Tools • Non Traditional (not as commonly used) – – – – – – Tax exempt financing Conduit financing for qualified manufacturing/housing Local option sales tax for ED infrastructure Angel Investor tax credit Sales tax exemptions for qualified business New Markets Tax Credits 13 Financing Tools • Tools that require a source of capitalization – Revolving Loan Fund – Interest Buy Down Program • Tools that provide a source of capitalization – – – – – Tax Increment Tax Abatement Tax-Exempt Financing, not conduit Minnesota Investment Fund IRRRB and DEED Grant Funds 14 Financing Tools • Primary Tools – – – – – Tax Increment Financing Tax Abatement DEED Programs IRRRB Grants HRA/EDA levy 15 Primary Financing Tools • Tax Increment Financing – – – – – Redevelopment Renewal and Renovation Housing Economic Development Soils Conditions 16 Primary Financing Tools • Tax Abatement – – – – How does it work? Simpler than TIF, minimal administration Educational process for other jurisdictions involved Creative use? o Community Centers, Ice Rinks, Swimming Pools 17 Primary Financing Tools • DEED – Contamination cleanup, Demolition loan, Infrastructure funding, etc • IRRRB – – – – Commercial redevelopment grants Infrastructure grants Film production, Dev partnership, etc. Comprehensive Plan Grants • Entities required to have updated Comp Plans 18 Primary Financing Tools • EDA/HRA – Levy Authority o o HRA – 0.0185% of taxable market value EDA – 0.01813% of taxable market value • EDA/HRA – Benefits of EDA/HRA o o Created by statute for purposes related to housing, redevelopment, or other real estate-type activities Authorized to own, lease, buy and sell property, loan money, etc. 19 Secondary Financing Tools • Tax Exempt Special Assessment Financing – MN Statutes 429 – special assessments – Assess certain improvement against benefitting property – Benefitted property gains the advantage of tax exempt financing 20 Secondary Financing Tools • Tax Exempt Conduit Financing – Business entity uses public entities tax exempt status – Allows them to borrow at lower tax exempt rates – Qualified projects only, manufacturing & housing, nonprofits – NOT a source of capital – Bank Financed at tax exempt rates 21 Secondary Financing Tools • Other Tools – Local Option Sales Tax • ED Infrastructure – – – – Angel Investor Tax Credit New Markets Tax Credits Community Development Block Grants Revolving Loan Fund (RLF) 22 Capitalization Options • • • • • • General or EDA/HRA levy Land Sales Admin Fees Tax Abatement proceeds or TIF Administration Tax Levy Minnesota Investment Fund 23 Financing Tools Questions? 24