FIN201 -- The Art of Self

advertisement

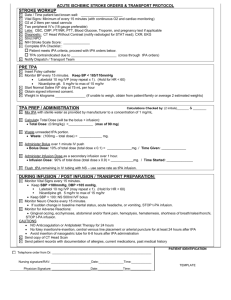

Large Deductible Program Cash flow Less $ on premium Retained losses are deductable Catastrophic protection Pricing driven by individual risk history Claims handling Have financial capacity to retain risk; financials meet carrier criteria Collateral and escrow Less budget stability Pricing driven by individual risk history Increased administration 1 Self-Insured Retention Program No collateral Less fronting cost Retained losses are deductable TPA or self administration selection Choose your lawyer Insurers do not “Drop Down” Dedicated internal resources to manage claims Limited carrier selection Certificate of insurance issues 2 Qualified Self-Insured Program Frequently the least collateral Must still buy excess coverage Possible reductions in assessments and taxes Collateral must be posted in each state TPA or self administration selection States hold on to collateral for a long time Choose your own lawyer No “Out and Back In” without reapplication Increased administration 3 Risk Transfer/Risk Retention Efficient Frontier Risk Transfer Savings Bare The Efficient Frontier 1 Risk Financing Alternatives Current “deductible” program Guaranteed Cost Risk Retention efficient frontier is the point at which there is no greater expected reward for a given level of risk retention 1The 4 Total Cost of Risk Measuring Program Efficiency Over Time TCOR + Savings Historical TCOR Defining Total Cost of Risk Historical TCOR Analysis Total Cost of Risk Total Cost of Risk as % of Sales Company Sales Revenue (000s) Total Premium $6M Premium as % of Sales 0.70% 0.60% $5M 0.50% $4M 0.40% $3M 0.30% $2M 0.20% $1M 0.10% PreviousYear PreviousYear PreviousYear PreviousYear Current Cost Target Cost 5 Walmart Stores, Inc. is comprised of: Walmart U.S. (approx. 1,420,000 associates) • • • • 3,600 Walmart Retail Stores 153 Neighborhood Markets 598 Sam’s Clubs 142 Distribution Centers Walmart International (approx. 709,000 associates) • 4,557 Retail Units • 14 Countries 7 • Self-insurance – 13 states • High deductible insurance coverage – 36 states • Administration through wholly owned subsidiary TPA – 35 states General Liability Workers’ Compensation Walmart’s casualty program utilizes the following structure: • Self-insurance – all states • Administration through wholly owned subsidiary TPA – 49 states • Administration through outside TPA – 1 state • Administration through outside TPA – 14 states 8 The Walmart Casualty Focus: Workers’ Compensation ensure associates that suffer work injuries: • Receive prompt and appropriate medical care that is focused on their recovery and return to gainful employment; • Receive prompt and appropriate disability benefits; • Compliance. General Liability Program ensure all customers claims are: • Addressed promptly and appropriately while recognizing the importance of our customers in the retail environment; • Compliance. 9 Program structure allows Walmart to concentrate on our associates and customers through: Self Administration RMIS Risk Control Process Improvement 10 Administering claims through our wholly owned subsidiary TPA helps ensure: Appropriate claims management by: Data integrity: • Accuracy • Owning the process • Analysis • Experience in best practices between in-house TPA and outside TPA vendors • Functional • Compliance focus • Direct relationship between operations and risk management 11 The appropriate RMIS tool is vital to the continual evolution of our program by allowing: Flexibility Scalability Sustainability The RMIS tool must act as an “enabler” to allow your property and casualty program to pursue overall company objectives. 12 Risk Control, although not part of our Risk Management Team, is an integral partner that focuses on: Accident prevention Safe place to work / safe place to shop Risk Control Accident investigation Post accident support 13 Lastly, our program structure allows for continual focus on process improvements. Utilization of real-time data from all aspects of Walmart to drive: Safety focus on accident prevention Workflow process improvements Trend analysis Resource allocation 14 In conclusion, our program structure: Works with our business model Ensures that we capture and evaluate the data to drive improvement Allows for optimum focus on our customers and our associates 15 Current Reality Panel Discussion Questions & Answers 17