EBITDARD

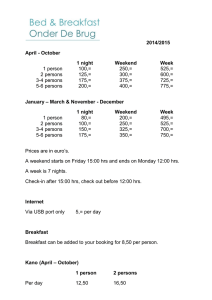

advertisement

Leagues Clubs Australia Conference May 2010 Managing budgets and the bottom line Topics Why so important - now more than ever Recent earnings trends Some budgeting techniques What targets to set Using budgets to drive performance Turning budgets into an operating plan Driving a marketing budget Summary 2 Thanks to CDOL 3 Financial flows – NSW $100 Gaming $69 Bar $15 Catering $13 Retail $2 Other $1 Gaming surplus $44 (64%) Bar surplus $4 (27%) Cater surplus <$1 (2%) Retail <$1(14%) Other $1 Front of house GP $51 (51%) Community $3-$4 Overheads $34 (34%) Capital/debt $8 - $15 (8%- 15%) EBITDARD $17 (17%) Financial flows – Qld $100 Gaming $61 Bar $15 Catering $17 Retail $4 Other $3 Gaming surplus $37 (60%) Bar surplus $5 (33%) Cater surplus $1.70 (10%) Retail <$1(5%) Other $3 Front of house GP $47 (47%) Community $3 (3%) Overheads $29 (29%) Capital/debt $8 - $15 (8%- 15%) EBITDARD $18 (18%) Financial flows – ACT $100 Gaming $66 Bar $19 Catering $12 Retail $? Other $2 Gaming surplus $43 (65%) Bar surplus $5 (27%) Cater surplus $0 (0%) Retail $?(?%) Other $2 Front of house GP $51 (51%) Community $3 Overheads $31 (31%) Capital/debt $8 - $15 (8%- 15%) EBITDARD $20 (20%) Financial flows – NT $100 Gaming $50 Bar $15 Catering $12 Retail $22 Other $1 Gaming surplus $26 (51%) Bar surplus $4 (26%) Cater surplus $0 (1%) Retail $3 (14%) Other $1 Front of house GP $34 (34%) Community Overheads $23 (23%) Capital/debt EBITDARD $11 (11%) Why so important Gaming and beverage shows little growth Operating cost are growing by 4% to 6% annually Capex has grown at over 6% per annum in the last 5 years The margins are declining 8 EBITDA trend in NSW 22% 20% 18% 16% 14% 12% 10% May-08 Longer term trend is stable Mar-09 9 month trend is worrying Jan-10 9 EBITDA trend in Qld 24% 22% 20% 18% 16% 14% 12% 10% May-08 Mar-09 Jan-10 10 EBITDA trend in ACT 28% 26% 24% 22% 20% 18% 16% 14% 12% 10% May-08 Mar-09 Jan-10 11 Expenditure per person 1,200 1,000 800 NSW ACT Vic 600 Qld 400 200 12 Leisure (3mnths) 80% Use computer at home 68.4% 60% 40% 75.1% 66.9% 60.6% Entertainment 54.2% Novel 49.1% 45.3% Saw a movie 34.8% 23.9% 52.9% 43.1% Day trip 40.1% Hobby 29.7% Played sport 20.9% 20% 0% Jan 02 Source: Roy Morgan Mar 09 9 years 13 Leisure (3mnths) 30.8% Went to a club 11.6% Went to a casino 5.4% Went to a racetrack Jan 02 Source: Roy Morgan 28.4% 9.4% 4.6% Mar 09 9 years 14 Spare time We are awake 112 hours each week Comprised of: – 16 hrs on the Internet – 12 hrs watching TV (declining) – 8 hrs listening to radio – 8 hrs using the PC off line – 5 hrs playing video games – 3 hrs reading newspapers – 2 hrs reading magazines That’s 54 hrs without work, study or house work 15 Competition for leisure wallet We now spend $32-$35b on mobile phones each year 32% of kids under 15 years have a mobile Pay TV $3.2b 16 So... Clubs must achieve at least 15% EBITDARD for “survival” 12% and below is concerning Over 20% allows a club to progress and grow with the market Over 24+% EBITDARD is superior and will advance a club far beyond competitors These parameters set the basis for targets and budgets 17 Budgeting technique Top-down and bottom -up and top-down Board Senior management Senior management Senior management Operational management Operational management Operational management Staff 18 Budgets to Op Plan Budgets are often the numbers that actual results are compared with in the middle of the next month A budget is only effective if it drives operations the whole management team and staff Best results are achieved from converting budgets to goals, initiatives, targets, responsibilities, timeframes etc The whole team must be engaged and “own” the budget 19 Budgeting technique Use of base budget and stretch budget – Base budget is the most likely outcome given strong management input and reasonable diligence – Stretch budget is normally based on best case outcomes eg 10% improvement in revenues and 2% reduction in some costs Also use maximum reasonable adversity (MRA) to assess the budget risk and financial sensitivity of the business Profit and loss budgets PLUS cash flow 20 Debt coverage Debt coverage measures how susceptible the business is to its debt burden - from movements in earnings, interest rates and unforeseen expenditure Interest rate cover – number of times the earnings of the club can cover interest commitments – 2 times is a min benchmark Principal and interest cover - number of times the earnings of the club can cover principal and interest commitments – 1.5 times is a min benchmark 21 Key business drivers Needs improvement Excellent EBITDARD <12% 25% Total wages >24% 18% Total AEMP >12% 6% Net/EGM/Day <$120 >$180 Gaming Promo >6% 4% Gaming wages ?6% 4% Bar GP <55% >64% Bar wages >24% <20% Catering GP <55% >62% Catering wages >50% <42% Overheads <25% >35% 22 Marketing - AEMP AEMP – Advertising, Entertainment, Marketing and Promotions Measured as a percentage of total revenue 3%-4% of gaming 2.5% total revenue + 6.5% total revenue = 9% 23 How do we spend 9% Gaming promotions 2.5% General marketing and promotions 4.0% Entertainment 1.5% General advertising 1.0% Total 9.0% 24 Marketing - AEMP 14% 12% 10% 12.8% 10.6% 9.6% 8.5% 8% 10.9% 9.4% 8.2% 9.1% 6.8% 6% 4% High Average Low 2% 0% Qld NSW ACT 25 Marketing - AEMP 10% 8% 6% 4% 2% 0% 26 Why 9%? We need high member penetration within the 2 – 5 km area – The average NSW clubs needs 17% of every adult within 5km to be a member Average Qld club needs 12% penetration Larger clubs with over 250 machines needs a 30% penetration rate in 5km On average, each member must visit around 11 times each year and spend $55 Clubs survive on localised repeat visitation and this requires regular communication and engagement 27 Why 9%? High level of competition Members benefits form a large part of AEMP and this is like a running “dividend” A large part of our benefits are provided as goods in the venue, such as meals, which are recorded at the full sales level but actually cost less (cost of goods) But we suspect that clubs have historically layered additional marketing initiatives rather than rationalise, refine, rotate and modify 28 Where is it going? Web-based and SMS platforms are obviously more cost effective compared with the traditional forms of communications But clubs still cater by and large to an aged demographic and they don’t respond well to this technology Fighting against a very crowded array of messages Response rates very low (20% open rate and 4% click-through rate are considered good) The real costs are in the database and technology 29 Where is it going? Social media marketing – Twitter, Facebook 350 million users worldwide 7.6 million users in Australia But it’s hard to get a clear message on social media Greatest benefit is gained when it is used as a referral base from users (the social media community) 30 Where is it going? More tiered loyalty This is particularly the case in Qld with four casinos Competition of the “wallet” Most wallets carry 12 cards We carry on average 3-4 credit cards each Add to that Medicare, MBF, licence, debit cards, senior card and it’s a crowded space So your card has to be relevant Rebates of between 0.25% and 0.50% turnover 31 Measuring ROI If we spend 9% of every dollar that comes through the door on AEMP, then we must understand the return Every material marketing activity would benefit from: – A business case assessment – A post completion short term and longer term impact and return assessment 32 How to measure ROI Door counters Average spend analysis (revenue/door count) Hourly revenue tracking and comparison Player loyalty expenditure analysis Focus group research Survey research Compare business activity with and without the marketing event (do nothing v outcome case) 33 Some common issues Marketing activity that generates enormous crowds but no-one enjoys themselves Marketing activity that simply moves existing visitation or expenditure to a different time or a lower margin product Marketing activity that drives low value customers in preference to high value customers 34 Some common issues Poorly executed marketing activities that no-one understands including staff Broad media marketing eg radio and TV when most clubs cater for a localised catchment (65% within 2km) Showcases v cash v product rewards Small v medium v large cash rewards Members’ draws? Gaming promotions that annoy premium players Entertainment that annoys players 35 Summary In the current market there is a need to drive EBITDA EBITDA below 15% needs to be improved upon We advocate all management understanding EBITDA All staff should understand the budget and be provided with business results At 9%, AEMP can be a big black hole or used to drive the business Marketing is an investment 36 Jim Hollington Partner PKF Chartered Accountants and Business Advisors Geoff Wohlsen Principal DWS 37