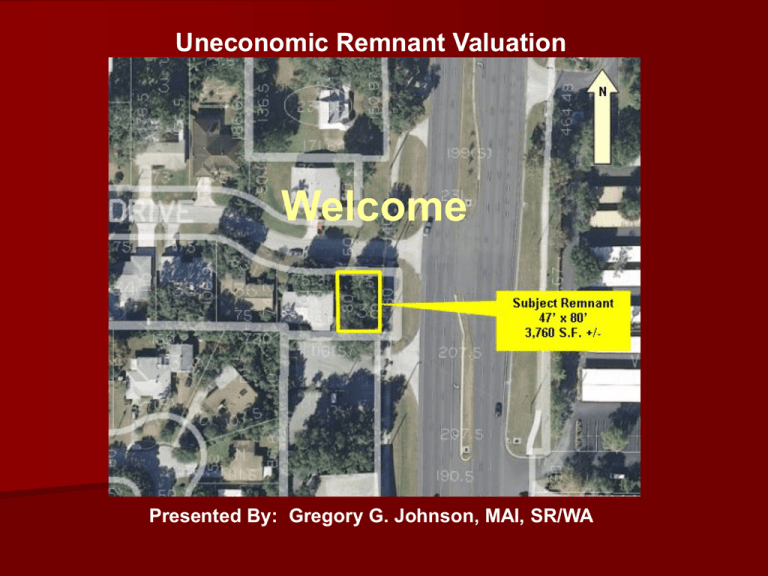

Uneconomic Remnant Valuation

advertisement

Uneconomic Remnant Valuation Welcome Presented By: Gregory G. Johnson, MAI, SR/WA Discussion This is a discussion of a valuation issue that receives little, if any attention; however, based on research, it is estimated that approximately 66,000 uneconomic remnant parcels are held in the Florida public domain. Presentation 1) Identify the issues 2) Discuss valuation procedures 3) Open the issues for discussion among participants 4) Close – 1 Hour We need to be finished in an hour and there’s a lot to cover are we ready? What is an uneconomic remnant? Remnant Definition: “A remainder that has negligible economic utility or value due to its size, shape or other characteristics; also called uneconomic remnant.” Four characteristics of value: Demand Utility Scarcity Transferability Uneconomic remnants are so constrained, that they have no or little utility. Therefore, they have little or no “Market Value” or “Value in Exchange”. However, uneconomic remnants can have significant Value-in-Use Measuring Value in Use Analysis Questions: 1) Can the utility of the remnant parcel increase if it is assembled with an adjoining property? 2) If so, what market value would it add to the adjoining property? 3) What is the annual cost of holding the property in the public domain. In this case, these answers were as follows: Additional Market Value to adjoining owner: $23,500 Annual holding cost of the property to the public. Real estate taxe loss - $470.00 Maintenance - $720.00 Cost / Benefit Analysis What are the costs and benefits that accrue to the property owner and the public? Property Owner Costs: 1) Increased property tax ($470.00/Year) 2) Increased maintenance cost (Nominal) Property Owner Benefits: 1) Increased “market value of property” ($23,500) 2) Additional area for expansion of existing use 3) Peace of mind in knowing how the property would be used in the future. Cost / Benefit Analysis (Cont.) Public Costs: 1) Loss of property tax revenue ($470 / Year) 2) On-going maintenance cost ($720 / Year) 3) Potential liability costs Public Benefits: 1) Increased property tax revenue 2) Eliminate on-going maintenance cost 3) Eliminate potential liability costs Comparative Values Property Owner $23,500 Public $16,380 * * Note: PV ($470 Tax Loss; $720 Maintenance Cost = $1,190/Yr @ 6%, 30 Years, Annual Conversions) Why is this important? This case involves a small residential remnant that when combined with the adjoining parcel, increased its market value by $23,500. The public was benefited by adding the property to the tax roll and eliminating on-going costs of maintenance and liability with a present value estimated to be $16,380. There are an estimated 66,000 remnant parcels in public ownership in Florida. Many of these are considerably more valuable than this parcel; however, if we considered a public benefit of $15,000 per remnant parcel and a market value addition for each adjoining property of $20,000; the range of taxable to market value added by this type of transaction would be $990 Million > $1.32 Billion. Questions and Discussion Comparative Values Property Owner $23,500 Public $16,380 * THANK YOU!