ECommerce Best Practices and the US Communities Marketplace

advertisement

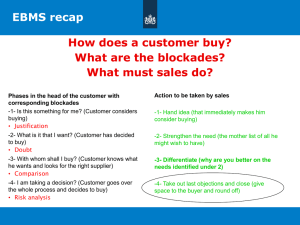

NAEP: E-Commerce Best Practices Agenda Session and Marketplace Overview: • Welcome and Introductions • Agenda Review • Industry Benchmarks • Technology Adoption Trends Overview of the U.S. Communities Marketplace Customizations and Extensions of this Marketplace Case Studies: Fairfax County Public Schools and Portland Public Schools P2P (Procure-to-Pay) Process Defined Procurement workflow—The transactional workflow to find, request, purchase, and receive product Search—Meta-search capabilities that access internal and external catalogs and preferred supplier websites and contracts Catalog—Types of catalogs maintained may be internal or external punch out; internally maintained by the buying organization or serviced by the supplier Payment—The extension of the settlement of a supplier invoice after a good or service has been received Source: AMR Research 2009 Public Sector P2P (Procure-to-Pay) Adoption Source: October 2011 NIGP Member Survey: “Use of Procurement Software in the Public Sector” Early Adopters of Procurement Workflow (eRequisitioning) Now Focused on Procurement Marketplaces to Aggregate/Manage Spend P2P ROI Improvement Opportunity Aberdeen Group research has found that even mature e-Procurement programs (average 5+ years) typically have failed to achieve targeted goals, largely due to user adoption: “User adoption continues to be a challenging aspect of an e-procurement initiative and an intuitive, easy to use procurement system is required to drive user adoption.” Performance Area Average Best-inClass/Target* Compliant Spend 51% 86% 35% More On–Contract – Average Lost Savings 12% for Off-Contract User Adoption 63% 90%* 27% More User Adoption Requisition-to-order cycles 3.4 days < 1 day 70% Faster Cycle Time Days to On-Board Catalog Supplier 13 days 3.2 days 75% Faster Cycle Time Off-Catalog Requisitions 34% 10%* 24% More “Touchless” POs Requisition-to-order costs $31 $22 29% Savings per PO % of POs Compliant w/Existing Contract ROI GAP Source: Aberdeen Group - Effective E-Procurement 2010, E-Procurement Benchmark Report 2008, E-Procurement Trials and Triumphs 2007 P2P Solutions Market Landscape Catalog Shopping/Content Management Capabilities ERP Equal Level Private Marketplace (SAP, ORCL, PSFT, JDE) Supplier Networks Public Sector Solutions (Ariba, SciQuest, Hubwoo) (eSchool Mall, Unimarkets, K12Buy) Functionality • • • • • Punchout Support Single UI Search w/Punchout Social Shopping (Ratings) Document/Policy Management Punchout Catalog Verification Supplier Enablement • Supplier Ramp Management • Free E-Commerce Site • No Supplier Fees Cost • High >$1M • Medium $150K-$1M • Low $<150K What is the USC Marketplace? • Free online system • Single login to access many different vendor catalogs, increasing purchasing efficiency • Ability to place purchases with pcard or PO • Quick visibility into products and pricing • Standardization for decentralized purchasing • Provides comprehensive reporting on past purchases • New “Browse Now” function for non-registered agencies Marketplace Homepage Results from USC Contracts Product Detail Page Payment Screen Customization of Marketplace • Marketplaces can be customized for specific agency needs • Free services to get started • Help with registration of users • Training/webinars for end users • Some punchout connections from existing systems • Other customizations can address: • Approvals/workflows • Branding/customized UI • Inclusion of an agency’s specific contracts • Full integration with ERP systems Customization of Marketplace Case Studies • Stand Alone System- Portland Public Schools • Integration with existing ERP System- Fairfax County Public Schools Portland Public Schools Marketplace Model Model: Stand-Alone Marketplace Catalogs: Punchout Catalogs Content Management: Outsourced Supplier Enablement Requisition Management: Marketplace Workflow Approval (Grant Funds) Transaction Management: Marketplace-Managed Electronic Order Delivery Case Study: Portland Public Schools Overview Portland Public Schools (PPS) is the largest school district in the Pacific Northwest, with approximately 47,000 students in 85 schools Mandate for process automation driven by Districtwide budget cuts and headcount reductions Deployed Stand-alone, PPS-branded Private Marketplace platform solution in 30 days with no IT support required End-to-end process support with fully transparent shopping across multiple cooperative contracts , workflow approval for Grants Fund purchases, and electronic PO delivery/status Results Consolidated Spending Through Single Portal to Reduce Maverick Buying and Increase Spend Visibility Enabled Users to Comparison Shop Multiple CoOperative Contracts and Suppliers to Identify “Best Value” Purchases at the Item Level Increased P-Card Utilization and Rebates by Capturing Millions in Federal Grants Dollars with Workflow Approval Support Eliminated Warehouse Operations and Buffer Inventories by Empowering End-Users to Order Directly and Receive Timely Delivery Fairfax County Marketplace Model Model: ERP Integrated Marketplace (SAP) Catalogs: Punchout Catalogs Content Management: Outsourced Supplier Enablement Requisition Management: ERP (SAP) Transaction Management: Marketplace –Managed Electronic Order Delivery Case Study: Fairfax County FOCUS Marketplace FOCUS Marketplace Goals • Single portal for County and Schools • One stop shop for commodities and commoditized services • Increase utilization of cooperative contracts • Reduce off-contract or Maverick Spend • Generate revenue to the county through higher rebates (P-Cards and CoOps) • Improve operating efficiencies • Enhanced reporting – NIGP commodity codes more specific to public procurement – provides map to GL account coding and spend analysis reporting FOCUS Marketplace Requirements • SAP Integration – – – • User Experience – – – • Amazon-like , comparison shopping for “best value” “Walk-Up” or “Shop Only” access for Non-SAP users “Touchless” orders (95% require no purchasing involvement) Supplier Enablement – – • Single-Sign On (SSO) access from SAP SRM Shopping Cart returned to SAP for approval workflow with NIGP codes mapped from UNSPSC Approved SAP orders delivered electronically (cXML) to suppliers with PCI compliant “ghosted” P-Card payment information encrypted in PO Maximize supplier managed “punchout ”catalogs Enable large and small, local vendors for E-Commerce including punchout catalogs and Level III P-Card transactions IT Support – – Minimize IT resources with “cloud” solution IT views single firewall punchout as more secure FOCUS Marketplace P2P Process Flow Shopper Full Cart FOCUS Auto PO Match & Payment Supplier PO with P-Card Deliver Receiver Receipts Pcard Bills Reconciler Private Marketplace Questions?