Customer Credit, Why & How? - ICS, Institute of Chartered

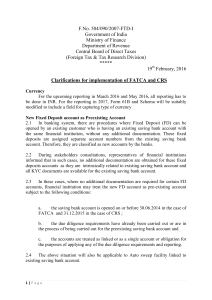

advertisement

Customer Credit… Why & How Institute of Chartered Shipbrokers Lectures Singapore August 2014 So who am I? John Phillips MSc, BSc (Hons), FICS, CMILT, Visiting Research Fellow University of Plymouth Chartered Shipbroker, entered tanker operations & port agency 1982, own business 1990-1995, worked in Middle East, Greece, & Singapore, specialised in counter-party risk and intelligence/research in maritime sector since 2002 Awyr Las Pte Ltd (inactive) • Managing Director Soyuz Bunkering Group • Global Head of Credit and Soyuz Bunkering Group (SBG)? Established in 2013 by interests affiliated to Souz Petrolium SA through Summa Group Europe Holdings BV Part of the Summa Group (Russia) Offices in Rotterdam, Dubai, Singapore and Hong Kong Strong position on Russian Far East, ARA and West Africa Team of experienced Traders and Operators Strong support from parent group What is Credit & what are the Risks In most of the bunker market trading & supply businesses, Credit runs hand-in-hand with due diligence and is usually described as: “Credit, Due Diligence & Country Party Risk” Managing Credit / unsecured transactions Risks of Non-Payment Using Credit as a Sword & Credit as a Shield Understanding Credit Risk Credit Risk can be defined as the amount of risk taken against non (or delayed) payment for goods delivered today but paid in the future An extension of the RISK we manage everyday We all come across Credit Risk in work If I lend you my Ferrari for the weekend, what is the likelihood I will get it back on Monday undamaged (or at all)? Shipbrokerage & Shipagency the impact of introducing parties where default occurs Financial (cash-flow) Reputational (measurable?) the risk of operating without adequate pro-forma funding Delayed Payment (cash-flow) Non Payment (cash-flow + legal recourse + reputation) Shipowner & Operator Vessel Withdrawal (always best option?) the impact of non-payment of freight or hire Financial (cash-flow) Reputational (bank confidence in decision making ability) Three Key Themes Knowing your Customer Prevention is better than Cure Forearmed is Forewarned These cannot be overstressed and have been a mantra of Credit Report Writers and Managers since the 1970s Selecting the Right Party Adoption of ‘Best Practices’ Use of Rightship or equivalent processes (best practice!) Carry out Due Diligence review on at least bi-annual basis Credit reporting Agencies assistance (Due Diligence data) Dynamar Infospectrum Lloyd’s List Intelligence Ocean Intelligence Implications of Transacting unsecured Will customer still exist at due date? Will I be paid on time or delayed (if so, how long)? What is my cost of borrowing (see next item)? What is my margin (is it worth it)? Do I have capacity (Loss of Opportunity)? What is my exposure profile (Ratio 1-5 risks) Recovery costs Impending Default - Some Warnings Speak with brokers – Is tonnage idle, what is happening in macro and how will it impact micro economics? Check Press & other Media comments Calls are met with ‘unavailable’ or ‘will call back’ Has there been a steady slipping of payments (legal implications of not addressing immediately) Have Reporting Agencies (OI, LLI, Info, Dynamar) reviewed recently, change in recommendations? Revisit Review – Why? Why Revisit: • Has something changed in the business? • Moreover is business still there? Use of Financial Statements Reporting Standards Some jurisdictions do not report (this applies to most in this sector) Creative Accounting Age (even for PLC’s can be 1Q out) Difficulty in obtaining even when reported Language used Do Financials have a Value? Corp. Hancock: Sir. [Offers mug of tea] Maj. Gen. Urquhart: Hancock. I've got lunatics laughing at me from the woods. My original plan has been scuppered now that the jeeps haven't arrived. My communications are completely broken down. Do you really believe any of that can be helped by a cup of tea? Corp. Hancock: Couldn't hurt, sir. What can you learn? How a business has performed historically Suggest how it may perform going forward Indicate how it has structured its finances Give insight into shareholders’ commitment Show how it remained liquid historically Is the business ‘open & available’ Who audited and what opinion Reading Between the Lines What type of Company is it What is it trying to say in its Financials What is not there that should be there? Why are the Financials overdue? In an improving market why are numbers down? Has business been lost & what is the orderbook? So what should be there? And why isn’t it? To do this you really need to know who your customer is and what it does Legal & Recovery Considerations Are we being “Reasonable” Ensure data collected is accurate Speed may well be of the essence Empty Threats are No Threats Interact with Legal and Finance Remember Legal Recovery has a cost – evaluate Establish track on vessel (www.sea-web.com or www.seasearcher.com) and maybe go active The REAL cost of recovery Debt chasing Arrest of vessel – if a Maritime Lien exists Enforcement of award after vessel release However, this can take months or years. Example from Marine Fuels sector How long would it take to make back a USD 1 margin on a 1,000 tonne sale of IFO 380 cSt at USD 610 pmt Any Guesses? Its an reasonably easy one… 610,000 tonnes And remember, in the meantime you have financed a purchase at USD 609 which you maybe paid on 5 days! (finance cost) A thought…. So what percentage is this of annual sales? I’m sure this translates to brokerage commissions or agency fees, how many more deals to be done to recover the money outlaid to bring a customer in who doesn’t perform! Now tell me that good credit decisions have no value Getting it right will save time and money Use Credit as a Sword and as a Shield Develop Business Using good due diligence as a way to grow your Business safely Wise Growth - Considered & Reasoned Growth Use credit/unsecured transactions to encourage wanted accounts Protect the Business Credit/unsecured transactions only where credit is due Closing out unwanted accounts Use credit to deter unwanted accounts The Importance of Audit Trail Internal & External Factors Best Practice Credit Insurance & Finance Approvals Counterparty Confidence Bank Confidence Management Purposes (ISO identification of system failures) System Improvements (ISO remedial & Main Players Credit Manager / Business Development Manager (Strategic implementation of Corporate wide solutions to meet strategic goals) Research Teams Finance and/or CFO AP/AR & Treasury Officers Legal Counsel …and of course – Operations teams Credit Management Structures For those with credit sales in portfolio Hierarchical system Triangular Systems Multi-Point Systems Single Advice Methods Passed Responsibility Method Each of these can be developed with or without a Credit Model to support it - Thank You