CS Reddy - Sa-Dhan

advertisement

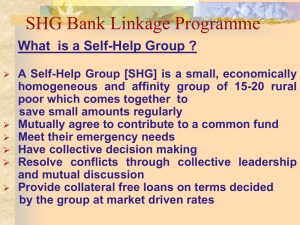

APMAS APMAS BUILDING THE DEMAND STREAM: THE NEED FOR INVESTMENT Sa-dhan Conference, 17th March ‘10 CS Reddy, creddy@apmas.org APMAS APMAS APMAS-Vision & Mission Vision Sustainable Women Self Help Movement in India Mission Enable Self Help Promoting Institutions to facilitate strong and vibrant SHGs, SHG federations and commodity cooperatives providing quality services to their members. APMAS believes in self reliance of community based organizations engaged in microfinance and livelihood promotion, strives for excellence in whatever it does and promotes women empowerment APMAS will emerge as a national level support organization by influencing public policy to create an enabling policy and regulatory environment to support the self help movement APMAS APMAS Achievements • Trained more than 90,000 professionals & paraprofessionals on SHG & SHG federation related • Developed several training modules & manuals. • Quality assessment (rating) of 450 SHG feds. • Capacity Building support for livelihood promotion. • More than 30 studies conducted • Several policy workshops & conferences organized • Anchoring National Network (ENABLE) • Supporting SHG quality improvement in Bihar, UP, MP, Orissa and Andhra Pradesh. Demand based support for other states. APMAS APMAS Microfinance Trends (March 2010 estimates) • Almost 7 million SHGs have a bank account • Almost 5 million SHGs have bank loan outstanding of Rs.28,000 crores • MFI reach 25 million clients • MFI loan outstanding Rs.22,500 crores • Total member/client outreach 61 million • Total loan outstanding Rs.50,000 crores • More than 100,000 SHG federations in the country. APMAS Quality Issues • SHGs are to be autonomous, self-managed and self-reliant groups. The dependence on promoters is high. • Limited training for SHGs (member education) • Though Rs.10,000 per SHG is needed as promotional cost, not even half of that is invested in SHG capacity building. • SHGs offer savings service to members • However, promoters place very little emphasis on savings mobilization & utilization (eg. SHGs don’t pay interest on members savings) • Though SHG – bank linkage is facilitated, utilization of loans for livelihoods does not get due attention. • SHGs are increasingly becoming Credit Management Groups (CMGs) • SHGs are becoming a channel for bank loans & for government schemes. • MFIs have very limited focus on financial literacy APMAS Financial Literacy – What has been done? • • • • • GoI & RBI are committed to financial inclusion Financial literacy is a pre-requisite for FI Two funds are established: FIF, FITF at NABARD Opening of no-frills accounts by banks To accelerate financial inclusion, technology solutions are being explored (smart card projects, mobile technology, etc) • National Alliance for Financial Literacy (NAFil) is promoted by Indian School of Microfinance for Women • Use of Business Correspondent (BC) model • Limited work financial literacy reaching borrowers. APMAS What Can Be Done? • NABARD to establish a task force on SHGs (SHG quality, bank linkage, SHG federations, financial literacy and social agenda) • Autonomous state specific funds to be established jointly by NABARD, State Governments & SLBCs to fund capacity building of SHGs & financial literacy • Campaign on savings mobilization & responsible borrowing. • SHG federations to be strongly supported (funded) to work on financial literacy & to promote bank linkage • A strong component of training SHG promoters and MFOs on financial literacy. • Use of information technology to reach SHG members and MFI clients APMAS APMAS APMAS APMAS APMAS Open for discussion & Thank You For further details contact: APMAS Plot No. 20, Rao & Raju Colony Road No-2, Banjara Hills, Hyderabad Ph: +91-40-23547952/27; Fax: +91-40-23547926 Web: www.apmas.org; www.shggateway.in email: info@apmas.org