Bush Tax Cut Presentation

advertisement

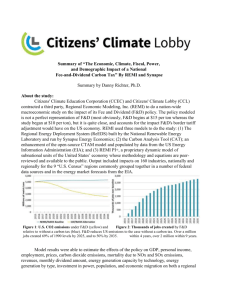

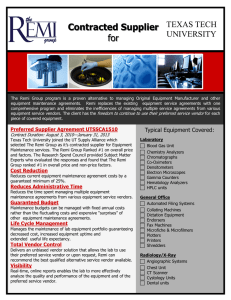

Understanding the Effects of the Bush Tax Cut Expiration Presented by: Dr. Frederick R. Treyz Chief Executive Officer Fall 2010 WebEx Series what does REMI say? sm Bush Tax Cuts • Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) – This legislation significantly reduced tax liabilities between 2001 and 2010 by cutting individual income tax rates, increasing the child tax credit, repealing estate taxes, raising deductions for married couples who file joint returns, increasing tax benefits for pensions and individual retirement accounts, and creating additional tax benefits for education. • Jobs Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) – This legislation reduced taxes by advancing to 2003 the effective date of several tax reductions previously enacted in the EGTRRA. JGTRRA also increased the exemption amount for the individual alternative minimum tax, reduced the tax rates for income from dividends and capital gains, and expanded the portion of capital purchases that businesses could immediately deduct through 2004. • Although some of these law’s provisions have been made permanent, most are scheduled to expire on or before December 31, 2010. what does REMI say? sm Economic Considerations Source: BLS Source: CBO • Federal expenditures are exceeding federal revenues at an increasing rate what does REMI say? sm • Raising taxes in a time of high unemployment may slow the economic recovery Capitol Hill Agendas Democrats Republicans • • • • Let taxes increase for high-income households; extend tax cuts for middle and low-income households Economic Rationale: – High-income earners, investors and descendents have lower marginal propensities to consume – Keeping the rates low has less “bang for the buck” in terms of short-term stimulus – Having rates increase helps manage long-term deficit problems what does REMI say? sm Extend tax cuts for all households Economic Rationale: – While high-income earners, investors and descendents may have lower marginal propensities to consume, low tax rates incentivize investment – Keeping the rates low encourages investment – Higher investment levels are worth short-term increases in the deficit Possible Scenarios • Allow all tax cuts to expire (do nothing) • Extend all tax cuts to all taxpayers for a limited time (i.e. 2 years) • Extend all tax cuts to some taxpayers (i.e. individuals making less than $200K and married couples making less than $250K … “Obama’s Plan”) • Make all tax cuts permanent what does REMI say? sm Scenario 1 Scenario 1: Offset Dividend Tax Rate Increase with Increased Government Spending • $10B/year for 10 years in dividend taxes (modeled as increases in capital costs) spread across all 169 industries • $10B/year for 10 years increase in government spending • Run using Historically Observed model closure – • • assumes that capital markets do not adjust during the first two years following an exogenous shock – during the third and fourth year of a policy simulation, an implicit Federal Reserve reaction function changes the cost of capital sufficiently to restore employment to a level that is consistent with a non-accelerating inflation rate of unemployment Note: According to Bloomberg Businessweek article, extending current dividend and capital gains tax rates will cost ~$315B over 10 years (~$238B under Obama’s plan) Note: According to CBO, extending current dividend and capital gains tax rates will cost ~$348B over 10 years what does REMI say? sm Scenario 2 Scenario 2: Differ Income Tax Rate Increase for 2 Years • Two year extension for higher-income individuals/households ($70B/year) • After sunset period (2013) assumes a corresponding $70B/year tax increase • Run using Historically Observed model closure – • • • assumes that capital markets do not adjust during the first two years following an exogenous shock – during the third and fourth year of a policy simulation, an implicit Federal Reserve reaction function changes the cost of capital sufficiently to restore employment to a level that is consistent with a non-accelerating inflation rate of unemployment Note: According to Bloomberg Businessweek article, extending current income tax rates for higher income individuals will cost $700B over 10 years. Note: This scenario is entirely hypothetical. We impose an additional $70B/year increase in personal taxes to balance the extension. While total net income tax changes for high income individuals is equivalent to that proposed by democrats, the timing is in line with those who propose a two year extension. Note: We have assumed that the propensity to consume for higher income tax payers is the same as the average tax payer. what does REMI say? sm Issues Not Considered • Differing rates of marginal propensity to consume • Changes to levels of savings • Long-term expiration • Feedbacks what does REMI say? sm Tax PI Model Integration what does REMI say? sm Tax PI Model Overview what does REMI say? sm Economic-Fiscal Dilemma • Federal and States are in a dual crisis – Economic – Fiscal • Fiscal crisis solution options – Raise taxes – Cut government spending • Economic crisis problems – Fiscal solution options harm economy what does REMI say? sm Tax PI Model Linkages what does REMI say? sm Importing Tax Data what does REMI say? sm Tax Inputs and Variables what does REMI say? sm Policy Variables what does REMI say? sm Shortfalls in the U.S. what does REMI say? sm Questions/Comments? Frederick R. Treyz Christopher S. Gerlach Chief Executive Officer Associate Economist Headquarters: 433 West St. Amherst, MA 01002 District Office: 700 12th St. NW, Suite 700 Washington, DC 20005 Ph: 413.549.1169 fred@remi.com www.remi.com Ph: 202.904.2490 chris.gerlach@remi.com www.remi.com what does REMI say? sm Structural Model what does REMI say? sm New Economic Geography Model Structure what does REMI say? sm