Customer Vulnerability

advertisement

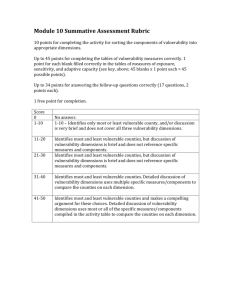

Consumer Vulnerability Martin Coppack Consumer & Market Intelligence 1 Current perspectives in a nutshell… Industry • • • • • Consumer organisations Lots being done Numerous good practice guides for dealing with different ‘types’ of consumer Head office policies and systems in place Goodwill amongst staff Complex area • • • • • Numerous good practice guides & systems may be in place Recognise there is goodwill amongst FS staff FS staff on the front line not always trained appropriately Products & services not flexible enough Not always “rocket science” End consumer • • • 2 Lack of consistency in approach Products and services often do not reflect/react to the realities of people’s lives One poor decision/action can lead to significant detriment What do we mean by ‘consumer vulnerability’? ”A vulnerable consumer is someone who, due to their personal circumstances, is especially susceptible to financial detriment, particularly when a firm is not acting with appropriate levels of care.” (PRR definition) 3 Those who have been vocal on this agenda: Consumer Futures ESAN 4 Outcomes Approach More concerned with what “good” looks like to consumers than exact definitions of vulnerability. A best practice, more consistent, approach should be developed for FS market Outcome: All financial services firms create and put into practice appropriate strategies to address the needs of consumers in vulnerable circumstances. …to make markets work well for consumers so they can get a fair deal & products & services which meet their needs over their lifetime 5 What does good look like?* Firms should have appropriate policies in place to identify consumers in vulnerable circumstances There should be a consistent approach within firms. Firms should seek proactively to identify vulnerability Firms should put in place policies to approach consumers in vulnerable circumstances in a sensitive and flexible way Vulnerability factored into product design, marketing and service provision Firms adaptive and empathetic Staff adequately trained to implement policy Firms should be as transparent as possible in their dealings with consumers in vulnerable circumstances Firms’ policies clear to consumers and consumer organisations * According to consumer organisations who attended our vulnerability roundtable. 6 Why is this on our agenda? It aligns to several of our statutory powers: • In considering the appropriate degree of consumer protection, the FCA must have regard to - “the differing degrees of experience and expertise that different consumers may have” • In considering its competition objective, the FCA may have regard to - “the ease with which consumers who may wish to use those services, including consumers in areas affected by social or economic deprivation, can access them” It also aligns to several existing elements of our supervision, for example: • FCA Principles 6 & 7 - “a firm must pay due regard to the interests of its customers and treat them fairly”. - “a firm must pay due regard to the information needs of its clients, and communicate information to them in a way which is clear, fair and not misleading”. 7 Why is this on our agenda? • 8 BCOBS 4.1.5 requires that the information requirements (elsewhere) in BCOBS - “may vary according to matters such as the information needs of a reasonable recipient having regard to the type of retail banking service that is proposed or provided and its overall complexity, main benefits, risks, limitations, conditions and duration” • ICOBS has rules requiring: - customer communications to be clear, fair and not misleading (ICOBS 2.2.2R) - information provided to be appropriate for an informed decision (ICOBS 6.1.5R) - insurers to handle claims fairly (ICOBS 8.1). • • CONC 8.2.7: A firm must establish and implement clear and effective policies and procedures to identify particularly vulnerable customers and to deal with such customers appropriately. What are we doing about it? • Consensus-building with both Consumer and Trade Bodies – what does good look like, problems and issues • Embedding the concept of vulnerability into different work streams across the FCA • Producing an Occasional Paper on consumer vulnerability to be published early next year • Impact of industry behaviour • Policy/practice gap • What good looks like 9