2014 - Keeping Current Matters

advertisement

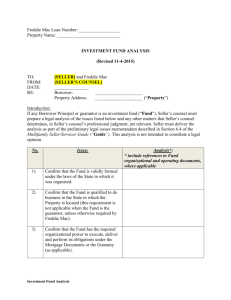

How to Create a Brand as the GO-TO Mortgage Professional 5.2014 Single-Family Mortgage Originations FreddieMac Today, we will construct a unique value proposition that will allow you to stand out as the “go-to mortgage professional” with your real estate partners by giving you the tools your agents need: 1 – To dominate the market of Millennial buyers who are now entering the market in record numbers 2 – To leverage the opportunity presented by the Baby Boomers who are moving-up to the house of their dreams or downsizing their primary residence and buying a second vacation/retirement home 3 – To readily identify the three most important activities they can be involved in over the next 90 days Answer ANY & ALL questions you have regarding Bridge Builders and the opportunities it provides MILLENNIALS HOUSEHOLDS in the U.S.* 2014-2017 *Urban Land Institute’s 2014 Emerging Trends in Real Estate 3.7% Projected Growth over the Next 3 Years 121M Current Households in the United States 4.48M Additional Households to be Formed Are 4.2M First Time Buyers about to Buy? % 10 4.2M of all renters nationwide would like to buy within the next 12 months first-time home sales, if all renters that wanted to buy actually did purchase a home in the next year Zillow 3/2014 Unemployment Rate: Millennials Ages 25-32 with a Bachelor’s Degree vs. U.S. Rate Bureau of Labor Statistics & Pew Research Median Annual Full Time Wage: Millennials Ages 25-32 with Bachelor’s Degree vs. U.S.Rate Bureau of Labor Statistics & Pew Research MILLENNIALS are ready to buy homes… 85% of Millennials plan to purchase a home in the future 58% increased their interest in purchasing a home in the past year as the positive attributes of homeownership resonate with this generation Pulte Group 2014 49% plan to purchase a home in the next two years Of those planning to buy in the near-term: 56% 41% are current homeowners are renters Millennials: Associate Owning A Home with… Happiness - 62% Independence - 61% Achievement - 59% Pulte Group 2014 Percentage of Buyers by Generation NAR 2014 Buying is CHEAPER than renting in ALL of the 100 largest metros by % an average of… 38 Trulia 2/2014 The Increasing Cost of Renting Median Asking Rent 1988-2013 Census Bureau 2014 Homeowners Net Worth… OVER 30X greater than renters Federal Reserve An American Family’s Net Worth Federal Reserve 2014 will be the year of the repeat homebuyer - Trulia % 63 Consumer Views on Housing & Economy have a positive outlook on the economy this year Lending Tree Survey 2014 69 % have a positive outlook on housing this year 71 % said they are considering selling their home in 2014 We are anticipating a meaningful increase in the supply of homes for sale. The survey evidence suggests that rising prices are motivating more owners to list their homes. Paul Diggle Capital Economics Boomers are starting to move… “The oldest Baby Boomer turns 68 this year, and the youngest turns 50. They are buying homes in droves as their employment situation, home values, and stock portfolios have almost fully recovered from the Great Recession. We are seeing strong sales in this same demographic throughout the country.” - John Burns Real Estate Consulting Baby Boomers ready to buy a 2nd home… 25% said they’d likely buy a second home, such as a vacation or beach house, to use during retirement BH&G 2014 Vacation Home Sales UP 29.7 % NAR 2014 Thinking about moving up to the home of your dreams? Move-Up Seller Comparison – End of 2015 Current Price Future Price (+8%) Future Gain Actually Lost Current Home Move-up Home $300,000 $324,000 $24,000 $400,000 $432,000 $32,000 $8,000 Impact of Increasing INTEREST RATES "One thing seems certain: we are not likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012." Freddie Mac Freddie Mac Actual Rates January 2013 – May 2014 Freddie Mac Projected Rates May 2014 – 2015 4Q 1/2013 5/2014 Freddie Mac 5/2014 Date Mortgage Interest Rate* P&I** Today $250,000 4.5 $1,266.71 End of 2015 $270,000 5.7 $1,567.08 Difference in Monthly Payment $300.37 *Average Commitment Rate per Freddie Mac **Principal and Interest Payment Date Mortgage Interest Rate* P&I** Today $800,000 4.5 $4,053.48 End of 2015 $864,000 5.7 $5,014.66 Difference in Monthly Payment $961.18 *Average Commitment Rate per Freddie Mac **Principal and Interest Payment Historic Mortgage Rates by Decade Decade 1970s 1980s 1990s 2000s 2014 YTD Average Rate 8.86% 12.7% 8.12% 6.29% 4.36% Payment $1,589 $2,166 $1,484 $1,237 $997 The average 30-year fixed mortgage rates and the approximate payment for a $200,000 mortgage. Payments are principal & interest only, based on a $200,000 fully amortizing mortgage. All terms are assumed to be 30 years. Freddie Mac 3/2014 CONFUSION FEAR Jumbo Loans Thrive As Other Mortgages Slip - Boston Globe 5/12/2014 FHA Announces Blueprint for Greater Homebuyer Access to Credit - National Association of Realtors 5/13/2014 U.S. Backs Off Tight Mortgage Rules -Wall Street Journal 5/14/2014 They must… Be their ‘Expert’ This is a person to whom people will turn for advice on difficult or complex real estate decisions.