General Aviation Myths & Realities

advertisement

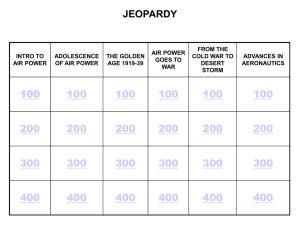

General Aviation Myths & Realities: Preparing Your Airport for What’s Ahead April 20,2010 SEC-AAAE Annual Conference Next Year Will Arrive in 2011-ish "Forecasting future events is often like searching for a black cat in an unlit room, that may not even be there. " --Steve Davidson in The Crystal Ball. "If you can look into the seeds of time, and say which grain will grow and which will not, speak then unto me. " --William Shakespeare "It is far better to foresee even without certainty than not to foresee at all. " --Henri Poincare in The Foundations of Science Forecasting is the art of saying what will happen, and then explaining why it didn't! “ --Anon. Historical Impact Factors Economic Cycles Fuel Shocks Transitory Events Product/Manufacturer Liability Tax Incentives 250,000 50,000 Bonus Depreciation 40,000 150,000 30,000 100,000 20,000 50,000 10,000 Oil Spike Oil Spike Oil Spike Recessions Active Aircraft 2009E 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 0 1981 0 1980 Active Aircraft 200,000 Hours Flown Source: FAA, L&B Hours Flown (in thousands) General Aviation Revitalization Act GA Fleet & Primary Use Small piston aircraft dominate the U.S. general aviation fleet. Business jet and turboprop aircraft still have relatively small share of the market Almost two thirds of U.S. general aviation is for business or commercial purposes Piston aircraft are deployed in more discretionary uses than turboprop and jet aircraft # of Aircraft % of Total Personal Business 163,013 89% 8,906 5% 12% 88% 11,042 6% 15% 85% 182,961 100% 47% 53% Piston Turboprop Business Jet 37% 63% Source: FAA, L&B Segmentation tells a story… Prolonged decline in single engine piston use masks growth in business jet and turboprop segments Business jet aircraft utilization increased threefold between 1994 and 2006. Segment most effected by recent recession Turboprop utilization has more than doubled Index of Hours Flown by Aircraft Type: 350 Total Hours Flown Jet 300 Piston 200 150 100 50 2009E 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 0 1994 Index (1990=100) Turboprop 250 Source: FAA, L&B Business GA Market Drivers… Economic Growth Fractional Ownership Corporate Profits Value of Time Public Perception Metro Airport Congestion Commercial Airline Product Security (TSA) Percent Change in Real U.S. GDP 5.0% Historical 4.0% Forecast 4.0% 4.0% Annual Percent Change 3.0% 2.0% 3.2% 1.0% Long Term 2.7% AAG 0.0% -1.0% -2.0% -2.4% -3.0% -4.0% 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Bureau of Economic Analysis, Federal Reserve. Private GA Market Drivers… Cost of Fuel! Cost of Fuel!! Personal Liability Socio-Economic Factors Aviation Career Opportunities Crude Oil Prices Per Barrel (In 2008$) $120 Actual Forecast $111 $87 $80 $60 $40 $20 2030 2025 2020 2015 2010 2005 2000 1995 $0 1990 Crude Oil ($ per Barrel) $98 $100 $100 $104 Source: EIA Green Shoots or Yellow Weeds… Bombardier Business Jet Fleet Forecast : 2009-2018 FAA Forecast 2009-2030: CAGR Active Aircraft: Piston Turboprop Jet Total Hours Flown: Piston Turboprop Jet Total 0.1% 1.4% 4.2% 0.5% 1.0% 1.7% 6.1% 2.3% World Wide Delivery Units Worldwide CAGR North America Delivery Units North America CAGR 11,500 6.0% 5,400 4.0% Rolls Royce Market Outlook: 2009-2028 VLJ's Small Business Jets Medium Business Jets Large Business Jets Busines Jet Total Honeywell Business Aviation Outlook 2009-2019 Business Jet Delivery Units Long Range Large Medium Light Very Light Personal Jets 11,000 1,500 1,000 2,400 2,400 2,800 1,000 CAGR 14.7% 1.8% 3.3% 7.9% 4.4% Is Airport Closure an Option… “The FAA has only rarely granted a sponsor a release from its Federal obligations sufficient to allow for the closure of an airport, and then only in very unusual circumstances. A request for airport closure from a sponsor requires a demonstration that closure results in a net benefit to aviation. Because of the important role that this Airport plays, the FAA does not anticipate granting any request for release to allow closure of the Airport. The Airport is and will continue to be too valuable for that to occur.” The majority of U.S. airports are federally obligated Grant assurances that obligate the airport sponsor will require the facility to be operated for a set amount of time (normally 20 years) There is no limit to the duration of obligations for airport property acquired with federal monies Private airports for public and private use have and will fail Demand or supply…what’s the hurdle? Airport Competition Catchment Area Profile Monitor Activity Trends Market Capture Facility Benchmarking Facility Inventory Local & Itinerant User Survey Market Potential Local Business Survey Financial Position/ Funding Tenant Aircraft Purchase Plans Runway Requirements… Define Critical Aircraft Part 91, Part 91K, Part 135 operations Minimum Standards/Insurance Long Range Jet Gulfstream 500 Global Express Gulfstream 450 Large Jet Falcon 2000EX/LX Hawker 4000 Citation X Midsize Jet Gulfstream 150 Hawker 900 Hawker 750 Learjet 35 Light Jet Citation Encore Hawker 400 Phenom 100 VLJ Citation Mustang 0 1,000 2,000 3,000 Runway Length 4,000 5,000 6,000 Note: Assumes MTOW, ISA, Sea Level Impact on Airside Planning Standards… Re-visit Airport Role in State System Plan & NPIAS Community Implications On-Airport Land Use (Non-precision approaches) Financial & Funding Considerations A-I Cessna 172 B-I Phenom 100 B-II Cessna Citation II B-II Cessna Citation II C-III Gulfstream V 1,632’ 3,400’ 3,360’ 3,360’ 5,930’ Approach Minimum (statute miles) >= ¾ Small Only <¾ >= ¾ <¾ <¾ Runway Safety Area (RSA) - Width 120’ 300’ 150’ 300’ 500’ RSA – Length Beyond R/W End 240’ 600’ 300’ 600’ 1,000’ Object Free Area (OFA) – Width 250’ 800’ 500’ 800’ 800’ OFA – Length Beyond R/W End 240’ 600’ 300’ 600’ 1,000’ 150’ Small Only 250’ 240’ 300’ 400’ Standard Minimum Runway Length Runway to Taxiway C/L Separation Case Study 1 (Dayton Wright Bros)… Benefit Cost Analysis Removal of 590 ft. displaced threshold allowing for full use of 5,000 foot Runway 20 Full ILS for Runway 20 Primary beneficiaries B-II design category jets Displaced Threshold Relocate Austin Road Relocate utility corridor along Austin Road modifications Relocate airport security fence New airport service roadway New runway blast pad New PAPI system (remove VASI-4) Eliminate current 590-foot displaced threshold Installation of MALSR approach light system (remove existing MALS) Upgrade the existing Runway 20 localizer unit Add runway 20 glide slope, RVR (2), outer marker Runway marking, lighting and signage Property Acquisition and Land Swap within the Runway 20 approach area Future aviation easements within the Runway 20 approach area Re-grading of the runway safety area Runway obstruction mitigation Relocate Miami Township Maintenance Facility 1" = 300' 150 0 Graphic Scale in Feet N 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 300 DRAFT RSA STUDY ALT-1 R/W 20 F ile: W :\DW B\RSA ST UDY\RSA Sutdy ALT-1 (Future ALP).dwg | Layout: RW 20 Exhibit 2 Case Study 2 (Gnoss Field)… The current runway length of 3,300 feet limits the ability of current Airport tenants to operate aircraft at optimum weight for maximum efficiency The Airport needs to comply with current FAA standards for Runway Safety Areas (RSAs) 4,400 feet Critical Aircraft: Citation 525 1,100-foot runway/ taxiway extension Runway Approach Lighting… Business and corporate operators want ability to operate at night under instrument conditions Land availability considerations MALSR gives CAT I type capability MALSF option based on land availability, could affect minimums Navigational Aids… Precision Approaches • ILS- (Glide Slope, Localiser-DME, Marker Beacons) • GPS – Global Position System • RNP – Required Navigation Performance Non-Precision Approaches • VOR – Very High Frequency Omni-range • RNAV - Area Navigation (GPS-LNAV, VNAV, LPV) LAAS (Local Area Augmentation System) WAAS (Wide Area Augmentation System) Radar Approaches • PAR – Precision Approach Radar • ASR – Airport Surveillance Radar The fuel dichotomy… Jet aircraft account for 17 percent of general aviation hours flown but almost 75 percent of total fuel consumed Greater emphasis on JetA and full service fueling Should airport allow non FBO tenants to establish self fueling capabilities? Price of fuel should reflect level of service Total Fuel Consumption (2008, in gallons) 14 gph Piston 13% 13% 94 gph Turboprop 365 gph 74% Business Jet Source: FAA A more demanding customer base… Hangars (Long Term/ Overnight) Oxygen/ Nitrogen Service Towing Equipment Jet Aircraft Maintenance Aircraft De-Icing Courtesy Transportation/ Ground Access Fuel Tanks Extended Hours of Operation Services/ Facilities Business Center/ Wifi Weather/ Flight Planning Facility Customer Check In Counter/ Lounge Area Pilot/Crew Lounge THANK YOU!!!! Contact: Dil Gruffydd dgruffydd@landrum-brown.com 513-305-2264 (cell) 513-530-1226 (office) Contact: Monica Geygan mgeygan@landrum-brown.com 513-319-8299 (cell) 513-530-1207 (office)