Ted Abernathy - Watauga County Economic Development

advertisement

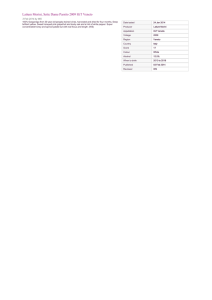

ted@econleadership.com I Have Nothing Profound the Say Think …except, many of the things we all used to know we knew, have changed Today’s New “Place” Reality • • • • • • The economy changed The competition changed Locational factors changed The U.S. workforce has changed The talent demands changed Customer (talent & companies) demands/expectations changed • The pace of change and everything else changed How Is The Economy? Corporate Profits at All Time High Stock Market at All Time High Housing Price Index- Inflation Adjusted Source: Calculatedriskblog.com Stagnation of wages and slow growth of jobs Wide disparity between people and places So What Are Some Economic Facts? Annual U.S. Employment Change 3,000,000 2,331,000 2,193,000 2,103,000 2,484,000 2,071,000 2,019,000 2,000,000 1,022,000 1,115,000 1,000,000 62,000 0 -532,000 -1,000,000 -2,000,000 -1,757,000 -3,000,000 -4,000,000 -3,617,000 -5,000,000 -5,052,000 -6,000,000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: BLS Nov 2013 2013 Annual U.S. Employment Change By Sector March 2013 to March 2014 800,000.00 667,000 700,000.00 600,000.00 529,000 500,000.00 406,000 400,000.00 334,000 300,000.00 200,000.00 151,000 72,000 100,000.00 29,000 57,000 0.00 -19,000 Government Leisure/Hosp Ed/Health Services Prof/Biz Services Financial Information Trade/Trans/Util Manufacturing Construction -100,000.00 Source: BLS April 2014 Southern States 1-Year Employment Changes Feb 2013 to Feb 2014 3.0% 2.8% 2.8% 2.5% 2.0% 1.5% 1.0% 1.5% 1.4% 1.2% 1.4% 1.2% 1.2% 1.0% 0.8% 0.5% 0.5% 0.4% 0.3% 0.2% 0.0% 0.0% -0.3% -0.5% AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA WV Source: U.S. BLS, Dec, Measured Feb 2013- Feb 2014 Southern States 1-Year Employment Changes 350,000 314,200 300,000 250,000 211,500 200,000 150,000 100,000 56,000 46,400 50,000 32,000 14,30011,600 9,900 7,600 0 4,900 27,500 20,200 37,700 1,900 -5,800 -1,800 -50,000 AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA WV Source: U.S. BLS, March 2014, Measured Feb 2013 to Feb 2014 NC Employment Change By Sector Feb 2013 to Feb 2014 25,000 19,000 20,000 15,000 11,600 10,000 5,000 5,400 5,300 2,800 2,100 0 -600 -2,900 Government Leisure/Hosp Ed/Health Services Prof/Biz Services Financial Trade/Trans/Util Manufacturing Construction -5,000 Source: BLS April 2014 NC Employment Growth 4,500,000 4,000,000 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 Jan Annual Employment Source:NCESC.com “Everyone has a plan ‘till they get hit in the mouth” Mike Tyson The Punch- Job Change 1990 to 2012 200,000 182,905 The loss of about 80% of our traditional manufacturing jobs 180,000 160,000 140,000 120,000 92,531 100,000 1990 86,962 2012 80,000 60,000 40,000 30,685 30,229 16,530 20,000 6,119 8,338 0 Textiles Tobacco App/Cut Sew Furniture Source: NCESC.com NC Employment Changes By Sector 2000-2012 50% 35% 40% 18% 20% 0% 3% 1% 1% 0% -10% -9% -20% -30% -13% -30% -40% -26% -18% -42% Accom/Food Art/Enter Health Education Prof/Tech Real Estate Employees on nonfarm payrolls by state and selected industry sector, seasonally adjusted Finance/Ins Info Trans/Ware Retail Wholesale Manufacturing Construction Mining Agriculture Total -50% 28% 28% 27% 30% 10% 40% Source: QCEW County Sector Data Employment Change January 2008 to January 2014 60,000 54,730 NC Total 60,557 50,000 44,050 40,000 30,000 20,000 10,000 3,714 0 -763 -10,000 -20,000 -10,393 -12,276 -18,505 -30,000 West Charlotte East Northeast Southeast Triad Triangle Source: NCESC.com Southern States Per Capita Income 1990-2012 (% Different from Nation Change) 50% U.S. Change 120.6% 39.2% 40% Inflation 73% 31.5% 30% 20% 10% 22.0% 20.5% 7.5% 19.7% 11.2% 8.5% 7.5% 18.2% 6.7% 1.5% 0% -4.3% -5.1% -10% -13.0% -10.7% -20% AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA Source: bber, University of New Mexico WV NC Per Capita Income Compared to U.S. 1990-2012 $45,000 $40,000 $35,000 $30,000 $25,000 United States $20,000 NC $15,000 $10,000 $5,000 $0 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 Source: bber, University of New Mexico GDP/Capita Changes in the NC 19972011 $50,000 $45,000 $40,000 $35,000 $30,000 1997 1998 1999 2000 2001 2002 2003 2004 NC 2005 2006 2007 2008 2009 2010 USA Source: BEA, Oct 2012 2011 Contextualizing Change A “Place-Based” Strategy Choices of Intentional Actions To Move From Here To There Where You Are, Your Current Reality Goals Context Actions Where You Desire To Be Compass Change Metrics Leadership Information Curation Direction, or Compass is driven by the Vision, Mission and Core Values of the organization or place 26 Context is determined by the conversion of comparative and longitudinal data into information that can be used as knowledge Change is the group of factors, outside your control, that influences your future, global trends, demographic shifts, changing technology Action Plan • • • • • • • • What actions will we undertake? Who will be responsible for those actions? What resources do we need to be successful? Where will those resources come from? When will each action start and be completed? What results do we expect? How will those results be evaluated, and; How will we monitor the plan and continuously update it? “No one born after the turn of the century has ever known anything but a world uprooting its foundations, overturning its values and toppling its idols.” Peter Drucker 1957 Big Trends Urbanization U.S. Population Concentration Metro-Non-Metro 100% 90% 80% Almost 60% of US population lives in Cities of 1 million or more 80% 70% 60% 50% 40% 30% In 2012 over 90% of GDP and 86% of all jobs are in metropolitan areas 20% 10% 0% 1910 1920 1930 1940 1950 Metro 1960 1970 Non-Metro 1980 1990 2000 Source: Census Southern States % of Population Rural & Small Cities 2010 80% 72% 67% 70% 61% 60% 59% 58% 54% 51% 50% 43% 45% 50% 44% 46% 46% 39% 40% 35% 30% 30% 25% 20% 20% 17% 13% 10% 0% AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA WV KS IL IA NE Source: U.S. Census 2010, Daily Yonder 2012 2013 Ranking for NC Metropolitan and Metropolitan Statistical Areas Of 366 Metropolitan Areas Top Third (7) Middle Third (3) Bottom Third (4) Of 576 Micropolitan Areas Top Third (8) Middle Third (4) Bottom Third (14) Source: Policom.com, 2013 Global Interdependence State Goods % Exports Growth 2010-2013 60% 50% 53% 50% 40% 37% 35% 31% 30% 30% 29% 25% 25% 20% 32% 28% 18% 16% 9% 10% 5% 0% 0% AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA WV Source:2010-2013 data from U.S. Census and Foreign Trade Technology McKinsey & Company Disruptive Technologies: May 2013 Energy Advanced Materials Mobile Internet Next Generation Genomics Robotics, Cloud, Digital-intel, 3D Printing The Talent Bar Is Rising US Adults Years School Completed 80% In 1980, 32% had some college & 17% BA 76% 70% In 2010, 56% some college & 30% BA 1940 60% 1950 50% 1960 40% 30% 20% 37% 31% 1970 31% 30% 26% 14% 1990 17% 15% 13% 1980 2000 2010 10% 5% 5% 0% Less than HS HS Grad Some College BA plus Source: U.S. Census Work Shifts Creative Work Routine Work Routine Work Outsourced Routine Work Machines Source: National Center on Education and the Economy, Tough Choices or Tough Times, 2007 “What is different now is the nature of jobs going away has changed…the type of jobs affected have moved up the income distribution.” Peter Diamond MIT Economist 2010 Nobel Prize Winner Source: Economicmodeling, Joshua Wright, Oct 3, 2013 Local policy could be worsening the hollowing out of the job market. Data Source: Federal Reserve Bank of Kansas City Southern States Percentage of New Jobs 2010-2013 Paying Middle Wage 35.0% 32.0% 30.0% 30.0% 29.0% 29.0% 24.0% 25.0% 25.0% 22.0% 22.0% 20.0% 18.0% 16.0% 22.0% 19.0% 17.0% 17.0% 14.0% 15.0% 10.0% 10.0% 5.0% 0.0% AL AR FL GA KY LA MD MO MS NC OK SC TN TX VA WV Source: The Atlantic, Joshua Wright, Oct, 2013 So What… th 24 June and th 25 at RTP • Commercialization must come from the top of the university. • A culture of change towards entrepreneurship and risk-taking must occur on all levels of the university. • A centralized point of contact, for industry looking for university invention • Restructure teaching structures by pushing beyond the standard seat-in-a-classroom, semesterorganized, graduate in four years model • Centers and programs that stretch across traditional academic boundaries • Incubators and/or accelerators for student and faculty startups, and business plan competition with sizable cash awards. • Entrepreneurship programs that permeate the university with entrepreneurial opportunities. “Do what you have, with what you have, where you are.” “ Leadership and learning are indispensable to each other.” John F. Kennedy ted@econleadership.com