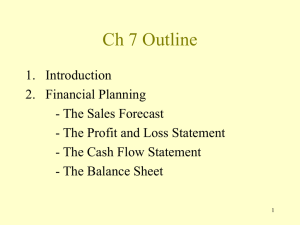

Chapter 10

The Financial Plan

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objectives

• To understand the role of budgets in preparing

pro forma statements

• To understand why positive profits can still

result in a negative cash flow

• To learn how to prepare monthly pro forma

cash flow, income, balance sheet, and sources

and applications of funds statements for the

first year of operation

10-2

Learning Objectives

• To explain the application and calculation of

the break-even point for the new venture

• To illustrate the alternative software packages

that can be used for preparing financial

statements

10-3

Operating and Capital Budgets

• Sales budget - An estimate of the expected

volume of sales by month

• Determined on the basis of sales forecasts

• Manufacturing ventures - Costs of internal

production and subcontracting are compared

• Includes ending inventory estimation

10-4

Table 10.1 - A Sample Manufacturing

Budget for First Three Months

10-5

Operating and Capital Budgets

• Operating costs

• Fixed expenses incurred regardless of sales

volume

• Variable expenses must be linked to strategy in

the business plan

• Capital budgets - Provide a basis for evaluating

expenditures

10-6

Table 10.2 - A Sample Operating Budget

for First Three Months ($000s)

10-7

Pro Forma Income Statements

• Pro forma income:

• Projects net profit calculated from projected

revenue minus projected costs and expenses.

• Starts by calculating monthly sales

• Projects operating expenses for each of the

months during the first year

• Projections should be made for years 2 and 3 as

well

10-8

Table 10.3 - MPP Plastics Inc., Pro Forma Income

Statement, First Year by Month ($000s)

10-9

Pro Forma Cash Flow

• Projected cash available calculated from

projected cash accumulations minus projected

cash disbursements

• Not the same as profit

• Sales may not be regarded as cash

• Profit as a measure of success may be deceiving if

there is significant negative cash flow

• Can be projected using the indirect or direct

method

10-10

Table 10.5 - Statement of Cash Flows:

The Indirect Method

10-11

Table 10.6 - MPP Plastics Inc., Pro Forma

Cash Flow, First Year by Month ($000s)

10-12

Pro Forma Balance Sheet

• Summarizes the projected assets, liabilities,

and net worth of the new venture

• Consists of:

• Assets

• Liabilities

• Owner’s equity: Amount invested and/or retained from

the venture operations

10-13

Table 10.7 - MPP Plastics Inc., Pro Forma

Balance Sheet, End of First Year ($000s)

10-14

Break-Even Analysis

• Breakeven: Volume of sales where the

venture neither makes a profit nor incurs a

loss

• The break-even formula

B/E(Q) = __________TFC______________

SP-VC/unit (marginal contribution)

• Weakness - Determining if a cost is a fixed or

variable

10-15

Table 10.8- Determining Break-Even

Formula

*Fixed costs are those costs that, without change in present productive capacity, are not affected by changes in volume of output.

† Variable costs are those that are affected in total by changes in volume of output.

‡ The variable costs per unit is all those costs attributable to producing one unit. This cost is constant within defined ranges of production.

10-16

Figure 10.1 - Graphic Illustration of

Breakeven

10-17

Pro Forma Sources and Applications

of Funds

• Summarize all the projected sources of funds

available and how these funds will be

disbursed

• Sources of funds

•

•

•

•

Operations

New investments

Long-term borrowing

Sale of assets

10-18

Pro Forma Sources and Applications

of Funds

• Uses

•

•

•

•

Increase assets

Retire long-term liabilities

Reduce owner or stockholders’ equity

Pay dividends

10-19

Software Packages

• Track financial data and generate financial

statements

• Present different scenarios and assess their

impact on the pro forma statements

10-20