Tax Issues -PPT - Department of Agricultural Economics

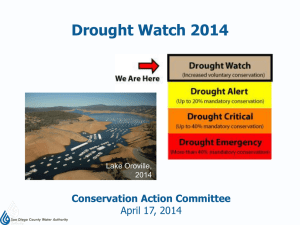

advertisement

Tax Update for Weather Related Sales of Breeding Livestock and Tax Management Strategies after the Tax Year Ends J C. Hobbs Oklahoma State University Department of Agricultural Economics Assistant Extension Specialist Farm Management and Taxation Weather-Related Sales of Livestock • Applies to sales of livestock due to weatherrelated conditions: flood, drought, or other weather-related condition causing a shortage of water and/or feed. • Allows taxpayer to postpone recognition of income from the sale proceeds of animals sold in excess of normal practices (to avoid bunching of income). Involuntary Conversion • Must plan to purchase replacement livestock within a 2 year period. (example, for sales in 2013, must replace livestock by end of 2015). • Replacement period can be extended from 2 years to 4 years if the area has been declared eligible for disaster assistance by the Federal government or an agency. Involuntary Conversion • Livestock (draft, breeding, or dairy) held for any length of time and a weather-related condition caused the sale. • Gain realized from the sale can be postponed if the sale proceeds are used to purchase replacement livestock within the time period previously described. • Replacement animals must be used for the same purpose as those sold. (dairy for dairy and breeding for breeding) Drought Sales of Livestock • For the Code Section 1033(e) election. • When does the replacement period expire in a continuing drought situation? • It does not expire until the end of the first TAX year that ends after the first DROUGHT-FREE year for an applicable region (county) taking into consideration the original replacement period (4 years due to Oklahoma’s designations). Drought-Free Year The first drought-free year for an applicable region is the first 12-month period ending on August 31 that meets both of the following: • It ends in or after the last year of the taxpayer’s 4-year replacement period. • It does not include any weekly period for which exceptional, extreme, or severe drought is reported for any location in the applicable region. Applicable Region • The applicable region is the county that experienced the drought conditions causing the sale or exchange of the livestock and all counties that are contiguous to that county. Oklahoma Counties • For the period of Sept. 1, 2013 through Aug. 31, 2014, 9 counties were removed from the list of Oklahoma Counties designated as experiencing severe, exceptional, or extreme drought conditions. End of Replacement Period • When does the replacement period end for producers who sold breeding livestock in late 2010 or 2011 and elected to defer the reporting of income be electing to replace them? • If they sold animals in 2010, they received an automatic 1 year extension last year. 2014 • At the present time, producers in 67 of 77 counties have been given an automatic one year extension. • The counties of Adair, Cherokee, Coal, Haskell, Latimer, LeFlore, Mayes, McIntosh, Pittsburg, and Sequoyah were removed from the list. Drought Free Counties • The counties of Adair, Cherokee, Coal, Haskell, Latimer, LeFlore, Mayes, McIntosh, Pittsburg, and Sequoyah are still within the 4-year replacement provision which ends on December 31, 2015 for animals sold in 2011. Haskell and Sequoyah Counties • For the period of 9/1/14 through 8/31/15, watch the designations for Haskell and Sequoyah counties. • If these counties are not included in the 2015 list, producers must have their replacement animals purchased by Dec. 31, 2015 for animals sold in 2011. • These 2 counties are not contiguous to a county which was designated in the top 3 drought designations in the 2014 report. Tax Management • Some tools work prior to year end. • Some tools work after the tax year has passed. Farm Income Averaging • Takes advantage of unused lower tax brackets from 3 prior years. • Example: 2014 – Due to a sizable Livestock Forage Disaster Program payments, taxable income is $195,000 (25% tax bracket starts at $148,850). Farm Income Averaging • Manage the tax bite by Averaging • 2011 – $10,000 below beginning of 25% bracket. • 2012 - $15,000 below beginning of 25% bracket. • 2013 - $20,000 below beginning of 25% bracket. Farm Income Averaging • Move $30,000 from 2014 and put $10,000 additional income in 2011, 2012, and 2013 and save roughly $3,000 in total tax. • Income averaging does not reduce self-employment tax; net investment income tax; or phase-out of personal exemptions and itemized deductions Farm Income Averaging • Can use ordinary income as well as capital gains (all or any part). • Elected Farm Income is from Schedule F or capital asset sales but not land. • Individual, Partner, & S Corp Shareholder can use this provision (not a C-Corporation). • Pay the increase in income tax only. • Does not change self-employment tax. Crop Insurance & Disaster Payments • Generally report the payment income in the year it is received. • However can elect to postpone if all 3 of the following conditions are met. – Use the cash method of accounting. – Receive the insurance proceeds in the same tax year the crops were damaged. – Show under normal practices the sale would have occurred in the year after the damage. Section 179 Expense Deduction For Section 179 the property must be: • Qualifying property that is new or used (not real property or a multi-purpose ag structure) • Acquired for use in a trade or business (actively farming or materially participating in a rental arrangement) • Acquired by purchase Qualifying Property • • • • • • Tangible personal property Integral part of production Research facility Storage facility Single purpose agricultural structure Off-the-shelf computer software Section 179 Expensing - 2014 • Purchased capital assets that are depreciable (new or used). • 2013 was $250,000 with a $500,000 investment limit • 2014 was to revert back to $25,000 with a $200,000 investment limit but 2013 amounts were extended. • 2015 is to revert back to $25,000 with a $200,000 investment limit. • Will legislation be enacted to modify this? Additional First-Year Depreciation • 2013: 50% Additional First-Year Depreciation is allowed for qualifying property placed in service through 12/31/2013. • 2014: Expired effective January 1, 2014 but extended for 2014. • 2015: Expires effective January 1, 2015 • NOTE: Will legislation be enacted to keep this provision? The End!! • Thank you!