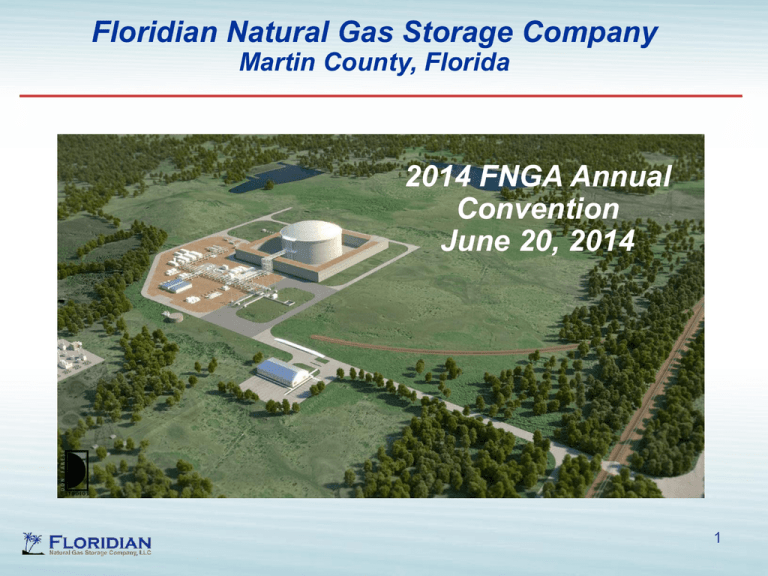

Floridian Natural Gas Storage Company Martin County, Florida

advertisement

Floridian Natural Gas Storage Company Martin County, Florida 2014 FNGA Annual Convention June 20, 2014 1 Floridian Natural Gas Storage Company, LLC • Fully permitted – FERC 7c Certificate – All state and local permits • Strong Financial backing - Warburg Pincus (~ 76% ownership) – Multi billion dollar investment fund – Balance of ownership is held by FGS and Private Investors • Strong support from local community 2 FERC Permitted Capacity • Permitted as Phase I and II • 8 bcf LNG storage capacity – 2 – 4 bcf Full Containment Tanks Artist Rendition – Phase I & II • 100,000 MMBtu/day Liquefaction (1.2 million gal/day) – 4 – 25,000 MMBtu/day (300,000 gal/day each) • 800,000 MMBtu/day Vaporization – 4 – 200,000 MMBtu/day vaporizers • 2 Bay Truck Loading Facility – 30 to 48 trucks per day loading capacity (300,000 to 480,000 gal/day) 3 Phase I Facility Configurations Originally Permitted Configuration Consolidated Plot Plan Configuration * 2 – 25 MMSCFD Liquefaction trains 1 – 25 MMSCFD Liquefaction train 400 MMSCFD Vaporization 100 MMSCFD Vaporization 1 – 4 BCF Full containment LNG tank 1 – 1 BCF single containment LNG tank w/ 30 ft tall MSE wall impoundment 2 Truck loading bays 2 Truck loading bays 4 Mile pipeline connection to FGT & Gulfstream 4 Mile pipeline connection to FGT & Gulfstream * Pending final FERC approval 4 Natural Gas Can Be Sourced From Both Existing Pipelines Natural Gas from Gulf Coast and Mid Continent suppliers Florida Gas Transmission Over 3 bcf/day Gulfstream Over 1 bcf/day FGS site at Indiantown 5 Indiantown Area Floridian Site 145 acres 6 Heavy Industrial Zoned FPL Martin Power Plant Floridian Site 145 acres Heavy Industrial Zoned 7 Developing Florida Markets For Liquefied Natural Gas • Over the road trucks – I-95 Florida Corridor – Agricultural trucking • Marine fuel – Access via truck (and future rail) to Port of Jacksonville, Tampa and Port Manatee, Port of Palm Beach, Port Everglades, Port of Miami – Cruise industry • High horsepower engines – Agricultural and Mining industries • Small scale exports – ISO Containers to both FTA and NFTA • Distributed LNG – Stationary engines for flood control and industrial uses – Natural gas pipeline pressure control of both intra and interstate pipelines 8 Access to Florida Ports By Truck FGS to Port Canaveral 126 Miles FGS to Port Everglades 83 Miles FGS to Port of Miami 103 Miles FGS to Port of Jacksonville 259 Miles FGS to Port Manatee 147 Miles 9 FGS Access to Rail • Planned addition for loading rail cars • LNG tank cars • 40 ft ISO containers • Requires FERC approval Floridian • CSX mainline runs through FGS property • CSX spur on FGS property 10 Floridian Natural Gas Storage Company Interstate LNG “Pipeline” • Inland Sites – Back up fuel for power plants – Local distribution for truck fuel – Peak shaving reinjection into interstate and intrastate pipelines • Florida Ports – East and West Coasts – – – – – Bunker barge for marine fuel ISO container loading for small scale export Small bulk barges for FTA, NFTA, and US Territories Local distribution for truck fuel Reinjection into interstate and intrastate pipelines Note: The concepts discussed on the following slides about Satellite tanks and proposed tariff structures have not been filed with or approved by FERC 11 Potential Satellite Tank Sites 12 FGS Interstate LNG “Pipeline” Tariff Structure • Structure tariff similar to Interstate Pipeline – Rate Schedule in existing FGS tariff providing Receipt and Delivery Point • Receipt Point – FGS Indiantown – Receive natural gas for liquefaction and storage • Delivery Points – FGS Indiantown • Revaporization or truck loading – Specific satellite tank locations • Revaporization, truck / ISO tank loading, or barge loading • Similar to a pipeline path, customer would own capacity and “path” between receipt point and specific delivery points – Customer would provide own transport between receipt and delivery point – FGS would provide “path” from receipt point to delivery point including delivery into and receipt from intermediate non-jurisdictional transport 13 FGS Interstate LNG “Pipeline” Advantages to Customer • Eliminates regulatory uncertainty associated with facilities and markets • FERC tariff governs from receipt of gas to ultimate delivery to market • Allows customer access to any market through one FERC jurisdictional facility – Interstate natural gas storage – Transport to and revaporization into interstate pipelines – FTA & NFTA Exports subject to customers appropriate export license (FGS is not an export facility) – Motor fuel – Bunker fuel – Intrastate use 14 Projected Schedule • Planned Construction start – Late Summer 2014 (pending final FERC approvals) • Projected in service Summer 2016 • Facilities to serve the immediate market for liquid – 1 – 25,000 MMBtu/day (300,000 gal/day) liquefier (negotiating PA’s for 2nd liquefier) – 2 bay Truck Loading facility capable of loading 300,000 gal/day firm and up to 480,000 gal/day on an interruptible basis – 1 bcf storage capacity (12,000,000 gallons LNG) – 100,000 MMBtu/day vaporizer for pipeline sendout • Discussion on-going to add barge loading capabilities at ports for export and bunkering operations – Projected in service 3rd Qtr 2016 • Will start process for adding rail car loading as demand identified 15 Regulatory Environment • A lot of misinformation and unknowns • FERC vs. Non-FERC? • Section 3 vs. Section 7c? • PHMSA and 49 CFR 193 and NFPA 59A Standards? • Hinshaw exemption? Hawaii Gas Ruling? • Very similar to the large scale LNG changes that resulted in the “Hackberry” rule for large scale projects – Took over 1 ½ years – Multiple FERC hearings in Washington • Multiple filings on jurisdiction with no response to date 16