new-exposures

advertisement

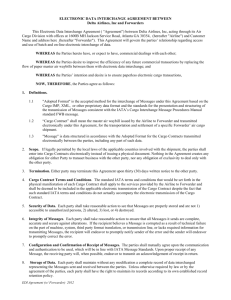

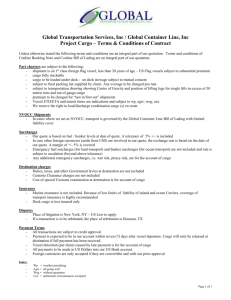

E&O INSURANCE 101 AND NEW EXPOSURES Presented By: Jason Wieselman 09/18/2013 WHAT IS E&O/CARGO LEGAL An unforeseen Act, Error, or Omission made by the insured that directly contributes to financial loss suffered by a 3rd party. An amount the insured is held Legally Liability for under their own bills of lading, while acting as an NVOCC, Warehouseman, Domestic Property Broker, or Air/Ocean Freight Forwarder, Delivery Agent. *** (Damaged machinery 40k NVO was Sued, Ocean Carrier exercised Tokyo selection clause 8k legal still open) WHO NEEDS E&O INSURANCE Doctors (malpractice) Financial Planners Attorneys (Professional Liability) Insurance Agents Forwarders and Brokers Every time you issue an invoice, you can be named in the event of loss or damage. WHAT IS COVERED (Generally) COVERED Wrongful Release *** Misdirected Cargo *** Temperature Settings *** Classification Errors *** BL Exposure Failure to Notify *** NOT COVERED Willful Acts Commercial Disputes Illegal Activity IMPORTER SECURITY FILING (ISF) Cargo Holds (demurrage, delays, loss of market, perishables) Penalties (3rd party exposure) Clarify your role with importers to avoid confusion. (are you handling the ISF or is the forwarder?) ISF Penalties have been issued! DOMESTIC LOAD BROKERING E&O (endorse current policy to include domestic load brokering) Contingent Cargo Contingent Auto Negligent Hiring of Truckers *** Risk/Reward if not licensed as a Property Broker PAID CLAIMS Importer sued CHB for charging 300k in duties over 3 years for goods that were duty free. 220k recovered from CBP.– 5k deductible – 6400 legal -75k paid 64k Furniture shipment released without the original BL. 5k ded. 59k paid – 3600 legal CHB sued for 2Million for failing to validate a POA from a FF which lead to distribution of counterfeit merchandise. 44k legal 45k settlement Sushi Grade Tuna shipment set at wrong temperature. 113k value – deductible 5k – 109k paid. Can you afford E&O? TIPS FOR AVOIDING LIABILITY VALIDATING POA’S (call importer to verify) WAREHOUSE RECEIPTS DOCUMENT EVERYTHING UNDERSTAND THE RISKS OF AD/CVD TERMS & CONDITIONS(website, emails, invoice) FORCE SHIPPERS TO ACCEPT OR DECLINE MARINE INSURANCE CONTRACTS (show your broker before accepting) WAREHOUSE PERSONNEL IN CONCLUSION Talk to your Broker about your operations Evaluate the cost/sales ratio to carry coverage Know what policy is right for you. Educate your staff about taking on new business Get procedures in place Grow your company safely by protecting your bottom line and your personal interests. QUESTIONS? WWW.INTLBONDMARINE.COM