Connected Chapter 5

advertisement

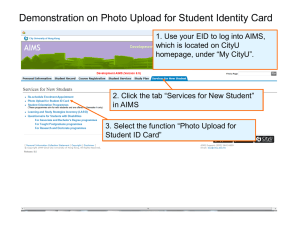

Chapter 5 The Buck Starts Here Bank Runs Northern Rock Bank • In September of 2007, Northern Rock bank closed its doors for one day and asked the Bank of England to cover its deposits. • The brief scare started a chain reaction. • Long lines formed outside many branches as people attempted to withdraw their money. Photo by Dominic, Flickr Bank Runs Withdrawers knew their actions were unreasonable. Why did so many people show up and stand in line for hours if they thought their money really was safe? •Social Networks played a large role. •People who had heard that friends were going were more likely to join in the frenzy. •These bank runs are examples of hyperdyadic spread. Millions of pounds were withdrawn causing a financial crisis that effected not only Northern Rock Bank but the entire banking and investing community. Photo by Christopher Elison Bank Runs Individual rational behavior led to communally irrational behavior. Photo PhotobybyLilly, Lilly,Flickr Flickr Social Networks can make the problem worse. A few panicked people can influence many others, as panic spreads. Tracking the Spread of Information What is the path through a network that things take when they spread? • A good alternative to tracking people is to track the flow of money. • WheresGeorge.com was created to track money. • The path of a bill can be traced if enough people input the same bill into the system. Photo by WheresGeorge.com Tracking the Spread of Information Applying the same principle elsewhere can help us understand other types of communication within social networks. Researchers study the paths of money, diseases, cell phone calls, emails, and anything else that is traceable. Photos by Ed Yourdon Random Walk and Lévy Flight • A random walk is a path in which movements are in a random direction and all the steps are equal size. • A Lévy Flight is a path in which movements are in a random direction but the distance traveled varies with each step. Sometimes, there is a very long step or “flight.” Tracking the Spread of Information Researchers found that information moving through a network follow a path between a random walk and Lévy Flight. Tangible applications include better information about how a disease like SARS might spread. Photo by Christian Keenan Moody Markets • These “paths” can affect the way the cost of a good changes. • Cost depends on supply and demand. Demand: • Where does “demand” come from? Social networks, in part. Supply: Photo by molotalk and Yoshimai, Flickr Moody Markets • People set new prices by evaluating what others want. •As a result, they are influenced by past prices. •This can cause prices to skyrocket (creating bubbles) or to plunge (creating crashes). Photo by runneralan2004, Flickr Moody Markets How many jellybeans? The average of a group’s guess can be accurate if they guess simultaneously or without knowledge of others’ guesses. But when they know about previous guesses, the group does not get as close! In an efficient market, people decide concurrently and independently But in social networks, people decide sequentially and interdependently. Photo by Inkyhack, Flickr The Strength of Weak Ties Strong ties affect people more deeply. Weak ties often link more people. Photo by johntrainor, Flickr “Bridge” members have many weak ties to members outside their group. The Strength of Weak Ties People need both strong and weak ties in order to network successfully. The same is true for companies. Photos by Steve Polyak and Wesley Fryer The Strength of Weak Ties Mix of strong ties to previous collaborators and weak ties for fresh faces balances rapport, organization, and creative ability. Broadway shows that follow this model are more likely to succeed! Photo by Brian Lane Winfield Moore Power in Numbers Why not go it alone? Muhammad Yunus earned a Nobel Peace Prize in 2006 for inventing micro-finance banking. Small loans were given to groups (usually women) in impoverished countries to start small businesses or projects. Photo by GarmeenBank.com Power in Numbers Social ties, rather than money, were used as collateral and could be used to guarantee a loan. Yunus founded the Grameen Bank which now fosters social networks which • optimize trust • connect groups through weaker ties • help find creative solutions through connections Photo by Inkyhack, Flickr