Introduction overview October 2013

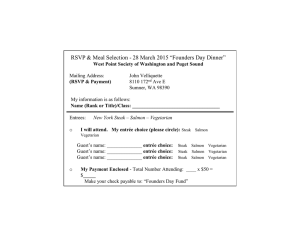

advertisement

Introduction to Salmon Software Salmon Software October 2013 Salmon Treasurer Company 30 Years of Knowledge – Founded in 1985 • • • • Founded in 1985 in Dublin Ireland, Salmon Software Limited Independent company and has over 25 years specialist experience in Treasury knowledge. Main shareholders; J Byrne & J O’Brien 8% Owned by Enterprise Ireland (Irish Government) who support R&D funding • • • • • • Built on Microsoft to take advantage of the continued evolution of technology. Heavily focused on development and customer feedback. Functionally rich for ‘future proof’ treasury operational growth. Simple and effective user interface for logical system navigation. ‘Treasury kept simple’. Large reporting library and simple report adjustment tools. Strong data integration tools and a single MS SQL DB • Offices: Dublin, Ireland & Olomouc, Czech Republic Functionality across all levels Automated File Import Bank Communication & Reconciliation: The scheduled batch for downloading Electronic Statements for all banks is set up as a automated process. MT940 Import file Mapping your files: The ability to automatically import or export data files in or out of the TMS is made simple with Salmon’s ‘Import Module’ Shown is an example of a MT940 import mapping from a bank file. • This is a once off configuration • Simple to update or change should a new bank relationship be made. MT940 Import Mapping made easy User Friendly System Navigation “The User Cockpit" • • • Planned Cash Flow "Cash Flow Worksheet" The user can review group wide Cash Management, check on non reconciled Items and review multiple, multi tiered cash forecasting across groups, regions, divisions and subsidiaries. Any Downloads of Zero Balance Transactions (ZBA), Notional & Multi-Tiered Physical Cash Pooling or any Centralised or De-Centralised web based user interaction and reporting can also be automated. Using the ‘What-if ‘Scratch pad functionality the user can simulate any Leveling of Accounts/Cash Pools, money transfers and/or FX movements as well as loans and deposits required. Function examples System walk throughs' • Automated Account Statement Upload • Cash Pooling made easy • Scratch Pad – Simple management of accounts • Cash Sheet – Build a group wide overview • Liquidity Planning – Forecast/Actual/Budget comparisons Dealing & eTrading, matching integration In addition from the ‘Scratch Pad’ and ‘Dealer Pad’ functionality, any Controls, such as Dual Authorisation or reject/confirm/counter processes or Segregation Of Duties for Front, Middle and Back Office workflows that have been set up will also take effect and can be overviewed in the ‘daily activities’ workflow function. Salmon Treasurer can also be interlinked with your trading platform so any trading decisions that have taken place will automatically feed through to execution and back as confirmations. Alternative quotes, provided by various banks etc can also be automatically read in. Transactions generated from dealing activities such as Payments and Daily Deal Activity Logs are automatically updated. As well as critical Logs of significant events such as Limits Breaches etc. You are also comforted by the fact that automated email server warnings are linked into these workflows. On trade execution, Electronic Matching to Mysis or other confirmation matching systems automatically takes place. Intercompany Salmon Supports automated Intercompany Position Updates, calculation of Interest due or calculation of accounting accruals. A summary and position detail reporting with multi currency conversions to all currencies required is also available to you. All of this includes Centralised or De-Centralised web based user interaction to support your Intercompany workflows for departmental, regional or subsidiary access. Data & Graphics Exposure & Risk Exposure: Counterparty, Currency See your current position (Mark to Market) Review your trading & positions FX, MM, IC…. • • • • • • Review your Risk, Hedging and Exposure with our full range of flexible reporting capabilities. Counterparty & Intercompany limits Full Hedge Accounting: Compliance reporting & Stratergy confirmation reporting. Review Mark To Market Valuations Cash & Counterparty Exposure. Intergrated Data Feeds to Bloomberg, Thomson Reuters, Patria or your preferred supplier. In House Banking Salmon Treasurer enables the users to nominate Hedging Ratios for their FX positions. These ratios then generate in house FX deals with Treasury who effectively ‘Buy’ the subsidiaries positions to create a Global Treasury Position. It also facilitates Net Settlement between subsidiaries. This facilitates much lower trading volume with external counterparties. This in turn reduces Currency Risk and Dealing Costs for Treasury. These modules are unique, highly sophisticated and very effective. Salmon Treasurer The Assistant Treasurer ‘Salmon is a cost effective, comprehensive Assistant Treasurer. Primarily focused on simplicity and user friendliness. If it can be done automatically, it does it. For the rest of a Treasurers working day it offers a pleasant environment and a range of functionality allowing you clear relief and support during your working day.’ Petr Jablonský Treasury Manager Net4Gas, Prague. The future of Cash Forecasting Analytics Salmon Treasurer Experience & References Salmon Treasurer Overall Benefit Salmon Treasurer provides extended treasury management functionality enabling you to centralise or decentralise treasury operations and manage unlimited accounts, facilities, books, funds, dealers and companies. By automating the majority of treasury management processes, including automated bank statement upload and reconciliation, Salmon Treasurer effectively eliminates the need for manual data collection & reconciliation, spreadsheets and late, reactive reporting . In turn, allowing the Treasury team to focus on adding value in other areas while the CFO & Management team have an up to date, pro active oversight with a complete overview of cash and activities across the group, entities, divisions, departments and accounts.