Presentation Mr. Stopford

advertisement

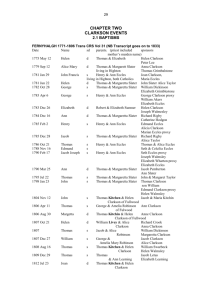

SMM Press Conference 8th Sept 2014 World Shipbuilding Dr Professor Martin Stopford Managing Director, Clarkson Research CLARKSON RESEARCH SERVICES LTD Shipyards surviving better than expected 1. 2. 3. 4. 5. 6. Shipping Market Trends World Economy & Ship Demand Newbuilding Contracts & Future Supply Shipyard Capacity & Orderbook Regional Shipbuilding Trends Energy, Environment & Innovation “This is turning into a long shipping recession. Meanwhile the increase in fuel costs and regulatory standards presents the biggest technical challenge for fifty years” CLARKSON RESEARCH SERVICES LTD Recession now in year 6 and still searching for light at the end of the tunnel CLARKSON RESEARCH SERVICES LTD Chart 1: Shipping Market Earnings 1993-2014 50 2008 $50,000/day Earnings are NOT adjusted for inflation 2004 $39,000/day 45 35 2000 $24,000/ day 30 25 $27,178/day 20 15 $12,145/day $12,000/day 10 $8,500/day 5 2013 2011 2009 2007 2005 2003 2001 1999 1997 1995 0 1993 Clarksea Index $000/day 40 (Clarksea Index shows weighted average earnings of tankers, bulkers, containerships & gas.) CLARKSON RESEARCH SERVICES LTD Chart 2: Growth of Trade & Cargo Fleet Shows the “rolling” 7 Year Increase in trade & fleet 60% % Growth sea trade over 7 years % growth of cargo fleet over last 7 years 50% World Fleet grows faster than trade 40% 30% 20% 10% Fleet grows slower than trade Sea trade steady at 4% growth 0% 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 % increase over last 7 years 70% CLARKSON RESEARCH SERVICES LTD Chart 3: “Shadow” Surplus & Laid Up Tonnage Shadow surplus Tankers laid up Bulkers laid up 2011 2006 2001 1996 1991 1986 1981 1976 “Shadow” surplus is soaked up by slow steaming today 1971 1966 “Shadow” Surplus – tonnage in excess of the dwt of ships needed to carry trade at full speed 1961 7a 250 240 230 220 210 200 190 180 170 160 150 140 130 120 110 100 90 80 70 60 50 40 30 20 10 0 1956 M dwt Shows “Shadow” surplus tonnage and the proportion laid up CLARKSON RESEARCH SERVICES LTD Collapse of Thai baht sparked Asia Crisis Dot.com crisis - millionaire for a day Are these sovereign bonds for the bin, pal? Middle East crisis, Lehman Mark 2, China problems??? CLARKSON RESEARCH SERVICES LTD Chart 4: World GDP & Sea Trade Growth % change Credit Crisis Oil Crisis 1991 Financial Crisis 1997 Asia Crisis The sea trade growth trend is 3.8% pa 2001 Dot.com crisis 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 14% 12% 10% 8% 6% 4% 2% 0% -2% -4% -6% -8% -10% World GDP (red line) and sea trade (blue line) Crisis 1 Crisis 2 1973 1979 1st Oil 2nd Oil Crisis Crisis Crisis 6 2007 Credit Crisis CLARKSON RESEARCH SERVICES LTD I made millions ordering against timecharters 2 I should never have ordered those bulkers I ‘ve really gone off ordering ships I LOVE ordering new ships One of those nice shipyards arranged some credit, sir CLARKSON RESEARCH SERVICES LTD Orders Orders in 2013 for 169.7m dwt was the 3rd highest ever! 240 220 200 180 160 140 120 100 80 60 40 20 0 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 MillionDWT Deliveries Chart 5: Shipbuilding Orders 1963-2014 15 Source Maritime Economics 3rd Ed Martin Stopford (Updated August 2012) CLARKSON RESEARCH SERVICES LTD Chart 6: Top Ten Shipping Investors First half 2014 by Investor Country of Domicile $ billion orders 1st half 2014 5 10 0 Greece China Japan Germany Singapore USA Italy Norway UK S Korea 15 7.3 6.0 2.9 2.9 2.8 2.3 2.3 2.2 1.1 1.1 N America 8% Other 4% Europe 48% Asia 40% Contracts $39.9 bn 1st half 2014 CLARKSON RESEARCH SERVICES LTD The shipyards are winding down from the biggest boom ever, but sales still active and volatile . Marine equipment sales about $70 bn in 2013, up 30% from $53 bn in 2012 Marine equipment market busy with eco-ships CLARKSON RESEARCH SERVICES LTD Chart 7: The Shipbuilding Cycle Shipyards adjust capacity downwards after 2000s boom Million Dwt In 2010 deliveries peaked at 169m dwt 2013 Deliveries m dwt 180 160 140 120 100 80 60 40 20 0 Other, 5.6, 5% Offshore, 2.2, 2% Tankers, 21.4, 20% Forecast 106 m dwt in 2015 Containers, 15.9, 15% Bulkers, 62.8, 58% 2015 2011 2007 2003 1999 1995 1991 1987 1983 1979 Demolition 1975 1971 1967 1963 Deliveries CLARKSON RESEARCH SERVICES LTD 1200 1100 1000 900 800 700 600 500 400 300 200 100 0 1123 983 907 677 637 618 625 664 696 759 1168 1098 1020 918 808 696 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Number of Yards Chart 8: Number of Active Shipyards Source: Clarkson Research CLARKSON RESEARCH SERVICES LTD 240 220 200 180 160 140 120 100 80 60 40 20 0 Average yard produces 50% more than in 2009 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Yard Output Index Chart 9: Average Yard Output 1998-2013 Source: Clarkson Research CLARKSON RESEARCH SERVICES LTD Chart 10: World Cargo Ship Demolition Shows the demolition (bars) on left axis & % fleet demolished on right Million Dwt 70 % fleet % cargo fleet scrapped (right axis) 60 8% M Dwt demolished in year (left axis) 50 7% 6% 5% 40 4% 30 3% 2012 2009 2006 2003 2000 1997 1994 1991 1988 0% 1985 0 1982 1% 1979 10 1976 2% 1973 20 CLARKSON RESEARCH SERVICES LTD China and S Korea “neck & neck” for top position CLARKSON RESEARCH SERVICES LTD Chart 11: Regional Shipbuilding Shares 1903-2013 See: page 616 100 other countries % total ships launched 90 USA China 80 70 Korea 60 50 40 Scandinavia 30 20 10 Europe Source; Lloyds Register of Shipping, Clarkson Research 1903 1908 1913 1918 1923 1928 1933 1938 1943 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003 2008 2013 0 Britain Japan FIGURE 15.1 Shipbuilding market shares 1902-2013 CLARKSON RESEARCH SERVICES LTD CGT 35.9% GT 35.4% CGT 33.8% GT 35% CGT 18.4% GT 20.4% GT 1.7% Chart 12: 2013 Shipyard Output by Country 2013 Output by Country and Ship Type Bulker Tanker Builder China P.R. S. Korea Japan Philippines Norway Vietnam Germany Taiwan USA France Other Total August 2014 M.CGT M.CGT 7.8 1.4 5.1 0.4 1.4 3.5 0.6 0.0 0.2 Container ship M.CGT 1.8 4.8 0.3 0.1 Gas Offshore Other Total M.CGT M.CGT M.CGT M.CGT 0.2 1.6 0.3 0.9 0.7 0.1 1.1 0.5 0.6 0.0 0.0 0.0 0.3 0.0 13.3 12.5 6.8 0.6 0.4 0.3 0.3 0.3 0.2 0.2 2.2 37.0 0.3 0.1 0.0 0.0 0.3 0.0 0.1 15.1 0.3 5.8 0.2 0.1 7.3 0.0 2.1 1.0 3.2 0.2 0.6 3.5 www.clarksons.com CLARKSON RESEARCH SERVICES LTD 19 • After 30 years of technical stability shipping faces technical challenge • The key issues are:_ – Bunker price escalation – Regulations & carbon footprint CLARKSON RESEARCH SERVICES LTD Chart 13: Fuel Cost Versus Ship Cost Ship cost: based on cost of new Aframax tanker, including interest, depreciation and OPEX, Fuel cost: based of 49 tpd for 70,000 tonne cargo at 16 knots 12 Fuel cost exceeds ship cost 8 6 Fuel Cost Ship Cost 4 Ship cost exceeds fuel cost 2 2013 2007 2001 1995 1989 1983 1977 1971 1965 1959 0 1953 cost $m per annum 10 CLARKSON RESEARCH SERVICES LTD Chart 14: Fuel Consumption 60,000 dwt Bulkers Fuel consumption TPD at 14.5 knots Oil price in 2013 $s 140 60 Bulkers 120 delivered in 2013 no 100 more fuel efficient than 80 in 1986 Oil Priceat $2013 prices Pre 2014 vessel service speed Orderbook vessel's service speed 55 50 45 40 60 35 40 30 2016 2014 2012 2010 2008 2006 2004 1997 1994 1991 1988 1986 1984 1982 1980 1978 1976 1974 1972 0 1970 20 1968 20 1965 25 New generation ecoships on way Year of Build CLARKSON RESEARCH SERVICES LTD Chart 17: Conclusions 1. It's been a long recession, more like the 1990s in the 1980s. The fleet is still growing too fast to allow trade to soak the surplus, so there is still a way to go. 2. The shipbuilding market is very active, and orders in 2013 were the 2nd highest ever. Europe is still the biggest shipping investor, with a 44% market share. 3. The shipyards have cut output by about a third, but deliveries will creep up again over the next 2 years. 4. China and Korea are vying for the top position and were "neck and neck" in 2013, with 33-35% market shares. 5. Energy costs are a game changer, but shipping is a conservative industry. The challenge is to embrace 21st-century technology. A little progress has been made but there’s still along way to go. 6. •Change is vital and the new technology is on show at SMM. So enjoy the exhibition and see how shipping is facing up to the challenge CLARKSON RESEARCH SERVICES LTD