Study Guide for Exam #2

advertisement

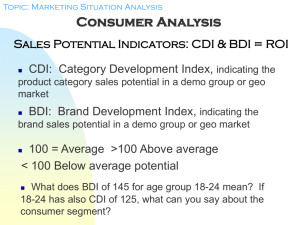

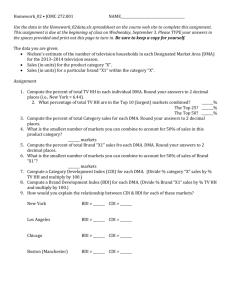

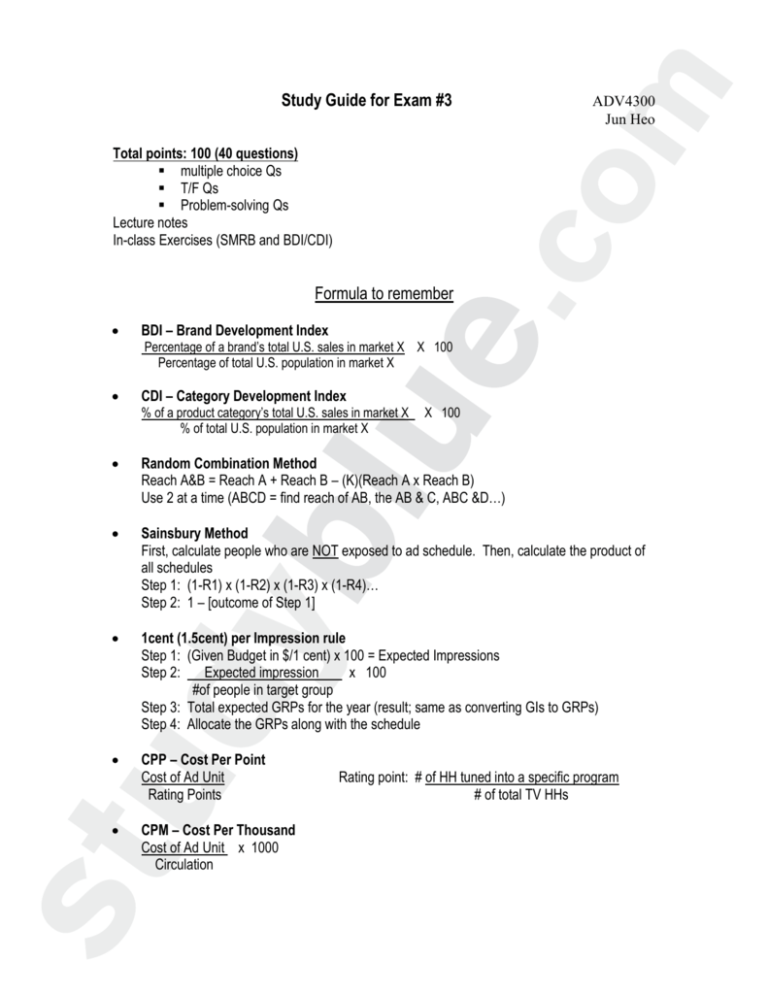

Study Guide for Exam #3 ADV4300 Jun Heo Total points: 100 (40 questions) multiple choice Qs T/F Qs Problem-solving Qs Lecture notes In-class Exercises (SMRB and BDI/CDI) Formula to remember BDI – Brand Development Index Percentage of a brand‟s total U.S. sales in market X X 100 Percentage of total U.S. population in market X CDI – Category Development Index % of a product category‟s total U.S. sales in market X % of total U.S. population in market X X 100 Random Combination Method Reach A&B = Reach A + Reach B – (K)(Reach A x Reach B) Use 2 at a time (ABCD = find reach of AB, the AB & C, ABC &D…) Sainsbury Method First, calculate people who are NOT exposed to ad schedule. Then, calculate the product of all schedules Step 1: (1-R1) x (1-R2) x (1-R3) x (1-R4)… Step 2: 1 – [outcome of Step 1] 1cent (1.5cent) per Impression rule Step 1: (Given Budget in $/1 cent) x 100 = Expected Impressions Step 2: Expected impression x 100 #of people in target group Step 3: Total expected GRPs for the year (result; same as converting GIs to GRPs) Step 4: Allocate the GRPs along with the schedule CPP – Cost Per Point Cost of Ad Unit Rating Points CPM – Cost Per Thousand Cost of Ad Unit x 1000 Circulation Rating point: # of HH tuned into a specific program # of total TV HHs GRPs – Gross Rating Points GRP = Reach (%) x Frequency GRP = Impressions (GI) x 100 Universe GIs – Gross Impressions GI = Reach (#) x Average Frequency GI = GRPs x Universe 100 Important Concepts New Topics (75~80%) How to read SMRB/MRI (each column: A, B, C, and D) o Column A: Given in Thousands (000). Signifies the total # of people who share this demographic characteristic. o Column B: Vertical or Down %. Describes the proportion of users who share this demographic characteristic. Total # of Users in Demo Group x 100 Total # of Users o Column C: Horizontal or Across %. Describes the proportion of a particular demographic segment that uses the product. Total # of Users in Demo Group x 100 Total # of People in that Group o Column D: Index. Propensity to Consume or use a product/brand for a particular demographic segment, compared to total general people. The index number is calculated by taking the % in the C column for a given category and dividing by the corresponding percentage at the top of the C column. % of Total Users in Row (Across) x 100 % of Total Users Overall (Top) Rank-order Index o When index numbers are close (less than 10), look at the population size (Column A) to determine which is better. Evaluation of Media Qualitative Evaluation o Generic nature of the medium o Inter media comparison o Media impact (ex. Buzz, PR creation, and etc.) o Attention potential Quantitative Evaluation o Clutter (CMR) o Audience size (SMRB) o Media consumption (SMRB/MRI – Quintile Analysis) Concepts of Quintile Analysis o A technique where either the population or users of a particular medium or the audience of a specific schedule is arrayed into 5 equal groups, according to their frequency of viewing/reading – Quintile 1: Heaviest / 2: Next Heavies / 3: Medium / 4: Next Lightest / 5: Lightest o Top 20% of customers accounts for 80% of sales o Things to remember: – Index = Column B (Vertical) x 100 Quintile (20%) – High Index number in Quintiles IV & V means low usage – When make a decision, look at the first two quintiles (Quintile I & II) – Low Index number doesn‟t necessarily mean non-usage Continuity Pattern Flighting: an intermittent pattern of insertions with gaps where no advertising is run o When to Use: – Funding is limited to cover the whole campaign – Long purchase cycle – Well-defined seasonality (know when consumers buy and only advertise before purchase) – Market share building and stealing (top share) (can dominate market for a time period) Continuous: pattern where the ad weight is consistent throughout the campaign o When to Use: – For frequently purchased products – Highly defined and narrow target markets – Expanding markets characterized by high CDI & BDI Pulsing: a mix of continuous and flighted insertions which result in “heavy-up” periods o When to Use – When you want to keep your brand name top of mind – Support merchandising events – Anytime purchase cycle calls for greater emphasis BDI/CDI HIGH CDI LOW CDI Good sales potential The category is not selling HIGH BDI Minimum marketing efforts Defensive approach ▶ Maintenance Strategy LOW BDI The category is selling well, but the brand is not High market potential Intensive marketing efforts with higher frequency in peak season ▶ Aggressive Strategy well, but the brand is Possible future decline in brand‟s sales Minimum/optimal budget level ▶ Defensive Strategy Neither the brand and the category is selling well Low market potential Limited budgeting in sales peak Promotional supports ▶ Extreme Aggressive Strategy OR Withdrawal Strategies for each market Weighting on BDI or CDI o Relative weight given to CDI and BDI varies depending on situation and marketing strategy o Better decision making based on marketing strategy o BDI: CDI 50:50 - no preference 30:70 - defensive 70:30 - offensive 100:0 - new brand Advertising Budgeting Methods o Ad/Sales Ratio Methods – Ad to Sales: a fixed proportion of the sales volume estimated – Ad to Margin: a fixed proportion of the estimated margin – Ad to Unit Volume: a fixed sum for advertising is allowed per unit – Pros: * Easy to Use * Easily defended to top management – “We must match competition” – Cons: * Arbitrary proportion set * The effects of advertising on sales is ignored * Without considering media cost inflation, it might fail to reach the goal o SOV/MS Methods – Comparison between Share of Voice and Market Share – Leading brand: SOV < MS – Followers: SOV > MS – New brand in the market: Peckham‟s Rule – Peckham‟s Rule: For the first 2 years, your plan to capture an advertising share (SOV) equals about 1.5 times the market share you hope to gain (MS) * Desired market share x 1.5 = Necessary SOV * Then apply this % to the total estimated category ad expenditures to get your $ budget – Pros: * Easy to use * Easily defended to top management – “We must watch competition” * Consider competitive activities – Cons: * It assumes that market share does follow share of voice, which may not be correct * It might be risky to match large brands that have a lower proportion of SOV (leader will have lower SOV, only needs to „maintain‟) o Competitive Parity Method – Match Competition. * SOV or actual amount * Equal or nearly equal ratio – Pros: * * – Cons: * * Easy to use Easily defended to top management – “We must watch competition.” Hard to define the right competitor among many Assume that competitors are spending the right amount, which might be wrong. o Task Method – A big role of media planner! – Specific objectives lead to budget 1. Objectives 2. Specific tasks/tactics 3. Costs associated with these tasks 4. Monitoring and re-evaluation – TASK regarding media goals * Set Effective Frequency Goal (Ostraw‟s Model) * Set GRPs/GIs Goal ( 1/1.5 cent per impression rule) * Estimate CPP/CPM * GRPs x CPP = Budget (for achieving goals) * Re-evaluate and Revise – Pros: * Campaign evaluation – measurable goal base * Affordability check – if the budget is enough to achieve the goal * Clearly defined advertising‟s role – Cons: * Not easy to do * The goal chosen might not be related to overall objectives. o Allocating Ad Budget – By time-period (The % of sales/sales trends) – By medium (competitive analysis, Quintile Analysis) – By sales area (BDI/CDI) – Contingency budget Media Buying o Estimating media cost o Negotiating for better media cost o Generating “added-value” o Monitoring o Reporting “post-buy” Media Plan Checklist I. Executive Summary II. Budget III. Introduction IV. Marketing Objectives V. Advertising Objectives VI. Media Objectives VII. Media Strategies VIII. Media Tactics Previous Topics (20~25%) Total Message Weight (GRPs and GIs) CPP and CPM Media Information Source Frequency distribution