Very Low Hydro-balance Ahead of Winter

advertisement

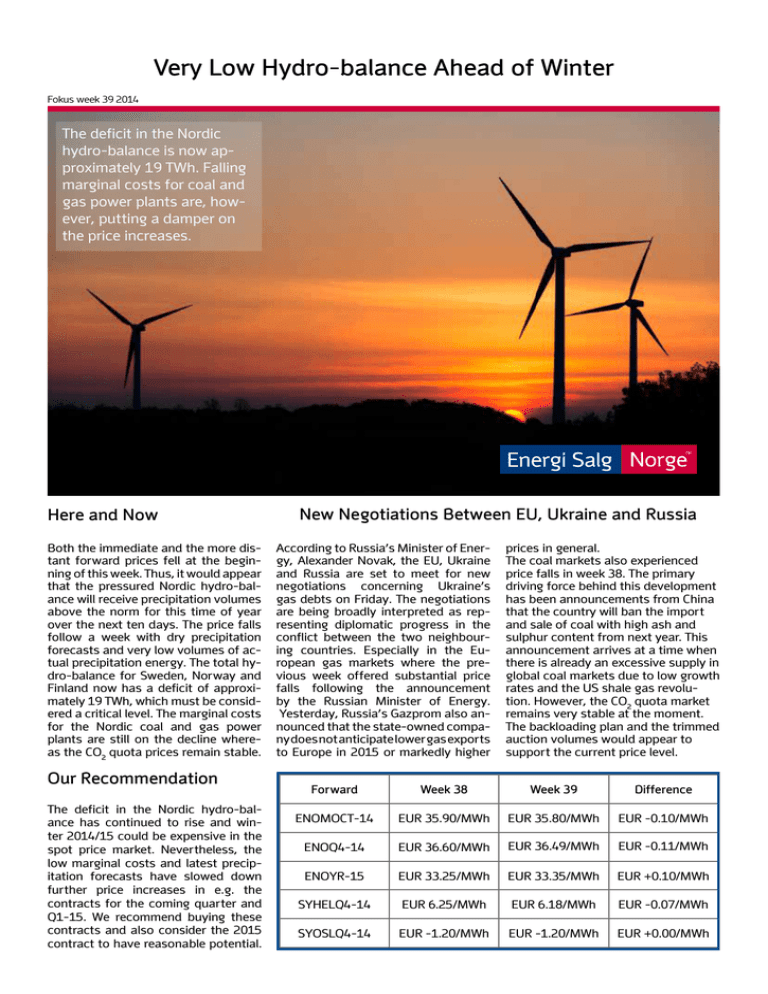

Very Low Hydro-balance Ahead of Winter Fokus week 39 2014 The deficit in the Nordic hydro-balance is now approximately 19 TWh. Falling marginal costs for coal and gas power plants are, however, putting a damper on the price increases. Here and Now Both the immediate and the more distant forward prices fell at the beginning of this week. Thus, it would appear that the pressured Nordic hydro-balance will receive precipitation volumes above the norm for this time of year over the next ten days. The price falls follow a week with dry precipitation forecasts and very low volumes of actual precipitation energy. The total hydro-balance for Sweden, Norway and Finland now has a deficit of approximately 19 TWh, which must be considered a critical level. The marginal costs for the Nordic coal and gas power plants are still on the decline whereas the CO2 quota prices remain stable. Our Recommendation The deficit in the Nordic hydro-balance has continued to rise and winter 2014/15 could be expensive in the spot price market. Nevertheless, the low marginal costs and latest precipitation forecasts have slowed down further price increases in e.g. the contracts for the coming quarter and Q1-15. We recommend buying these contracts and also consider the 2015 contract to have reasonable potential. New Negotiations Between EU, Ukraine and Russia According to Russia’s Minister of Energy, Alexander Novak, the EU, Ukraine and Russia are set to meet for new negotiations concerning Ukraine’s gas debts on Friday. The negotiations are being broadly interpreted as representing diplomatic progress in the conflict between the two neighbouring countries. Especially in the European gas markets where the previous week offered substantial price falls following the announcement by the Russian Minister of Energy. Yesterday, Russia’s Gazprom also announced that the state-owned company does not anticipate lower gas exports to Europe in 2015 or markedly higher prices in general. The coal markets also experienced price falls in week 38. The primary driving force behind this development has been announcements from China that the country will ban the import and sale of coal with high ash and sulphur content from next year. This announcement arrives at a time when there is already an excessive supply in global coal markets due to low growth rates and the US shale gas revolution. However, the CO2 quota market remains very stable at the moment. The backloading plan and the trimmed auction volumes would appear to support the current price level. Forward Week 38 Week 39 Difference ENOMOCT-14 EUR 35.90/MWh EUR 35.80/MWh EUR -0.10/MWh ENOQ4-14 EUR 36.60/MWh EUR 36.49/MWh EUR -0.11/MWh ENOYR-15 EUR 33.25/MWh EUR 33.35/MWh EUR +0.10/MWh SYHELQ4-14 EUR 6.25/MWh EUR 6.18/MWh EUR -0.07/MWh SYOSLQ4-14 EUR -1.20/MWh EUR -1.20/MWh EUR +0.00/MWh Low Volumes of Precipitation Energy Forecasts Precipitation: The forecasts for the next ten days in the Nordic region promise slightly more precipitation energy than the norm for this time of year. The largest volumes of precipitation energy would appear to be arriving on Friday and Saturday after which the scenario will be relatively normal again. The aforementioned development is supported by the 30-day forecast, which predicts a dry week 40. The water levels in the Nordic reservoirs are falling rapidly at this point in time. In particular, this is due to the low volumes of actual precipitation. This week the water reservoir levels are at 78.0% in Norway, 69.7% in Sweden and 59.7% in Finland. The Nordic hydro-balance, including snow and soil moisture, is well below the norm for this time of year, according to the Point Carbon Analysis Institute. Yesterday, the deficit was 19.2 TWh compared to 14.9 TWh last week. We expect the deficit to decrease this week. Production Costs Continuing to Fall Production and spot: During the past week, the daily Nordic system average price was around EUR 36.5/MWh on weekdays. Thus, the price level in week 38 was higher than in week 37. Prices are even higher at the beginning of this week due to lower wind power production and colder weather. The CfDs The CfDs were stable in week 37. Many of the Nordic nuclear power plants are now back at full power and the utilisation level in relation to the total Nordic capacity is now up to 79%. Contact CEO Espen Fjeld (esf@energisalgnorge.no) The falling coal and low CO2 quota prices mean that the Nordic coal power plants are able to produce noticeably cheaper electricity than e.g. the gas power plants. At this point in time there is nothing to indicate that this development will reverse. The latest growth data from China, USA and Europe is relatively moderate and the European coal stores remain full following a mild winter. Coal for delivery to Rotterdam in 2015 is trading at around USD 76.50/tonne whereas the price for emitting one tonne of CO2 is around EUR 6. In this connection there is no prospect of increases in any parameter. Telephone: +47 45 20 76 36 Communicative Analyst John Albertsen (jhal@energidanmark.dk) Telephone: 0045-8745-6948