Three Elephants

advertisement

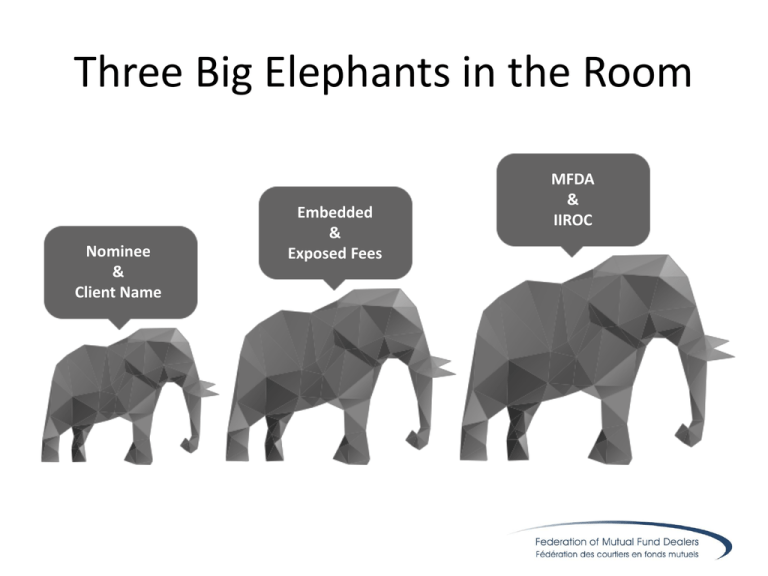

Three Big Elephants in the Room Nominee & Client Name Embedded & Exposed Fees MFDA & IIROC Three Big Elephants in the Room Nominee & Client Name MFDA & IIROC Embedded & Exposed Fees George Aguiar Patti Best Mark Kent John Webster President and CEO, GP Wealth Management SVP Client Experience, Mackenzie Investments President, Portfolio Strategies President, Queensbury Securities NOMINEE & CLIENT NAME Client Name Accounts versus Nominee Name Embedded Trustee Fee Transparent Trustee Fee Potentially limits investment options Quicker trade execution/less cumbersome trading Generally requires paper trail No trade forms Dealer/Advisor have limited control on the account (example, Transfer out) Dealer/Advisor have higher level of control on the account Direct Reconciliation Fund redemption settles to cash Fund redemption can settle to clients bank account Dealer/Advisor has direct control of client service experience Dealer/Advisor has partial control of client service experience Dealer/Advisor controls trading 3rd Party Reconciliation Dealer/Advisor at risk of direct trading NOMINEE & CLIENT NAME EMBEDDED & EXPOSED FEES A number of factors may threaten the commission-based model of the financial advisor. Meanwhile the fee-based model adoption is slow to emerge. Factors threatening the traditional commission based model Other jurisdictions are regulating a fee for service approach •Britain and Australia have taken steps to eliminate commissions as a form of advisor remuneration Revenue stream volatility •For a maturing advisor base, predictable revenue in a feebased model represents an attractive degree of stability Media and regulatory focus •Since the financial crisis, there is increased scrutiny placed on advisor remuneration and value delivery ETFs and ETF portfolios •ETFs are an increasingly important asset class and , for the most part, do not have compensation embedded in their fee structures Fee-based model slow to emerge in the financial advisor channels in Canada, meanwhile full-service brokers lead the charge Share of assets in fee-based programs Advisor fee-based adoption rates 85.0% 53.7% 0.9% 8.2% FA-MFDA FA-IIROC 28.3% 5.4% FSB* FA-MFDA FA-IIROC *Includes non-discretionary (FBB) and discretionary fee-based programs (AM, IHMW and SMW) 1Source: Investor Economics Retail Brokerage Report and Distribution Advisory Service; FA-IIROC includes MFDA firms with an IIROC platform e.g. Assante, Manulife, Peak. FSB* EMBEDDED & EXPOSED FEES MFDA & IIROC END From Wikipedia "Elephant in the room" is an English metaphorical idiom for an obvious truth that is either being ignored or going unaddressed. The idiomatic expression also applies to an obvious problem or risk no one wants to discuss.[2] It is based on the idea that an elephant in a room would be impossible to overlook; thus, people in the room who pretend the elephant is not there have chosen to avoid dealing with the looming big issue.