Netherlands Real Estate

Market Update August 2014

Whilst real estate market fundamentals are still to return to a period of sustained

recovery, investors have already returned to the market, initially focusing on the

prime locations in Amsterdam they are increasingly prepared to go further afield.

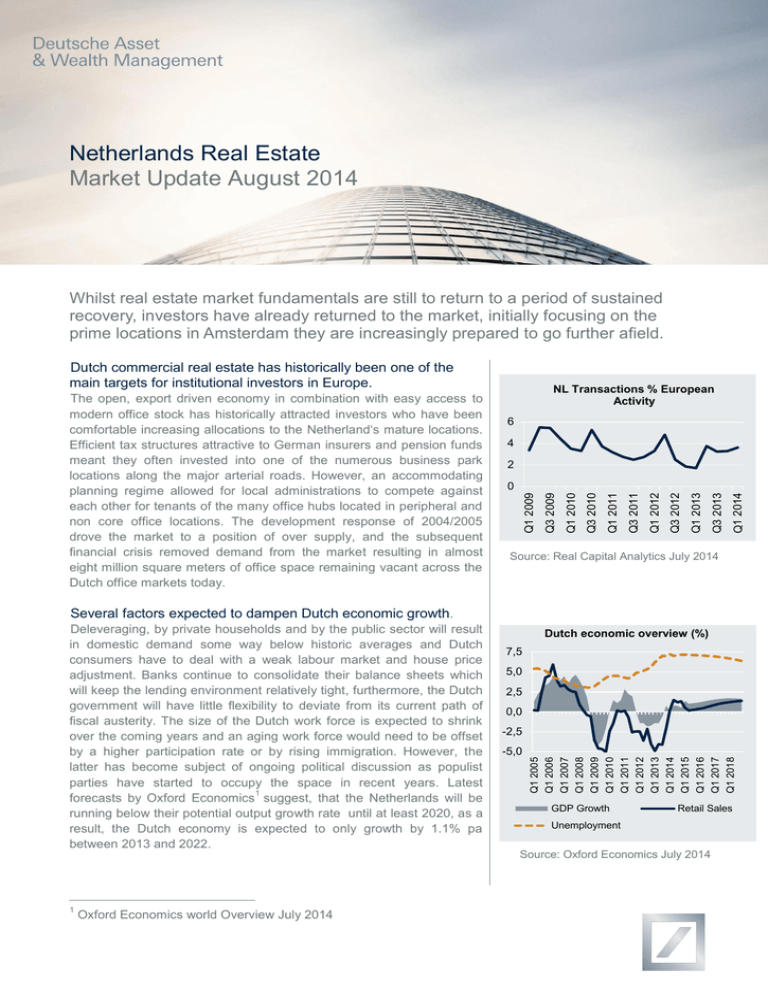

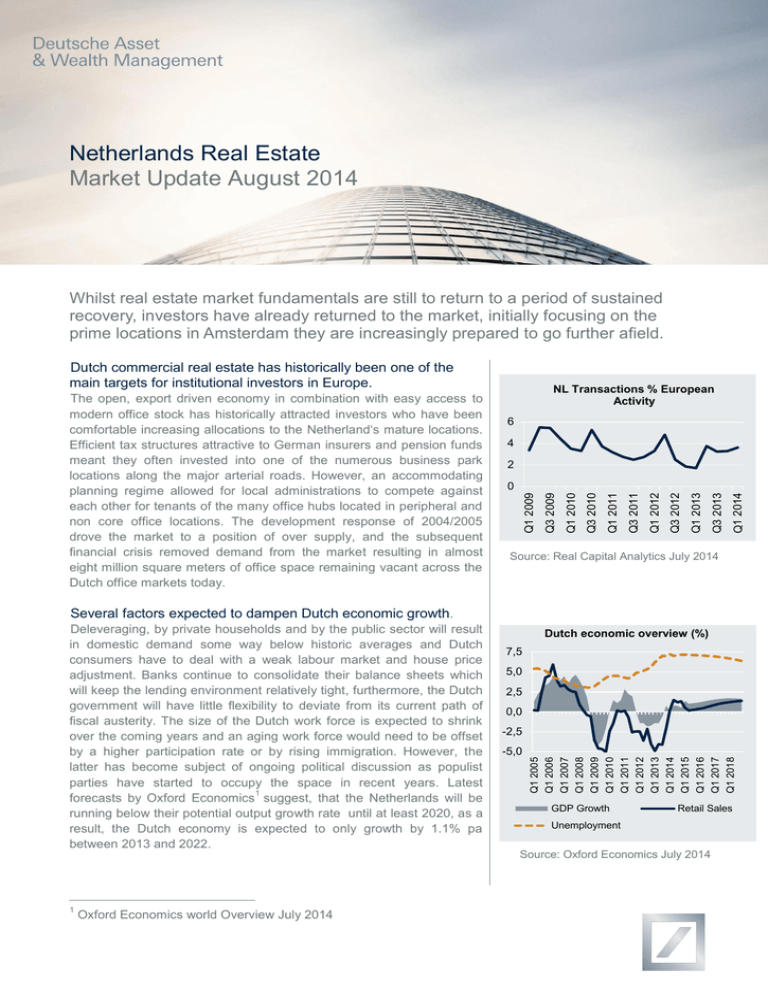

Dutch commercial real estate has historically been one of the

main targets for institutional investors in Europe.

NL Transactions % European

Activity

6

4

2

Q1 2014

Q3 2013

Q1 2013

Q3 2012

Q1 2012

Q3 2011

Q1 2011

Q3 2010

Q1 2010

Q3 2009

0

Q1 2009

The open, export driven economy in combination with easy access to

modern office stock has historically attracted investors who have been

comfortable increasing allocations to the Netherland‘s mature locations.

Efficient tax structures attractive to German insurers and pension funds

meant they often invested into one of the numerous business park

locations along the major arterial roads. However, an accommodating

planning regime allowed for local administrations to compete against

each other for tenants of the many office hubs located in peripheral and

non core office locations. The development response of 2004/2005

drove the market to a position of over supply, and the subsequent

financial crisis removed demand from the market resulting in almost

eight million square meters of office space remaining vacant across the

Dutch office markets today.

Source: Real Capital Analytics July 2014

Several factors expected to dampen Dutch economic growth.

Dutch economic overview (%)

7,5

5,0

2,5

0,0

-2,5

-5,0

Q1 2005

Q1 2006

Q1 2007

Q1 2008

Q1 2009

Q1 2010

Q1 2011

Q1 2012

Q1 2013

Q1 2014

Q1 2015

Q1 2016

Q1 2017

Q1 2018

Deleveraging, by private households and by the public sector will result

in domestic demand some way below historic averages and Dutch

consumers have to deal with a weak labour market and house price

adjustment. Banks continue to consolidate their balance sheets which

will keep the lending environment relatively tight, furthermore, the Dutch

government will have little flexibility to deviate from its current path of

fiscal austerity. The size of the Dutch work force is expected to shrink

over the coming years and an aging work force would need to be offset

by a higher participation rate or by rising immigration. However, the

latter has become subject of ongoing political discussion as populist

parties have started to occupy the space in recent years. Latest

1

forecasts by Oxford Economics suggest, that the Netherlands will be

running below their potential output growth rate until at least 2020, as a

result, the Dutch economy is expected to only growth by 1.1% pa

between 2013 and 2022.

GDP Growth

Retail Sales

Unemployment

Source: Oxford Economics July 2014

1

Oxford Economics world Overview July 2014

Copy Disclosure (9 pt) with line spacing (11 pt)

Office market

Typically there’s a lack of transparency in the Dutch office markets, as

prime effective rents can differ significantly from headline rents.

Furthermore, secondary space is often heavily discounted on the

leasing market, as competition remains fierce. Driven by low

construction levels over this cycle and a gradually decreasing amount of

modern space in prime locations, prime rents are expected to grow by

1.6% per annum over the next five years with growth set to improve

3

from 2015 onwards.

Office rents (LHS Index 2008) Vacancy %

125

20

115

15

105

85

5

75

0

Vacancy

Prime rents

Source: DeAWM Research, PMA

Retail market

Dutch households have suffered from a prolonged period of negative

real income growth and rising unemployment. Households are expected

to remain cautious for some years and consumers will likely remain

4

cautious. This has consequences for retailers, as real retail sales

figures have been negative for 11 successive quarters.

10

95

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

We can expect that long established central submarkets in Amsterdam,

Rotterdam and regional hubs such as Utrecht and Eindhoven will likely

start to experience prime rent growth from 2015. The Hague, with its

vast public sector exposure might need longer to remove its excess

capacities. However, given the ongoing slump in economic activity,

prime rents in Amsterdam don’t appear cheap. At € 345 sqm/year in

prime locations like the Zuidas in the CBD are above the pre crisis level

2

of 2008.

Real Retail Sales Growth % pa

10

5

0

-5

2

DeAWM Alternatives Research, PMA

DeAWM Alternatives Research, PMA

4

Oxford Economics World Overview July 2014

3

Copy Disclosure (9 pt) with line spacing (11 pt)

-10

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Tourist destinations such as Amsterdam are better placed. The prime

high street segment has performed relatively well and core locations are

in demand by international operators often willing to accept higher rents.

Occupier markets are less favourable in the Shopping Centre segment,

where prime rents have adjusted slightly over the last 24 months, the

outlook appears worse for the larger and medium sized secondary

centres. In contrast, smaller neighbourhood schemes, which provide a

strong grocery anchor, have seen relatively stable performance and will

continue to do so.

France

Germany

Netherlands

Spain

United Kingdom

Source: Oxford Economics July 2014

Logistics market

Of thel three key real estate sectors in the Netherlands, we expect the

logistics sector to outperform as investors continue to benefit from a

broader inward yield shift and moderate rental growth.

Copy Disclosure (9 pt) with line spacing (11 pt)

8

7

6

5

Office

ShC

Source: DeAWM Research, PMA

Logistics

2018

2016

2014

2012

2010

2008

2006

2004

2002

4

2000

Given the Netherlands prominent location close to a number of

dominant northern seaports it has retained its strong position in Europe.

In terms of tenant demand, the Dutch market is trailing only (the much

larger economies) of Germany and France. Much of the recovery of the

logistics market is linked to a rise in global trade. A large chunk of

European exports and imports are shipped trough Rotterdam,

Amsterdam and Belgium’s Antwerp, which is south of the border. But

there are other drivers too. The Netherlands is also experiencing a

general shift from high street to online trade and the larger cities are

also subject to urbanization. However, many logistics operators may be

attracted by the easy access to ports whilst at the same time reaching a

consumer base of 60-70m people within a radius of five hours drive.

Important Notes

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche

Bank AG or any of its subsidiaries. Clients will be provided Deutsche Asset & Wealth Management products or services by one or more

legal entities that will be identified to clients pursuant to the contracts, agreements, offering materials or other documentation relevant to

such products or services. In the U.S., Deutsche Asset & Wealth Management relates to the asset management activities of RREEF

America L.L.C.; in Germany: RREEF Investment GmbH, RREEF Management GmbH, and RREEF Spezial Invest GmbH; in Australia:

Deutsche Australia Limited (ABN 37 006 385 593) an Australian financial services license holder; in Japan: Deutsche Securities Inc. (For

DSI, financial advisory (not investment advisory) and distribution services only); in Hong Kong: Deutsche Bank Aktiengesellschaft, Hong

Kong Branch (for direct real estate business), and Deutsche Asset Management (Hong Kong) Limited (for real estate securities business);

in Singapore: Deutsche Asset Management (Asia) Limited (Company Reg. No. 198701485N); in the United Kingdom: Deutsche Alternative

Asset Management (UK) Limited, Deutsche Alternative Asset Management (Global) Limited and Deutsche Asset Management (UK)

Limited; in Italy: RREEF Fondimmobiliari SGR S.p.A.; and in Denmark, Finland, Norway and Sweden: Deutsche Alternative Asset

Management (UK) Limited and Deutsche Alternative Asset Management (Global) Limited; in addition to other regional entities in the

Deutsche Bank Group.

Key Deutsche Asset & Wealth Management research personnel are voting members of various investment committees. Members of the

investment committees vote with respect to underlying investments and/or transactions and certain other matters subjected to a vote of

such investment committee. Additionally, research personnel receive, and may in the future receive incentive compensation based on the

performance of a certain investment accounts and investment vehicles managed by Deutsche Asset & Wealth Management and its

affiliates.

This material was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive

it. It is intended for informational purposes only. It does not constitute investment advice, a recommendation, an offer, solicitation, the basis

for any contract to purchase or sell any security or other instrument, or for Deutsche Bank AG or its affiliates to enter into or arrange any

type of transaction as a consequence of any information contained herein. Neither Deutsche Bank AG nor any of its affiliates gives any

warranty as to the accuracy, reliability or completeness of information which is contained in this document. Except insofar as liability under

any statute cannot be excluded, no member of the Deutsche Bank Group, the Issuer or any officer, employee or associate of them accepts

any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this document or for any resulting

loss or damage whether direct, indirect, consequential or otherwise suffered by the recipient of this document or any other person.

The views expressed in this document constitute Deutsche Bank AG or its affiliates’ judgment at the time of issue and are subject to

change. This document is only for professional investors. This document was prepared without regard to the specific objectives, financial

situation or needs of any particular person who may receive it. No further distribution is allowed without prior written consent of the Issuer.

An investment in real estate involves a high degree of risk, including possible loss of principal amount invested, and is suitable only for

sophisticated investors who can bear such losses. The value of shares/ units and their derived income may fall or rise. Any forecasts

provided herein are based upon Deutsche Asset & Wealth Management’s opinion of the market at this date and are subject to change

dependent on the market. Past performance or any prediction, projection or forecast on the economy or markets is not indicative of future

performance.

The forecasts provided are based upon our opinion of the market as at this date and are subject to change, dependent on future changes

in the market. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is

not necessarily indicative of the future or likely performance.

© 2014 Deutsche Asset & Wealth Management. All rights reserved.

Copy Disclosure (9 pt) with line spacing (11 pt)

Office Locations:

Research & Strategy Team – Alternatives and Real Assets

Chicago

222 South Riverside Plaza

24th Floor

Chicago

IL 60606-1901

United States

Tel: +1 312 537 7000

Global

New York

345 Park Avenue

24th Floor

New York

NY 10154-0102

United States

Tel: +1 212 454 6260

San Francisco

101 California Street

26th Floor

San Francisco

CA 94111

United States

Tel: +1 415 781 3300

Frankfurt

Mainzer Landstraße 178-190

60327 Frankfurt am Main

Germany

Tel: +49 69 71909 0

London

Winchester House

1 Winchester Street

London EC2A 2DB

United Kingdom

Tel: +44 20 754 58000

Singapore

One Raffles Quay

South Tower

Singapore 048583

Tel: +65 6538 7011

Tokyo

Floor 17

Sanno Park Tower

2-11-1 Nagata-cho

Chiyoda-Ku

Tokyo

Japan

Tel: +81 3 5156 6000

Mark Roberts

Head of Research & Strategy

mark-g.roberts@db.com

Americas

Ross Adams

Industrial Specialist

ross.adams@db.com

Alexander Makarovski

Performance & Risk Analysis

alexander.makarovski@db.com

Ana Leon

Property Market Research

ana.leon@db.com

Alex Symes

Economic & Quantitative Analysis

alex.symes@db.com

Andrew J. Nelson

Retail & Sustainability Specialist

andrewj.nelson@db.com

Brooks Wells

Apartment Specialist

brooks.wells@db.com

Jaimala Patel

Quantitative Strategy

jaimala.patel@db.com

Erin Patterson

Property Market Research

erin.patterson@db.com

Europe

Simon Durkin

Head of Research & Strategy, Europe

simon.durkin@db.com

Gianluca Minella

Infrastructure Specialist

gianluca.minella@db.com

Tom Francis

Property Market Research

tom.francis@db.com

Farhaz Miah

Property Market Research

farhaz.miah@db.com

Matthias Naumann

Property Market Research

matthias.naumann@db.com

Simon Wallace

Property Market Research

simon.wallace@db.com

Asia Pacific

Koichiro Obu

Head of Research & Strategy, Japan & Korea

koichiro.obu@db.com

Minxuan Hu

Property Market Research

minxuan.hu@db.com

Natasha Lee

Property Market Research

natasha-j.lee@db.com

Mark Ho

Property Market Research

mark.ho@db.com

Copy Disclosure (9 pt) with line spacing (11 pt)

![[Headline_Arial_32 pt] [Subline]](http://s2.studylib.net/store/data/005744411_1-31273aa220ecaa5bbb57d2ef9f789ad2-300x300.png)