CDI BDI CPP CPM Dayparts

advertisement

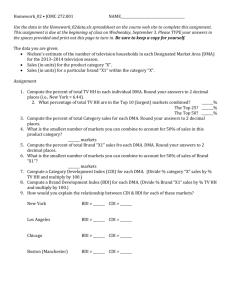

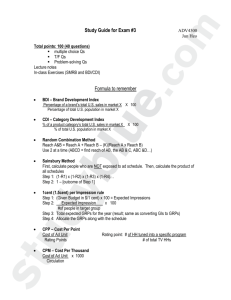

WHERE/WHEN/HOW CDI/BDI/INDEX CPM/CPP REVIEW WHAT IS REACH? -% OF PEOPLE EXPOSED TO A MESSAGE WHAT IS EXCLUSIVE REACH? -% OF DIFFERENT PEOPLE EXPOSED TO A MESSAGE WHAT IS FREQUENCY? AVERAGE # TIMES PEOPLE EXPOSED WHAT IS COVERAGE? POTENTIAL TO BE REACHED DIFFERENCE-REACH IS ACTUAL - COVERAGE IS POTENTIAL REVIEW (CONT) HOW DO YOU CALCULATE GRP’S/IMPRESSIONS? R X F=GRP’S R X F =GROSS IMPRESSIONS HOW DO YOU CALCULATE FREQUENCY? F=GRP’S/REACH OR IMPRESSIONS/REACH HOW DO YOU CALCULATE REACH? R= GRP’S/FREQUENCY OR IMPRESSIONS/FREQUENCY OBJECTIVE Student will learn new terms and apply them in class and out: Terms: Index, CDI, BDI, CPM, CPP Student will learn different broadcast dayparts and uses of dayparts. INDEX Index based on sales performance % population- a form of % that relate numbers to a base of 100. Used to demonstrate: -average -above average -below average In this course we use 2 ways : CDI and BDI CDI/BDI Category Development Index (CDI) -addresses category sales-defines pockets of strength and weakness for a new category entering a market or to compare CDI to BDI Brand Development Index (BDI -Generally displayed by region of country and shows how each area is performing relative to the US performance -Comparison of product category sales or brand sales with potential for sales of category or brand based on population -Allocation of advertising money across marketing regions -Allocation of extra marketing/advertising dollars CDI/BDI CDI =% of product category’s total U.S. sales in market A X 100 % of total U.S. population in the same market BDI =% of brand’s total U.S. sales in market A____ X % of total U.S. population in the same market 100 In Class Exercises 1. 2. Index Number Analysis BDI/CDI Interpretation of CDI & BDI High BDI Low BDI High CDI Both product and Brand is doing poorly brand are doing well: compared to category “A promising market.” Room for brand to grow Low CDI If the category shows No added investment of continuous decline, money no need to put extra money. If the market is being rejuvenated, then worth putting in more money Weighting of CDI & BDI Depends on marketing strategy Examples Young brands with limited sales history -more on CDI Mature brands -more on BDI Safe way is to weight BDI & CDI 50% each When to Advertise Decisions about when to advertise depends on number of important considerations When sales are greatest or least Budget constraints When competitors advertise Specific goals for the brand in question Availability of product Promotional requirement One point underlies Advertise when people tend to buy the product When-Analyze monthly sales Snow blower in New York…October or June? Ice Cream…May-Aug Ice Cream Sales NE Region MONTH CATEGORY BRAND INDEX January 8.2% 6.5% 83 February 7.7 6.5 85 March 8.5 8.2 96 April 8.2 7.5 91 May 8.5 8.9 105 June 8.2 8.9 109 July 8.5 9.4 110 August 8.5 10.3 121 September 8.2 8.2 100 October 8.5 8.8 103 November 8.2 7.6 93 December 8.5 9.5 112 When to Advertise Theoretically Brand should advertise more heavily in months when sales have been higher What if category sells well but brand does not? Should you advertise when category does best or when brand does best? Some considerations can require a change in your media strategy, but generally advertise when THE CATEGORY DOES BEST When to Advertise Planners need to keep in mind the effect of certain seasons in studying monthly sales records Back to School Christmas Easter Certain kinds of products (seasons/months) have become associated with “White Sale” months that sell linens, towels, tablecloths…If a brand belongs to a category associated with a season, pay special attention to monthly sales figures Budget constraints Often budget not large enough to permit year round sales Allocate dollars to best selling months: Maintain Continuity (continuous advertising all year long Flight (periodic advertising followed by hiatus) Planners will never have all they money they would like to have to do the “best plan”…This is one reason planners often provide 3 options of plans for a client to select from…One that shows what the ideal plan would be, one that shows minimal levels of advertising and one that is midway between the two (generally the one they think the client will go for) Competitive activity Important to consider when competitors advertise If your timing pattern is different from the category pattern you need to explain or justify why you are doing this Is it an opportunity? Do you have a Grand Opening planned? Is there a special sale? If you can’t compete during the category season, is there something you can do during another time of year that will help your client increase their share of business? Furnace company-spring check up at ½ price or check up in November (when you have more business than you can handle.) Specific Goals for the Brand React aggressively to competitive strategies Advertise heavily a month early to begin before the competition starts in order to increase market share Outspend the competition in a particular month…withdraw money from the year long effort for a concentrated attack New Product introduction Heavy initial weight Lighter weight later on Product Availability In certain situations demand outstrips ability to supply product Example at Christmas the newest Elmo doll always has more demand than the toy company can supply In such case, timing of advertising has to be related to production availability. Promotional Requirements If aggressive sales promotion campaign planned proceeding or during and ad campaign, this will affect timing Example-A cents-off deal might require aggressive advertising when the campaign to announce the promotion kicks off How Determining most efficient way to advertise is one way Basic measurements CPM CPP Cost efficiency of media vehicles Cost efficiency-related to media cost How many does it reach?-size How much does it cost?-cost Two Measures CPM: print media CPP: broadcast media How/CPM Cost efficiency of media vehicles based on audience size and cost****** In order to determine most efficient…part of how…need to sue the same yardstick to compare vehicles -COST PER 1,000 prospects Audience base: Circulation, # homes reached, readers, # of audience of any kind of demographic or product usage classification CPM is the great equalizer of media in terms of efficiency CPM enables planners to compare media vehicles with each other to find most efficient . Basis of comparison is the CPM HOW/CPM Print CPM Cost of 1 page (BW) Circulation (# prospects reached) X 1000 Broadcast CPM Cost of 1 spot # prospects in target X 1000 CPM Formula CPM ($) = Cost ($) X 1,000 Gross Impressions* *Gross Impressions -Circulation -# of actual readers -# of homes -# of audience members with specific demographic or product usage classifications CPM Strictly talking about efficiency Does not take into account qualitative. most efficient might not be most effective. When comparing different medias, planners will generally weight media by importance (last week covered advantages & disadvantages of each media) Planner might say, “Radio is only sound. TV & Cable are sight & sound. My product needs to be seen and heard in order to be understood, TV will be rated 50% more important than radio and I will decrease the CPM of TV accordingly when I compare the two medias. CPP Typically applied for TV and Radio Cost per rating point…Cost to reach 1% of the target population CPP ($) = Total Cost ($) Rating points* *Rating = % of target tuned in during average minute of a program Guided practice Example 1 Cost of 30-second commercial: $1,100 # households delivered at 2:00 p.m.: 77,000 CPM??? ($14.28 to reach 1000 households at 2:00 p.m.) Example 2 Cost of 30-second commercial: $1,100 DMA rating at 2:00 p.m. 8 (%) CPP??? ($137.50…It costs 137.50 to reach 1% of the DMA at 2:00 p.m.) Which one to use? CPM: The efficiency of individual vehicles or to compare various media CPP: Cost calculation for the entire broadcast plan or to compare various broadcast medias or dayparts to each other Broadcast Dayparts TV is a Reach media and is still the fastest way to get a message out. TV consists of several dayparts which loosely are (in this time zone): Early Morning (M-F/5-10 am) Early morning news, Today Show, Efficient daypart. Audience getting ready for work but fairly attentive. Element of soft news lends credibility to advertisers Daytime (M-F 10a-3 pm) Day , Game shows, Judge shows, Soap Operas, Talk shows…Regis & Kelly, Jerry Springer, Ellen, Dr. Phil. Low cost to advertise Generally an older less affluent audience. Good daypart for advertising to alcoholics, those out of work, retired, students Broadcast Dayparts Early Fringe (M-F 3-6:30 pm…or whenever News starts) Syndicated comedies…Malcolm in the Middle, Friends, Simpson's, some talk shows..Oprah) Generally low cost and efficient area. Good area for restaurants, fast foods, pizza delivery. Reaches Children, Teens, Ad 18-49. Access (M-F 6:30-7 pm) Game shows, entertainment shows, syndicated comedies …Entertainment Tonight, Extra, Seinfeld, King of Hill. More expensive than Early Fringe, but less than Prime. Great for restaurants, Pizza deliver, food categories, generally high audience levels. Early News M-F 4-6 time frame on some stations. High demand area. Expensive daypart. Good reach area for more affluent, better educated television viewers. Element of News lends credibility to advertisers. Local News does better than National News in any given market. Good area for food advertisers, car advertisers, political advertisers. Broadcast Dayparts Prime Time (M-Sa 7-10PM, Su 6-10PM) Prime. Highest Reach area. Expensive daypart. CSI, Grey’s Anatomy, Gilmore Girls. Good area to reach Ad 18-34, Ad, 18-49, Ad 2554, Ad 35+. Generally not used as a vehicle to reach teens due to inefficiency against that demographic. Most expensive daypart (except premium Sports) Late News (M-Su 10-1030 pm) High demand area. Expansive daypart. Comparable with Prime time cpp’s in many markets. Good reach area for affluent, better educated television viewers. Element of News lends credibility. Late Fringe (M-Su 1030p-1am) Late night. Tonight Show, Letterman, Conan O’Brien, Seinfeld, Friends, Talk shows, comedies. Efficient daypart. Lower reach than most other dayparts. Good area to reach males. Overnight (M-Su 1a-5a) Various. Very low reach. Often nocharged to advertisers.