PowerPoint

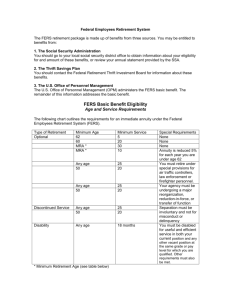

advertisement

Retire at 80% FERS Law Enforcement Tammy Flanagan Senior Benefits Director National Institute of Transition Planning, Inc. Tammy@nitpinc.com My “Hats” Tammy Flanagan – Benefits Specialist Presenter Pre-Retirement Seminars Mid-Career Planning New Employee Benefit orientation Co-Host: For Your Benefit www.federalnewsradio.com http://www.nitpinc.com/ Writer www.govexec.com Weekly Column “Retirement Planning” Edited by Tom Shoop – Senior Editor of Government Executive Magazine Tomorrow’s Column based on today’s presentation! Statement by Acting Director Elaine Kaplan on the Supreme Court Decision in United States v. Windsor OPM on Supreme Court Decision 6-26-13, DC – “Today’s historic decision by the Supreme Court that the Defense of Marriage Act is unconstitutional is a much welcome development in the continuing quest to ensure equal treatment under the law to all Americans. For the federal government as an employer, it will impact benefits for our married gay and lesbian employees, annuitants, and their families. “In the coming days, OPM will be working closely with the Department of Justice and other agencies to provide additional guidance for federal human resources professionals, benefits officers, and our employees and annuitants. While we recognize that our married gay and lesbian employees have already waited too long for this day, we ask for their continued patience as we take the steps necessary to review the Supreme Court’s decision and implement it. As soon as we have updates to share, they will be posted on our website.” Where did the 80% rule come from? The percentage stems from the "replacement ratio" studies that Aon Consulting and Georgia State University have done for the last 20 years. Basically, researchers cull information from the Bureau of Labor Statistics Consumer Expenditures Survey, which details how U.S. consumers, including older households, spend their money. Why 80%? These deductions stop when you retire: Retirement: 1.3% or .8% Social Security: • FICA: 6.2% • Medicare: 1.45% TSP: 5% - 10% - 20%? Taxes • Less income = less income tax • Some states don’t tax retirement benefits These expenses MAY go DOWN when you retire: Kids (food, clothing, schooling, weddings) Mortgage Clothing Commuting Costs Hired Help These expenses MAY go UP when you retire: Kids unemployment, emergency, grandkids Mortgage good old days Clothing are you joining a nudist camp? Commuting Costs are you going to stay home every day? Hired Help cut your own grass, paint your own walls, clean your own house Travel, hobbies, volunteer Healthcare and insurance What does it take to get to 80%? FERS Basic Retirement Benefit Law Enforcement 20 years = 34% of high-three 25 years = 39% of high-three 30 years = 44% of high-three Non-Law Enforcement 20 years = 20% of high-three (22% at age 62+) 25 years = 25% of high-three (27.5% at age 62+) 30 years = 30% of high-three (33% at age 62+) What else?: FERS Supplement Approximately $40 / month / year of FERS service 20 years = $800 / month or $9,600 / year 25 years = $1,000 / month or $12,000 / year 30 years = $1,200 / month or $14,400 / year What percentage of your salary will this replace? More for low salary Less for higher salary Replacement: 10 – 30% Supplement Ends at 62, then what? Social Security Eligible at 62 Reduced by 30% Delayed credits 24% increase at 70 Tilted towards the low wage earner Average benefit 2013: $1,221.22 Maximum monthly benefit 2013: Age 66: $2,533 (Born 1947) Age 62: $1,923 (Born 1951) Age 70: $3,350 (Born 1943) www.socialsecurity.gov The United States Social Security Administration POPULAR SERVICES new Get your Social Security Statement online Get or replace a Social Security card Apply online for retirement, disability or Medicare benefits Estimate your retirement benefits Research popular baby names Locate a Social Security office What else? Retirement Savings TSP Other employer savings plans - 401(k), 403(b) IRAs Savings Accounts Inheritance Use It • Spending Lose It Taxes – CPA / CFP Promote It Legacy planning – Estate Attorney What else? Retirement Savings Women: Listen Up! • Women are more likely than men to interrupt their careers for family • Of the 62 million wage and salaried women (age 21 to 64) working in the United States, just 45 percent participated in a retirement plan. • Women live a long time! • By and large women invest more conservatively than men. http://www.dol.gov/ebsa/publications/women.html Use It Leave it in TSP Low expenses G Fund Simplicity Monthly withdrawal options Transfer to IRA Multiple partial withdrawals Many investment choices Legacy planning options Lose It 0 – 59 ½ - Be careful! 10% tax penalty Exception: Separation in the year you reach 55 Exception: Monthly payments based on life expectancy or life annuity 59 ½ - 70 ½ - No rules! 70 ½ + Complicated Rules! TSP Web Site: Planning & Tools: Retirement Income Calculator TSP: Retirement Income Calculator Monthly Payments Balance: $500,000 Growth: 5% Dollar Amount $3,000 / month Run Out at age 78 $2,000 / month Balance at age 100: $209,484.99 Life Expectancy Monthly Age Balance $1,407.66 55 $508,224.49 $2,208.64 65 $557,817.99 $2,069.36 75 $572,237.19 $3,095.55 85 $539,728.21 $3,612.99 95 $347,388.27 $3,166.00 100 $212,558.69 How about an annuity? Features $500,000 purchase Begin at 55 100% Survivor (spouse or other insurable interest) 2% Interest Rate Index Level Payment No Cash Refund Payments Monthly Age Balance $1,683 55 $0 $1,683 65 $0 $1,683 75 $0 $1683 85 $0 $1,683 95 $0 $1683 100 $0 How about an annuity? Features $500,000 purchase Begin at 55 Single Life 2% Interest Rate Index Level Payment No Cash Refund Payments Monthly Age Balance $1,980 55 $0 $1,980 65 $0 $1,980 75 $0 $1,980 85 $0 $1,980 95 $0 $1,980 100 $0 How about an annuity? Payments Features $500,000 purchase Begin at 55 50% Survivor (you or spouse) 2% Interest Rate Index Increasing Payment Not available for insurable interest Cash Refund Monthly Survivor Age Balance $1,133 $566 55 $485,000 (approx.) $1,523 $761 65 $340,000 (approx.) $2,047 $1,023 75 $150,000 (approx.) $2,750 $1,375 85 $0 $3,696 $1,848 95 $0 $4,285 $2,142 100 $0 Did we get to 80%? Retire 55 with TSP Monthly Payments FERS Law Enforcement 30 years FERS Supplement $14,400 / high-three $100,000 TSP Monthly payment $2,000 x 12 = $24,000 Adds up to 82.4% 44% 14.4% 24% Did we get to 80%? Retire 57 with TSP Monthly Payments FERS (regular) 30 years FERS Supplement $14,400 / high-three $100,000 TSP Monthly payment $2,500 x 12 = $30,000 Adds up to 74.4% 30% 14.4% 30% Did we get to 80%? Retire 50 to Work Part-Time FERS Law Enforcement 20 years FERS Supplement $9,600 (High-three $100,000) Part-Time Job $36,400 Adds up to 80% 34% 9.6% 36.4% Thank You!