DAS 2011 - Money Advice Scotland

advertisement

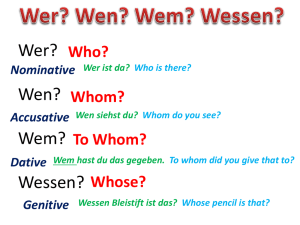

The New Debt Arrangement Scheme MATRICS would like to thank both the Scottish Government and the Accountant in Bankruptcy for their continued support and funding Policy Objectives of DAS • Enable people to resolve serious debt problems in a dignified way; • Reduce the need for creditors to take legal action to recover their debts; • Extend the benefit of money advice to those people who have a particular need for it; • Improve the quality of money advice, through training money advisers; and • Minimise the impact of bad debt on both debtors and creditors. Need for Reform • • • • • Take up-lower than expected Coverage across Scotland-not uniform Post code lottery Some areas-more chance of seeing Nessie Creditor participation-very low but Working for those who can access it Protects the debtor’s home Protects against diligence Powerful tool for money advisers Key changes-Overview New regulations SSI 2011 No 141 intend to: • Widen the Money Advice Gateway. • The DAS Administrator will take over the ongoing administration of DPPs from free sector money advisers. • New Computer system accessible by Money Advisers, creditors, payments distributers and the DAS Administrator Key Changes - Overview • Introduce a payment holiday of six months for debtors experiencing a reduction in disposable income by 50% or more. • Introduce Joint DPP for couples where they have a joint and several debt liable. • Introduce Single debt DPP but not appropriate when debtor paying under a Time to Pay Direction or Order or a Time Order. Key Changes - Overview • Debtor must make first payment under the DPP within 30 days of approval • Debtor must complete and submit tax or duty returns when due • DAS Administrator will automatically revoke a DPP if the debtor grants a trust deed and it becomes protected • Where Joint DPP revoked and debtor applies within 21 days for DPP in own name creditors cannot add interest, fees or charges – Reg 4 DAS (Fees) Regs 2011 The Advice Gateway • • • • • • More individuals can be approved to be DAS money advisers. These include: Existing approved money advisers. Qualified insolvency practitioners. an employee given authority by that insolvency practitioner. A money adviser for an organisation which is accredited at Type 2 level or above against Scottish National Standards for Information and Advice Provision; Advisers working for a citizens advice bureau Local Authority money advisers Under Reg 9 DAS regs 2011 DAS Admin satisfied fit and proper person to be a money adviser The Advice Gateway (contd) Benefits of the proposed changes: • Debtors will continue to receive face to face advice. • Solution to the 'postcode lottery'. • More advisers can offer DAS. • Less administration for free sector advisers, meaning advisers are freed up, to see more clients. • Increased debt options for debtors • Holistic approach to debt solutions The Application Process The debtor: • Cannot apply for their own DPP Free sector • Can use the services of a private DAS application Debtor advice or free sector Money Adviser The money adviser: Private sector • Completes an application form which is sent to the DAS Administrator (via the system). • A fee charging money adviser must inform the debtor that advice and access to DAS is free elsewhere. The DAS Administrator: • Records the application In the DAS Register (allowing protection earlier) • Submits the proposal to creditors (for free sector applications) The DAS System • DAS Administrator will administer all free sector DPPs. • Private sector DPPs will be administered by the private sector money adviser • All DPP administration will be conducted on the DAS system • Creditors will log in to the system to consent or refuse proposals. • DAS Administrator will supervise the process and make F&R decisions where appropriate. • Notices will be generated from the system regardless of the party conducting administration. • A side project will be run to create a database of creditors Payment Distribution • The regulations have changed so that AiB have to conduct a tender exercise to approve payments distributers • The DAS Administrator will charge an application fee which is 2% of sum distributed to creditors – collected by the payments distributers Approved Payments Distributers Benefits: • Appointed through open/transparent tender exercise • Better service-reduced costs to creditors • Charge a maximum of 8% • More competition through competitive tender for distributers. • Tendering contracts will ensure the best returns for creditors. Approved Payments Distributers The AIB has awarded contracts to: Carrington Dean, Begbies Traynor, MLM and Gregory Pennington now Think Link To be the payments distributers Debt Arrangement Scheme Hub (DASH) • Dedicated web portal • Access to case management system • Able to check status of cases through www.dasscotland.gov.uk The DASH Computer System DEBTOR Free Sector adviser Private Sector adviser DAS/DPP Application AIB/DA admin in free sector Dual routes Self admin in private sector AIB/DAS Proposals to creditors Accept? Computer Administration Reject? Fair & Reasonable Test applied DPP approved Payment Distribution to creditors Accept? System Reject? DPP falls Future help and support may be found at: AIB Helplines: Open from 9:30am to 4:30pm Monday to Friday. Tel:0300 200 2770 Fax:0300 200 2601 Post DAS Administrator Accountant in Bankruptcy 1 Pennyburn Road Kilwinning Ayrshire KA13 6SA or Money Advice Consultancy Service: T: 0845 123 2326 E: consultancy@matrics.org.uk