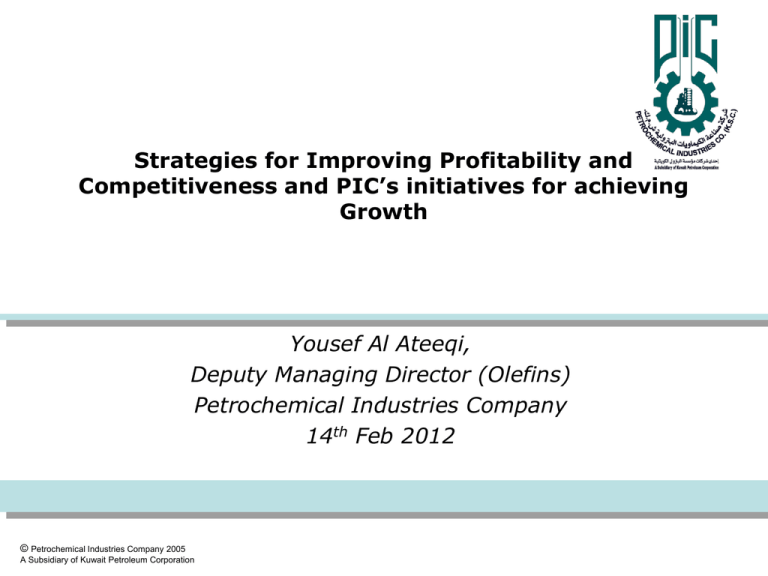

PIC Joint Ventures - Kuwait Petroleum Corporation

advertisement

Strategies for Improving Profitability and Competitiveness and PIC’s initiatives for achieving Growth Yousef Al Ateeqi, Deputy Managing Director (Olefins) Petrochemical Industries Company 14th Feb 2012 © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Content PIC Introduction PIC Business Portfolio Introduction to Petrochemicals Petrochemicals Industries Business within Kuwait Oil Sector Strategic Growth Challenges PIC efforts to implement LTS © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 2 PIC Among Kuwait Petroleum Corporation Subsidiaries KAFCO KOC KNPC KUFPEC OSSC KPC PIC is the petrochemical arm of Kuwait Petroleum Corporation ODC KGOC KOTC KPI KPC’s Strategic Direction for PIC is : Increase petrochemicals contribution in KPC’s turnover © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 3 PIC Vision We aspire to be a recognized global petrochemical player leveraging Kuwait national resources in value added partnerships to drive growth and being admired by our stakeholders PIC Mission PIC ,as a subsidiary of Kuwait Petroleum Corporation, shall achieve a marked position with downstream extension into high value petrochemical business while ensuring integration with KPC activities both domestically and internationally through: ─ Maximizing value addition of Kuwait hydrocarbons resources ─ Excelling our organizational performance through peoples’ empowerment and infusing industry best practices ─ Creating a challenging and fulfilling environment that will support skills and capabilities development ─ Collaborating closely with our partners towards a sustained and diversified global growth ─ Fostering National economy © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 4 2030 KPC Downstream Sector Mission & Vision © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 5 PIC Business Portfolio © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Petrochemicals Growth in Kuwait Realizing their long term potential, Kuwait ventured into commodity petrochemicals in 1990s A Historical perspective for PIC ….. 1963 : Started with Fertilizers business 1993 : MOU signed with UCC for setting up a world scale Olefins Complex 1995 : EQUATE Petrochemicals Company formed 1997 : PP Plant and EQUATE Complex successfully commissioned 2008/2009 : Olefins II, Aromatics and Styrene Plants start up 1997 Polypropylene, Ethylene, Polyethylene and MEG produced for the 1st time in Kuwait © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 7 PIC Business Portfolio PIC has diversified its position as a significant player in Petrochemicals, with local and International investments International Investments Local Investments Fertilizer Business Polypropylene Business MEGlobal markets Ethylene Glycol produced inside and outside Kuwait © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation EQUATE is the common operator for (PP, TKOC, TKAC and TKSC) 8 PIC Products 65% of the Petrochemicals products in PIC portfolio are produced in Kuwait PIC operates the Fertilizer plants PIC markets ─ Fertilizer product from Kuwait & GPIC plants ─ Polypropylene produced in Kuwait ─ Paraxylene Produced in Kuwait PIC Joint Ventures ─ Equate produce PE & EG and market Polyethylene & Styrene ─ MEGlobal market Ethylene Glycol produced inside and outside Kuwait ─ Equipolymers produce and markets PET © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 9 Growth in PIC Profits (1995 – 2011) Total Company Profit & Loss from 1995/1996 To 2011/2012 300,000,000 250,000,000 200,000,000 KD 150,000,000 100,000,000 50,000,000 0 -50,000,000 © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 10 Introduction to Petrochemicals © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation There are three major building blocks in petrochemicals Ethylene, Propylene, and Aromatics are the essential building blocks for the major petrochemical chains Feed stocks Processes Ethane LPG Pygas Pyrolysis Gasoil Fuel Gas Steam 1 Steam Cracking Light Naphth a Whole Naphtha Naphtha Splitter Heavy Naphtha Raffinate Reformate © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Ethylene Propylene C4 and C5 2 Naphtha Reformi Aromatics ng Vacuum Gas Oil Cat Naphtha etc Petrochemical building blocks FCC 3 Petrochemic al products Polyethylene's EDC/VCM/PVC Ethylene Glycol Polypropylene Acrylonitrile Butadiene Butylenes C5s Styrene Nylon PTA/ Polyester Propylene 12 Worldwide Trends in Petrochemicals Source Nexant 250 Historical Forecast 200 Total MMTPA Ethylene 150 Propylene 100 PTA 50 Paraxylene 0 1990 1995 2000 2005 2010 2015 2020 2025 Since the 1990s, key petrochemicals have achieved above GDP growth rates globally. © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 13 Middle East Trends in Petrochemicals Market share Source Nexant 20% ME Marketshare % Historical Forecast Ethylene 15% Propylene 10% Paraxylene 5% PTA 0% 1990 1995 2000 2005 2010 2015 2020 2025 ME started from a small presence & increasingly projected its importance in the petrochemicals sector, registering good growth in market share © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 14 Future Outlook Middle East producers are very competitive and well positioned to supply the fast-growing markets. Middle East feedstock slate will be heavier with lesser advantages. New projects will require access to technologies and new approaches to development. Innovation is a joint effort and requires a strong customer oriented culture. Higher expectation on Job creation and industry returns Industry cooperation can benefit all. © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 15 Maintaining Competitive Advantages Feedstock allocation & pricing– need to be better than netback basis Competitive energy cost Improved product offering, packaging and logistics to target growing end users markets Government Support and incentives to promote investment Promote downstream units as small and medium business unlike conventional mega projects Expectation on returns and job creation objective need to be aligned © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 16 Shift to Differentiated Products Commodity Products Differentiated/Downstream Products Low Value High Value High Volume Moderate to low volume Capital Intensive Low Capital Investment Low Labor requirements Labor intensive High level of integration Usually non-integrated Proximity to market not critical Links to market very critical Supply Chain/Logistics relatively less critical Supply Chain/Logistics very critical © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 17 Critical Success factors Scale and level of integration Access to technology – Differentiated products Marketing and Distribution ―Customer Focus – Innovation and Customer Support ―Supply Chain / Logistics efficiency Improved Projects Management and Execution ― CAPEX control and reduce delays Developing and Retaining best skill © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 18 Petrochemicals Industries Business within Kuwait Oil Sector © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation KPC Strategic Directions - Petrochemicals Pursue growth in petrochemicals, both inside and outside of Kuwait, with a partner focusing on high growth petrochemical products. Pursue full and effective integration between the petrochemical operations and KPC’s operations inside and outside Kuwait. Build and acquire leading petrochemical assets in mature markets outside Kuwait with a proper foreign partner. Pursue partial or full privatization of the petrochemical activity. © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 20 PIC’s previous growth path has resulted in the creation of a successful portfolio KPC’s vision for PIC : Grow in Petrochemicals Inside and Outside Kuwait Stage 1 Stage 2 Kuwait : Olefins-II, Aromatics, Styrene Overseas : PTA, PET, EG Build emerging businesses Extend and defend core businesses Achieve competitive regional position Expand domestic petrochemical capacities COMPLETED Create viable options Downstream extensions Further international expansions Growth Parameters New core extensions Derivatives Integration COMPLETED Value creation thru THE partnerships FUTURE Time Frame 2001–2005 2005–2010 2010-2020 Horizon 1 Horizon 2 Horizon 3 In the current Horizon, PIC plans to further strengthen its position inside and outside Kuwait © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 21 PIC’s future growth portfolio will target three key growth themes Enhance Core Olefins Derivatives Portfolio Financially Attractive/ Diversifying Investments © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Broaden Portfolio through Refinery/PC Integration 22 Create scale and enhance the positioning of its core businesses and diversify its portfolio PIC’s olefin portfolio Joint investments with “sister” K companies •will be measurably enhanced by building scale and share and diversifying feedstock exposure, product mix and asset location •will provide the basis for overall advantage and allow PIC to leverage a core strength of KPC (i.e. hydrocarbon advantage) Investments in “linked” •provide capital cycle diversification and the downstream specialties prospect of higher less cycle earnings component and diversified chemicals Targeting Asian investments •will provide diversification of asset base outside and also allows for capital optimization and enhancement of channels to market Opportunistic M&A •Grow/maintain market share in core businesses © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 23 Strategic Growth © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Opportunities feedstock allocation to projects with a diversified product slates Enhance business scale in near term with new olefins facilities Access high growth international projects and markets through strategic partnerships Opportunity to develop required local skills through knowledge transfer and support strategic growth Investments in downstream specialty chemicals & polymers will add value and diversify the overall portfolio Opportunity to boost private sector industrialization and participation in local economy. © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 25 Linking our growth plan to KPC downstream businesses PIC business growth has key linkages with KPC, KNPC, KPI and KOC : KPC/KOC for Gas feedstocks for EQUATE and TKOC. KNPC for liquid feedstocks like Propylene/Naphtha for PP and TKAC KPI for diversified refinery streams as feedstock to proposed China Project This value-adding collaboration within downstream sector of KPC will continue, building upon its integrated approach with new petchem projects, inside and outside Kuwait. © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 26 Sources of Integration Value Margin Maximization Operating Cost Reduction CAPEX Optimization Portfolio Options Sustainability Benefits © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Opportunity to create value for both sides “refining & petrochemicals” exists on a large scale ─ Large new petrochemicals facilities ─ Existing and planned refineries optimization ─ Broad product offering to meet Petrochemicals market demand, commodity and specialty products for the integrated complex ─ Flexibility to process a wide variety of feedstocks ─ Cost synergies while maintaining resources allocation ─ Capital optimization through planning to execution 27 Competiveness in International Markets Building upon core portfolio positions to expand advantaged business positions in olefins and aromatics both within Kuwait and in selected regional locations Partnering with sister “K” companies to build downstream cracker projects linked to current portfolio Investing in selected downstream investments that have connectivity to PIC and Partner business interests Establishing criteria for and pursue opportunistic, financial investments (i.e. M&A) with key caveats © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 28 Competiveness in International Markets Aggressive investment in core portfolio with objective of increasing overall regional/global share Build shared investment projects with KPI & KNPC to achieve refinery /petrochemicals integration diversifying feedstock base Develop a linked specialty platform Major geographic diversification investment Grow/maintain market share in core businesses © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 29 Key Drivers for Growth Access to advantaged feedstocks (e.g. methane, ethane, naphtha etc.) Integration with KPC refining sector, inside & outside Kuwait Access to world class technology and marketing tie-up with partnerships KPC financial strength and global positioning Track record in managing world scale petrochemical complex projects and plants Geographically located close to high growth Asian markets Well established relationship with financial sector Continuing the development of local skills through knowledge transfer and support strategic growth Enhance private sector industrialization and participation in local economy. Contribute to the local Economy ( GDP ) © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 30 Petrochemicals industries are a major player in Kuwait GDP creation Petrochemicals is a key enabler for industrialization 1$ of direct GDP creation in the chemical sector produces ~1.87 $ of total GDP creation in the Kuwaiti economy Manufacturing share of GDP approx 6% Manufacturing share of non Oil GDP approx 10% Contribution of manufacturing sector to GDP lowest in Kuwait among GCC countries © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 31 Project Opportunities under development 1. China Project with Kuwait Petroleum International to implement an Integrated Refinery/Petrochemicals Complex 2. Olefins III Project opportunity in Kuwait – World-scale project 3. PTA/PET Project in Kuwait. 4. Refinery/Petrochemicals Kuwait © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation integration Projects in 32 Challenges © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Challenges Limited ethane availability, tightening lighter feedstock availability with less feedstock advantage Constraints related to land availability, utilities and infrastructural facilities Limited exposure to specialty petrochemicals business Increased global competition from low cost high scale operators in Middle East and market regions Interlinked and highly leveraged global economy Increasing reliance on emerging markets economic prosperity © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 34 PIC efforts to implement LTS © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation PIC transition to Product Oriented Organization •The organization Chairman & Director isManaging Product Focus Board Secretary Deputy Chairman & DMD Planning DMD Admin & Finance •Introduced new functions like Corporate Finance Corporate Planning ENGHSE Engineering and HS&E Information Technology Human Resources ERM Services & Comm. Six Sigma •Established the basis for Growth focused Team work DMD Fertilizers DMD Aromatics DMD Olefins Business Analysis & Planning Fertilizers (Manufacturi ng) Marketing Business Analysis & Planning Business Dev. Marketing Business Analysis & Planning Business Dev. Marketing •Introduced best practices and business governance GPIC KARO TKSC © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation Equipolymers PP MEGlobal EQUATE Olefins II 36 Initiatives supporting PIC LTS implementation Developing the PIC-PGS : A conceptual Gated System was developed for overall execution of Capital Projects Continuous improvement – Six sigma program Competency development Responsible Care and CSR program Focus on certified management systems in Quality, Environment, Safety & Health © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 37 © Petrochemical Industries Company 2005 A Subsidiary of Kuwait Petroleum Corporation 38