Existing Functionalities in TRACES

advertisement

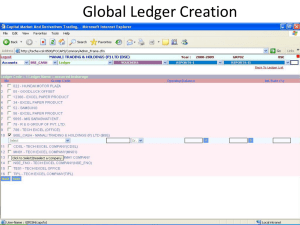

Centralized Processing Cell (TDS) 1 Deductor Functionalities @ TRACES Existing Functionalities in TRACES Default Summary View TDS/TCS credit Justification report Challan Status Download TDS Certificates Statement Status Deductor Dashboard PAN Verification & Conso Files Deductor Online correction Progress since 30th November,2012 Statements Processed (1st stage) More than 10 million Deductee Transactions processed 500 million Deductors registered on TRACES Portal Form 16/16A download 1 million 200 million approx. Taxpayers viewed Online 26AS Nearly 25 million Call Volumes 3500 plus per day Queries through e-mails 1200 per day 4 CPC (TDS) Performance Statistics Functionality Count (Apr 1 – Dec 31, 2013) Form 16/16A file downloads 30.67 Lakhs Conso File downloads 22.22 Lakhs Justification Report downloads 8.07 Lakhs 5.44 Crores hits 26AS Forms viewed Correction statements filed 22 lakhs Educational e-mails 60 Lakhs Committed to sustained tax compliance framework logon to www.tdscpc.gov.in Impact of CPC(TDS) 1 Growth in filers within due date (23% up over last year) 2 Growth in TDS payment within due date 3 Growth in TDS collections (19% growth against 8% growth in Non-TDS) 4 Reduction in TDS mismatch (matching more than 95%) 5 Reduction in PAN errors (97% valid quoting) 6 Better awareness among stakeholders (Tax professionals, Deductors and Department) 6 Status of Default related issues Sr. No. Issues 1 Wrong classification as Government /Non Government Deductor 2 Mismatch of 197 TDS certificate details 3 Citizen Type in 24Q 4 Challan overbooking under certain specific scenarios 5 Short Deduction under section 206AA in case of Tax Collection at Source 6 7 Surcharge rate DTAA tax rate (Total pendency against such issues as on date is around 6000 cases. Expected to be closed within Feburary,2014.) Upcoming Functionalities in TRACES Deductor Grievance Portal Green Initiative-Paper less intimations Enhanced version of Online Correction Justification report versioning Report Non filing of statement 197 TDS Certificate Validation EIntermediary— API based webservices Non resident TDS Certificate Deductor Online view of 26AS---Outside India Roadmap ahead at CPC(TDS) 1 Short deduction default resolution on auto basis in case of corrected PANs using data of ITR filing of the deductee 2 Profiling of Deductors based on their compliance pattern using Business Intelligence tools 3 Facilitating deductors to populate valid and correct PAN using Data quality tool 4 Collating TDS compliance of branches at Corporate Level 5 Linking of TDS defaults with item no. 27 of Form 3CD 6 Digital signature based access as an alternative to KYC based access 9 Expectations from Deductors-correct TAN category Total Correct Incorrect 5924 2621 3303 TAN Category 3303, 56% 2621, 44% Correct Incorrect Expectations from Deductors---quoting valid PAN Impact of Mentioning Invalid PAN in Statement Incorrect TDS Certificates Penal Action and Prosecution u/s 139A(5) Section 139A is regarding Permanent Account Number . Sub-section (5) of section 139A of the I T Act makes it mandatory to quote PAN in return and at other times. The said provision is as under : (5) Every person shall (a) quote such number in all his returns to, or correspondence with, any income-tax authority; (b) quote such number in all challans for the payment of any sum due under this Act; 277 provision will be applicable and prosecution will be done accordingly 272B. (1) If a person fails to comply with the provisions of section 139A, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of ten thousand rupees. Expectations from Deductors—Late filing Total Delay Defaulters Delayed Defaulters with Average Delayed Days >30 Days in FY2013 1425 330 Total Delay Defaulters 1425 81% Delayed Defaulters with Average Delayed Days >30 Days in FY2013 330 19% Expectations from Deductors- Implication of Correction In respect of count of deductee row Deductee Records Added through C9 - Year on Year Trend C9(Addition of Challan) Error Counts - Year on Year Trend 7000 6313 140 117 120 6000 5000 100 4000 80 3000 54 60 2325 2000 40 20 12 12 1000 236 0 C9 COUNT 2010 C9 COUNT 2011 C9 COUNT 2012 C9 COUNT 2013 15 0 C9 DD COUNT 2010 C9 DD COUNT 2011 C9 DD COUNT 2012 C9 DD COUNT 2013 THANK YOU 14 Deductor’s Dashboard Deductor’s Dashboard displays important information at one screen. The following information can be viewed by the deductor in its dashboard: • Statement Status: Processing status of the Statements of last four quarter along with Default Summary. • Communication Inbox: - To view the recent communication made between TRACES and Deductor. This also facilitates the downloading of Intimations sent to the deductor. • Summary of recent activity by the deductor. Back Deductor Dashboard on TRACES Online Corrections This feature enables the Deductor to file Online Correction statements through TRACES portal without downloading TDS/TCS Consolidated File. For this facility, the user needs to register its Digital Signature. Currently facilities for PAN Correction and Matching of unmatched OLTAS challans are functional and more functionalities are planned to be added in near future Back Enhanced Version of Online Corrections Apart from the currently available facilities for PAN Correction and Challan Correction. Following facilities are to be allowed • Add challan to statement • Modify/Add deductee row • Modify Salary details • Pay 220I, LP, LD late filing interest • Update of personal information Online Correction on TRACES Back Back Back Back Back TDS Matching- Before CPC(TDS) 26AS generated by ITD is used at CPC ITR Deductor files TDS statement to ITD TDS Mismatch at CPC ITR Tax payer uses 16A for ITR filing Deductor issues 16A to the Tax Payer TDS Matching- After CPC(TDS) 26AS generated by ITD is used at CPC ITR Deductor files TDS statement that goes to TDS CPC Perfect TDS Match at ITR CPC Tax payer uses 16A for ITR filing Form 16A is issed by TDS CPC to the Deductor Deductor passes Form16A to the Tax Payer