Panama Canal Changes and Impact on Global Shipping

advertisement

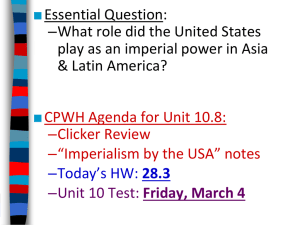

Gateways and Corridors: Routes to the Next Economy, Vancouver, November 17-20 2010 The Panama Canal Expansion and its Impacts on Global Shipping Patterns Jean-Paul Rodrigue Associate Professor, Dept. of Global Studies & Geography, Hofstra University, New York, USA Van Horne Researcher in Transportation and Logistics, University of Calgary, Canada Factors Impacting North American Freight Distribution in View of the Panama Canal Expansion Aggregate demand changes Supply chain diversification and differentiation Response from East and West coast ports Structure of production changes Economies of scale in shipping Response from railways Shipping costs structure New gateways Slow steaming Response from Suez Canal and Med transshipment hubs Global Shifts: The Unstable Structure of Production, Consumption and Distribution Southeast Asia South Asia East Asia E qu Eastbound Route Landbridge Panama Route a tor Westbound Route What Drives Supply Chain Management? Control Freaks Offshoring Costs / time / reliability Internalize efficiency Supply Chain Differentiation: Pick Your Preference Factor Issues Costs (38%) Stability of the cost structure. Relation with the cargo being carried. Lower costs expectations by the Panama Canal expansion. Time (12%) Influence inventory carrying costs and inventory cycle time. Routing options in relation to value / perishability. No/limited time changes with the expansion. Reliability (43%) Stability of the distribution schedule. Reliability can mitigate time. No/limited reliability changes with the expansion. At the Crossroads… Which Value Proposition for the Caribbean? 3) East coast capacity issues 1) Strong margins, but many not large enough to justify dedicated services 4) Last segment in importbased supply chains 2) Interlining between the America’s coastal systems Share of the Northeast Asia – U.S. East Coast Route by Option: Transition Already Completed? 100% 90% 3.0% 2.1% 11.3% 15.1% 2.0% 20.8% 80% 4.6% 1.5% 0.9% 1.8% 2.0% 2.0% 23.6% 33.8% 38.2% 40.1% 42.0% 43.0% 70% 60% Suez Canal Panama Canal Intermodal 50% 40% 30% 85.7% 82.8% 77.2% 71.8% 64.6% 60.9% 58.1% 56.0% 55.0% 20% 10% 0% 1999 2000 2001 2002 2003 2004 2005 2006 2007 Economies of Scale are a Bitch… Photo: Dr. Theo Notteboom Conventional Direct North Atlantic Central Atlantic South Atlantic / Gulf Transshipment Circum-Equatorial North Atlantic North Atlantic Central Atlantic Central Atlantic South Atlantic / Gulf South Atlantic / Gulf Caribbean Transshipment Triangle Slow Steamin’: What Hath You Brought Us? Prince Rupert 12 Vancouver Transit Times from Shanghai and North American Routing Options (in Days) 4 13 8 5 Seattle / Tacoma Toronto Oakland 13 5 Chicago 3 26 New York Los Angeles 25 Norfolk Atlanta 5 14 Dallas 5 Slow Steaming: More WC transloading More inventory in transit Savannah/Charleston 25 28 Houston 8 19 Lazaro Cardenas 22 Panama The Toll Conundrum: Potential Diversion between Intermodal and AWR for Asian Imports Market Share of All-Water Route (%) 100 90 80 Current 70 The Toll Conundrum: Financial pressures versus maritime shipping pressures 60 50 Expansion (unconstrained) 40 Expansion (constrained) Toll increases have already captured 40% of the potential savings of the expansion. The appeal of revenue maximization (NOT traffic maximization). 30 20 10 Yield management? 0 0 Adapted from A. Ashar (2009) 100 200 300 400 Cost Differential (Premium per TEU per Day Saved, USD) 500 Shipping Rate from Shanghai for a 40 Foot Container, Mid 2010 Vancouver Montreal $2,300 $2,110 $4,040 $3,950 New York $3,700 $1,830 Los Angeles $2,620 $1,400 Inbound rates: function of distance Outbound rates: function of trade imbalances $3,510 $2,560 $1,300 $2,100 Inbound Outbound Houston Governance Changes in Port Authorities: Competing over the Hinterland Conventional Port Authority • Planning and management of port area. • Provision of infrastructures. • Planning framework. • Enforcement of rules and regulations. • Cargo handling. • Nautical services (pilotage, towage, dredging). Expanded Port Authority Added Value Activities Performed at an Extended Gateway Activity Functions Consolidation / Deconsolidation Inventory management practices. Cargo consolidated (or deconsolidated) into container loads (paletization). Attaining a batch size (group of containers) fitting a barge or a train shipment. Breaking down batches so that they can be picked up by trucks. Transloading Change in to load unit (Maritime / Domestic). Consolidation, deconsolidation and transloading commonly mixed. Postponement Opportunity to route freight according to last minute and last mile considerations (dwell time). Buffer within a supply chain. Light transformations Forms of product and package transformations (packaging, labeling). Customization to national, cultural or linguistic market characteristics. Major Rail Corridors Improved since 2000 Intermodal Terminals and Recent Co-Located Logistic Zones Projects Every rail operator involved. Partnership with a major real estate developer. The North-American Container Port System and its Multi-Port Gateway Regions 4 2 1 3 Multi-port gateway regions 1. San Pedro Bay 2. Northeastern Seaboard 3. Southwestern Seaboard 4. Puget Sound 5. Southern Florida 6. Gulf Coast 7. Pacific Mexican Coast 6 5 7 The Caribbean Gateway? Emerging Global Maritime Freight Transport System Conclusion: The Complexities of Divergence Aggregate demand changes, structure of production Supply chain diversification and differentiation, economies of scale, Slow steaming No expansion: High impact (trend reversal) Expansion: Maintaining existing trends (AWR) Response from East and West coast ports, hinterland factors, tolls