presentation

advertisement

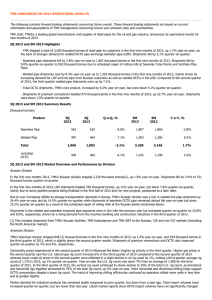

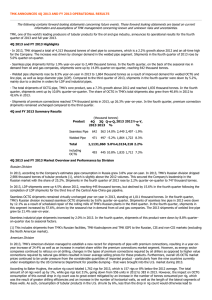

PROPRIETARY & CONFIDENTIAL Global Synergies PROPRIETARY & CONFIDENTIAL Investment Highlights Global market leader Leading producer of value-added steel pipes for the oil & gas industry 12% global seamless OCTG(1), 60% Russian seamless OCTG and 17% of the U.S. OCTG market in 1H 2010 Favourable industry dynamics Strong steel pipe industry fundamentals driven by robust demand for oil & gas Consolidated industry with significant barriers to entry Demand for seamless OCTG expected to experience significant growth Strategic supplier to the oil & gas sector Approximately 75% of 1H 2010 shipments went to the oil & gas sector in 1H 2010 Strategic partnerships with oil & gas majors Ongoing cooperation with multinational oil & gas companies Vertically integrated low cost producer Structural cost advantages over major international competitors Fully vertically integrated seamless pipe production (upstream and downstream operations) Growth potential and deleveraging Strategic Investment Programme (2004-14) aimed at 48% capacity increase Ability to efficiently integrate acquired businesses and realise synergies Commitment to maintain and improve credit ratings Key performance figures Revenue, US$ mln EBITDA, US$ mln Notes: (1) OCTG - Oil Country Tubular Goods 2006 2007 2008 2009 1H 2010 3,402 4,179 5,690 3,461 2,566 800 920 1,047 328 415 1 Global Operational and Sales Footprint TMK’s strategic positioning made it the steel tubular industry leader, with nearly 4 million tonnes sold in 2010. Steel tubular industry leader Sinarsky Seversky Moscow Cologne Calgary Production & Services Marketing subsidiaries & representative offices RosNITI Zurich Resita Camanche Chicago Geneva Brookfield Ambridge Koppel Wilder Catoosa Blytheville Houston Odessa Lecco Volzhsky Kaztrubprom Tagmet Astana Artrom Baku Ashgabat Beijing Dubai Baytown R&D Capacity (tonnes) North America Europe Russia and CIS Steelmaking 450,000 450,000 2,450,000 Seamless pipes 300,000 200,000 2,420,000 Welded pipes 1,150,000 2,200,000 Heat Treat 441,000 1,500,000 Threading 741,000* 1,560,000 Note: *Does not include ULTRA Premium connections of 520,000 joints Source: TMK accounts Singapore Cape Town 2 PROPRIETARY & CONFIDENTIAL Global Leader in Cost Efficiency Russia is one of the lowest cost regions for steel production Low raw materials costs 1H’10 Cash Cost per tonne (US$) Scrap purchase price, US$/’tonne 350 TMK 410 Shredded FOB Rotterdam 545 DRI 2,003 1,320 Favorable unit labor cost 1,274 Labor cost, US$/’month 993 768 TMK 750 Russia 4,200 U.S. 5,900 Germany Vallourec Tenaris US Steel Tubular TMK Low regulated energy prices Low gas prices Electricity prices, US$/MWh Gas price, US$/’000 m3 80 Russia 88 in Russia 100 China 400 in Europe 90 U.S. 100 Germany Source: TMK data (1H’10 - 2009 estimates) * Cash cost per tonne is calculated as (cost of sales minus depreciation) divided by sales volumes 3 PROPRIETARY & CONFIDENTIAL Segmenting the Global Pipe Market Consolidated industry with significant barriers to entry World Steel Industry Market Concentration (2009) Arcelor Mittal 6% World Seamless OCTG Market Concentration (2009) TMK (13%) Hebei Iron & Steel 3.3% Baosteel 3.2% POSCO 2.5% Wuhan Iron & Steel 2.5% Highly Consolidated Pipe Industry Top 6 76% Others 24% Others 82.5% World Tube Market Segmentation (2009) TMK Shipments by Industry (2009) LD Welded 17% Machine Other 12% TMK’s product mix is geared to meet the needs of the energy industry Building 5% OCTG 7% Line Pipe 3% Industrial Welded 49% Welded Welded Line Pipe OCTG 4% 2% Construction Seamles s Industrial 18% and Public Utilities 16% Oil & Gas 67% 4 Source: Company data and estimates, industry sources, WSA, World steel in figures PROPRIETARY & CONFIDENTIAL Russian Drilling - Moving East for Growth The increasing complexity of oil and gas production in Russia is expected to increase demand for higher Meters drilled value-added products Arctic offshore Timan Pechora Eastern Siberia Western Siberia Sakhalin Volga Caspian Production data, million tonnes Conventional Regions Unconventional Regions 2007 2008 2009 2010F 2011F 2012F Western Siberia 337.7 333.6 330.7 325.6 319.1 312.7 Volga-Urals 105.1 106.7 107.7 107.7 105.0 102.4 Timan-Pechora & Kaliningrad 28.0 29.1 29.0 29.0 29.0 29.0 Far East 15.0 13.8 16.0 17.0 19.0 22.0 Eastern Siberia 0.5 0.5 6.0 17.5 25.5 31.5 North Caucas & Precaspian 5.0 4.8 4.8 5.7 6.6 7.3 491.3 488.5 494.2 502.5 504.2 504.8 Total oil production 5 Source: TMK estimates, VTB Capital PROPRIETARY & CONFIDENTIAL Russian LD Demand Drivers Shtokman Barents Sea Yamal Indiga Murmansk – Volkhov Bovanenkovo Europe Yamal Kharyiga Timan Pechora Ukhta Urengoy Purpe - Samotlor Eastern Siberia Western Siberia Pochinki – Altai Project Gryazovets Vyborg Nord Stream BTS-2 Large-diameter pipe demand to remain robust as regions of production continue to move further away from consumption centres Yakutsk ESPO -2 Oil Pipelines Syzran Tengiz Gas Pipelines Novorossisk Beregovaya TBP South Stream Sakhalin – Khabarovsk – Vladivostok Caspian Blue Stream Gazp Gazp Tran Gazp Tran Tran Sakhalin-KhabarovskVladivostok Maintenance ESPO-2 Pochinki-Gryazovets BTS-2 Purpe-Samotlor Gazp Gazp/Tran Gazp Gazp Gazp Tonnes TMK 9M’10 Gazp Type 79,138 74,434 57,555 55,386 40,484 22,917 LSAW SSAW LSAW SSAW LSAW LSAW Bovanenkovo-Ukhta 15,151 (+47,000) LSAW Maintenance NordStream NordStream Urengoy Sakhalin-KhabarovskVladivostok 17,153 4,394 2,552 3,270 LSAW LSAW SSAW SSAW 689 SSAW Source: TMK estimates, Gazprom Gazp Gazp Gazp Gazp Gazp Gazp Gazp Tran Gazp Gazp Tran Gazp Gazp Tran Tran Tran Tran Gazp Maintenance Gazprom Misc. Projects Yakutiya-Vladivostok Altai Bovanenkovo-Ukhta-2 Ukhta-Torjok-2 Murmansk-Volkhov Tengiz-Novorossisk Shtokman SouthStream Transneft Lukoil (subsea) BlueStream Kharyiaga-Indiga Syzran-Novorossisk Zapolarye-Purpe Trans Balkan Pipeline Lukoil (land) K Tonnes 2,400 1,700 1,500 1,500 1,100 800 600 580 550 500 500 300 250 224 190 150 95 50 Estimated Russian LD Demand 20112015 6 TMK IPSCO – US Market Penetration Camanche, IA Brookfield, OH Capacity (tonnes) Product ERW OCTG line pipe, standard pipe 249,000 Threading 290,000 ULTRA™ Premium connections Second line (1H2011) Capacity (tonnes) ERW HSS Marcellus Hilliard-BaxterMancos Capacity (tonnes) 91,000 118,000 New Albany Niobrara Ambridge, PA Blytheville, AR Product Capacity (tonnes) Product 73,000 435,000 240,000 Antrim Catoosa, OK Heat Treating Threading Heat Treating Billets 240,000 Gammon 109,000 Product Capacity (tonnes) Product Bakken Geneva, NE Product Koppel, PA Capacity (joints) Product ERW OCTG, line pipe, standard pipe Heat Treating Threading 272,000 Seamless OCTG line pipe, standard pipe Woodford 91,000 181,000 Heat Treating Fayetteville BarnettWoodford Odessa, TX Capacity (tonnes) 296,000 73,000 Barnett Haynesville Capacity (joints) Product ULTRA™ Premium connections 150,000 Eagle Ford Baytown, TX Houston, TX Capacity (joints) Product ULTRA™ Premium connections 130,000 Product Heat Treating Threading Capacity (tonnes) 113,000 152,000 Wilder, KY Product ERW OCTG, standard pipe Capacity (tonnes) 517,000 Seamless Welded Finishing Steel Major Gas Shale Plays Major Oil Shale Plays Source: TMK, as of September 2010, Energy Information Administration 7 PROPRIETARY & CONFIDENTIAL US Drilling – Stronger than Ever (active rigs) (months) 2500 2000 1500 1000 Months of Supply 500 US Rig Count 0 Drilling activity brought months of OCTG supply back to normal. Ja nM 08 ar M - 08 ay -0 Ju 8 l S -08 ep N 08 ov Ja 0 8 nM 09 ar M - 09 ay -0 Ju 9 l S -09 ep N 09 ov Ja 0 9 nM 10 ar M 10 ay -1 Ju 0 lS 10 ep N 10 ov -1 0 16 14 12 10 8 6 4 2 0 2 500 Oil drilling and liquids rich gas plays have kept activity levels on the rise 2 500 2 000 2 000 1 500 1 500 1 000 Gas Premium tubular content increasing with unconventional drilling activity. Vertical - 32% 1 000 Horizontal - 55% 500 500 Oil 0 Directional - 13% Source: TMK & industry estimates, Baker Hughes Ja n0 Ju 3 n0 De 3 c0 M 3 ay -0 No 4 v0 Ap 4 r- 0 O 5 ct -0 M 5 ar -0 Se 6 p0 Fe 6 b0 Au 7 g0 Ja 7 n08 Ju l-0 De 8 c0 Ju 8 n0 No 9 v0 M 9 ay -1 No 0 v10 Ja n0 Ju 3 nDe 0 3 cM 03 ay -0 No 4 vAp 0 4 r- 0 O 5 ct -0 M 5 ar Se 06 p0 Fe 6 bAu 07 g0 Ja 7 n0 Ju 8 l-0 De 8 c0 Ju 8 n0 No 9 vM 09 ay -1 O 0 ct -1 0 0 8 PROPRIETARY & CONFIDENTIAL Lower Break-even Costs Encouraging Drilling The industry has traditionally viewed $5 to $6 as the economic drilling price of gas, but a recent study estimates surprisingly low break-even costs for the major shales. Henry Hub Natural Gas Price dollars per million btu 8 Historical spot price STEO price forecast NYMEX futures price 6 4 2 0 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Lower break-even costs will allow the higher rig count to continue despite lower natural gas price forecasts. Source: EIA Short Term Energy Outlook November 2101, Reuters News Service, CME Group, Credit Suisse 9 PROPRIETARY & CONFIDENTIAL Shopping Spree Over $60 billion in shale M&A activity over the last twelve months Bakken Major Gas Shale Plays Major Oil Shale Plays Gammon Antrim Marcellus HilliardBaxterMancos Q4 2009, ExxonMobil’s $41 billion acquisition of XTO Energy. New Albany Woodford Fayetteville Royal Dutch Shell offers $4.7 billion for Marcellus shale gas specialists, East Resources, Inc. Chevron Corp., agrees to buy Atlas Energy Inc. for $3.2 billion, giving it access to the Marcellus. Barnett Haynesville BarnettWoodford CNOOC offers $1.08 billion for a one-third stake in Chesapeake Energy Corp.’s Eagle Ford project. Eagle Ford STATOIL of Norway agreed to pay $843 million to set up Eagle Ford JV with Talisman Energy Inc. Reliance Industries commits $2.8 billion gains to access the Marcellus shale in Pennsylvania with Atlas Energy, and the Eagle Ford shale in Texas with Pioneer Natural Resources. 10 Source: Price Water House Coopers, Wood Mackenzie, Reuters News Services PROPRIETARY & CONFIDENTIAL Growth and Added Value Production ’10/’05, % Target capacity * Target/’10, % 2005 2010 Seamless 2,040k tonnes 3,035k tonnes 49% 3,670k tonnes 21% Threading 790k tonnes 2,103k tonnes 166% 2,300k tonnes 9% Heat Treating 730k tonnes 1,530k tonnes 110% 1,880k tonnes 23% Premium Connections - 330k tonnes - 450k tonnes 37% Longitudinal large diameter - 650k tonnes - 650k tonnes - Steelmaking * : TMK estimates 2,350k tonnes 3,350k tonnes 43% 3,700k tonnes 10% 11