Roadshow Presentation PPTX - Department of Social Services

advertisement

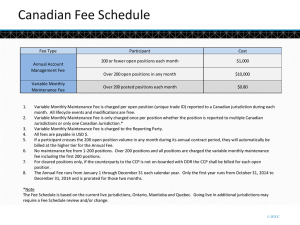

What Reforms? If you do not change direction, you may end up where you are heading Caring for Older Australians Reducing red tape Quality care for consumers Achievements Changes to legislation Home Care Packages Programme New supplements MyAgedCare and call centre Australian Aged Care Quality Agency Aged Care Pricing Commissioner Reforms going forward 2014 Accommodation prices published on MyAgedCare Changes to fees and subsidies Removal of high/low 2015 Increased functionality – MyAgedCare Commonwealth Home Support CDC for all Home Care Packages High Care and Low Care Only permanent residential aged care This distinction currently affects: • conditions of allocation for residential aged care places; • care approvals; • resident classifications; and • residential aged care accommodation payment arrangements. Conditions of allocation 1 July 2014 NO high care and NO low care places – all just residential care places Next ACAR NO high care NO low care place allocation Care approvals • No distinction between high and low approvals • Approvals will not lapse How do we classify residents? ACFI Ageing in place Check your resident agreements Remove ‘low care’ and ‘high care’ references No Change to Residential Respite Schedule of Specified Care and Services Proposed modernisation of items Classifications that can be charged a fee for Part 3 Additional care and services My aged care website My Aged Care For information about aged care services, and how to access them: • Visit the My Aged Care website at www.myagedcare.gov.au or • Call 1800 200 422* Call My Aged Care operators to discuss your needs from: • Monday to Friday – 8am to 8pm (local time) • Saturday 10am to 2pm (local time). The call centre is closed on public holidays. If you are deaf or have a hearing or speech impairment, we can help through the National Relay Service. Call 1800 555 667* and ask for 1800 200 422*, If you need an interpreter, we can help through the Translating and Interpreting Service. Call 131 450 and ask for 1800 200 422*. *1800 calls are free from fixed lines; however, calls from mobiles may be charged. More information…. Ongoing updates are available at: My Aged Care website www.myagedcare.gov.au Department of Social Services website: www.dss.gov.au/agedcarereform Aged Care Reforms – Home Care May 2014 Key Milestones 1 July 2014 Income testing for home care 1 July 2015 All Home Care Packages convert to CDC Income testing in Home Care Consumers can continue to be asked to pay a basic fee Some consumers can be asked to pay an incometested care fee The amount of subsidy paid is reduced by the consumer’s income tested fee DHS will administer the income assessment There will be a fee estimator on My Aged Care Home care – Government subsidy Vs. Client contributions 84% equates to approx $1.2 billion and 16% equates to approx $0.2 billion, based on 2013/14 data. Home Care income thresholds and caps Single person, March 2014 prices (current rates) Home Care – Safeguards Grandparenting arrangements Caps on the amount of income tested fees Full pensioners will not pay any income tested fees Part pensioners pay up to $5000 Self Funded Retiree’s pay up to $10,000 Financial Hardship Assistance Home Care Worked examples March 2014 prices Worked example 1 - Rose Income tested care fee $0. The Government will meet the full cost of Rose’s care. Income test Total assessable income: $14,500 p.a. A care recipient who is a member of a couple is taken to have half of the couple’s combined assessable income ($29,000 / 2) Income free area*: $19,172.40 (*partnered person rate) Total assessable income is less than the income free area, therefore: Rose cannot be asked to pay an income tested care fee. + Basic daily fee $3,483 per year or $9.57 per day Note: Rose’s provider can charge her the basic daily fee. This is calculated at 17.5% of the basic age pension. Worked example 2 - Joseph Total assessable income: Income free area: Income tested care fee $65,000 p.a. $24,731.20 Joseph’s income tested care fee will be the lower of: Total assessable income > income free area: • Joseph can be asked to pay an income tested care fee. $27.47 per day (being the daily calculation of the $10,000 annual cap) or • His care costs ($37.38); Joseph’s income is above the upper cap threshold of $57,882 so $10,000 cap applies. Joseph can be asked to pay a maximum of $27.47 per day. + Joseph’s package costs: $37.38 per day Basic fee $3,483 per year For more information • My Aged Care website (www.myagedcare.gov.au or 1800 200 422* • Ongoing updates available at the Department’s website (http://www.dss.gov.au/agedcarereform) • Email questions to agedcarereforms@dss.gov.au • * 1800 calls are free from fixed lines; however, calls from mobiles may be charged. Aged Care Reforms – Residential Care May 2014 Overview • Key Milestones • Overview of new fee arrangements • New means testing arrangements • Accommodation Payments • Safeguards for Residents • Examples of the new fee arrangements Key Milestones 19 May 2014 • Publication of accommodation prices began 1 July 2014 • • • • New means testing arrangements Accommodation payments Higher accommodation supplements Removal of high/low care distinction There are grandfathering provisions for existing residents. Residential Care Fees from 1 July 2014 • Basic Fee • Means Tested Care Fee • Accommodation • Extra Services Fee • Additional Services Fee Means Testing in Residential Care • Income and assets combined test conducted by DHS • Determines the fees and therefore the Commonwealth Subsidy paid for each resident • Fee estimator available from 1 July 2014 Safeguards for Residents Grandparenting arrangements Annual and lifetime caps Annual cap of $25,000 Lifetime cap of $60,000 Safeguards on the family home Financial Hardship Assistance Subsidies and Fees from 1 July 2014 New Residents from 1 July 2014 $154,179 Higher Means Moderate Means Pays Basic daily fee Pays basic daily fee Pays Accommodation Contribution Pays Accommodation Payment (receives some Accommodation Supplement) (no supplement) Does not pay Means Tested Care Fee – care is fully subsidised Pays Means Tested Care Fee – care is partially subsidised Pays basic daily fee only Receives full Accommodation Supplement $45,000 Does not pay Means Tested Care Fee – care is fully subsidised Lower Means $24,731 $62,944 Accommodation Costs – What’s New? • Choice of Payment Method • Refundable Accommodation Deposit or • Daily Accommodation Payment • Combination of Both • Fairer Assessment of Capacity to Pay. Accommodation prices– What’s New? • Consumer Protection and Safeguards • Accommodation Price cannot be more than the price published • Prices over $550,000 must be approved by Aged Care Pricing Commissioner • Increased Price Transparency • Prices must be published on MyAgedCare, provider websites and relevant printed materials Residential Care Examples Jenny Paying for accommodation Jenny has income less than $24,731, assets less than $45,000 Amelia Paying for Accommodation Amelia with income of $21,913 and assets of $120,000 Peter Government Accommodation vs Client Contribution for Accommodation Costs Peter with income of $65,000, assets of $1,344,500 Total assessable income: $65,000 Income free area: $24,731.20 Therefore: = 50% × ($65,000 - $24,731.20) / 364 Peter = $55.31 Income tested amount = $55.31 Total assessable assets: $1,344,500 Asset free area: $45,000 Working out the asset tested amount: 17.5% x ($154,179 – $45,000) + 1% x ($372,537– $154,179) + 2% x ($1,344,500 – $372,538) = $40,729.16 / 364 Asset tested amount = $111.89 Means Tested Amount =$167.21 Peter Accommodation costs Peter will pay his own accommodation costs because his means tested amount is greater than $52.49 + Means tested care fee Peter pays a means tested care fee of $114.72 up to $25,000 p.a $167.21 - $52.49 = $114.72 + Basic daily fee $46.50 per day For more information: • My Aged Care website (www.myagedcare.gov.au or 1800 200 422* • Ongoing updates available at the Department’s website (http://www.dss.gov.au/agedcarereform). • Transitional Business Advisory Service on 1800 122 092 or by visiting the website at www.kpmg.com/AU/en/industry/Aged-Care/tbas/ • * 1800 calls are free from fixed lines; however, calls from mobiles may be charged. My Aged Care For information about aged care services, and how to access them: • Visit the My Aged Care website at www.myagedcare.gov.au or • Call 1800 200 422* Call My Aged Care operators to discuss your needs from: • Monday to Friday – 8am to 8pm (local time) • Saturday 10am to 2pm (local time). The call centre is closed on publish holidays. If you are deaf or have a hearing or speech impairment, we can help through the National Relay Service. Call 1800 555 667* and ask for 1800 200 422*, If you need an interpreter, we can help through the Translating and Interpreting Service. Call 131 450 and ask for 1800 200 422*. *1800 calls are free from fixed lines; however, calls from mobiles may be charged.